PennDOT State/Local Highway & Bridge Programs

By Gueorgui Tochev , Senior Budget Analyst | 3 years ago

Transportation Analyst: Gueorgui Tochev, Senior Budget Analyst

PennDOT is responsible for approximately 40,000 miles of roadway and 25,000 bridges. The Highway and Bridge Construction/ Reconstruction Program supports the economic vitality of the commonwealth and the mobility and quality of life for its residents.

Managing Pennsylvania's highway and bridge system, along with aviation, bicycle, pedestrian, and other facilities in our state is a large, cooperative effort. PennDOT, with federal and local partners, provides programs, tools, and resources to look at how projects in the near term as well as the future meet financial realities and customer needs.

Department staff are involved in facilitating and making improvements to the transportation system, but also in planning near- and long-term activities. Staff serve as a liaison for Metropolitan and Rural Planning Organizations, the State Transportation Commission, and the Transportation Advisory Committee, as well as Transportation Management Associations, the public, and other stakeholders. At a high level, the products of this collaboration are the state's Transportation Improvement Program and Twelve Year Program, which include projects that you can see on the PA Transportation Projects website.

The Transportation Planning Program was established in all metropolitan and rural planning organizations to promote federal, state, and local transportation objectives. Key focus issues include updating long-range transportation plans, adopting Transportation Improvement Programs (TIPs), the commonwealth's Twelve-Year Program (TYP), and air quality conformity determinations where needed. Responsibilities focus on promoting transportation projects that provide for the maintenance and/or restoration of transportation infrastructure, providing a safer environment for the traveling public, and enhancing personal mobility and the movement of goods.

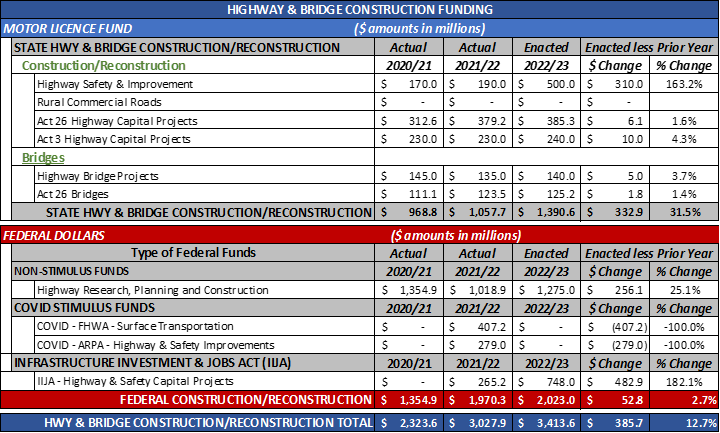

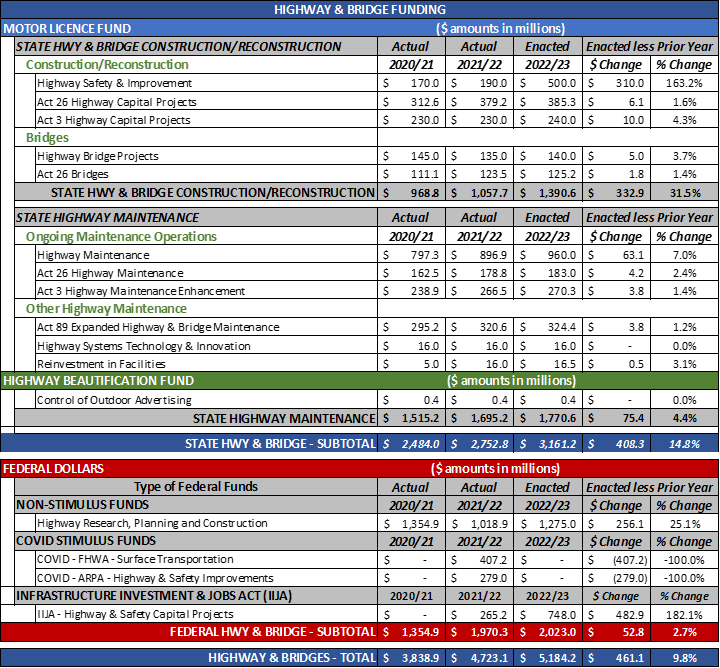

As we analyze the Highway and Bridge Construction program, we also must consider the line-items that provide funding and their sources (information provided by PennDOT Staff):

- Highway and Safety Improvements – This appropriation provides for the improvement of highways and bridges throughout the Commonwealth. The improvements contribute to the economic growth of the Commonwealth and improve the mobility of the traveling public. The appropriation funds construction, reconstruction, and major safety and mobility projects on the state highway system.

- Highway Capital Projects – Excise Tax - This executive authorization also provides funding to supplement the department's highway construction program. Funding for the authorization, reflects 40% of the 55 mills authorized under Act 26 of 1991.

- Highway Capital Projects - This executive authorization provides funding to supplement the Department's highway construction program. The authorization receives the incremental revenue from the 50% increase in registration fees (less $28 million earmarked to the PA Turnpike Commission) authorized in Act 3 of 1997.

- Highway Bridge Projects - This executive authorization provides funding for the repair and replacement of state bridges, itemized in the Highway-Railroad and the Highway Bridge Capital Budget Acts.

- Bridges – Excise Tax - This executive authorization provides funding to supplement the Department's bridge program. Funding for the authorization, reflects thirteen percent of the Oil Company Franchise Tax receipts authorized in Act 26 of 1991.

The conversation involving Highway and Bridge Construction/Reconstruction must also include the long-term funding challenges that the program is facing, including the challenges resulting from the COVID-19 pandemic. As the chart above indicates, all the state funding for the program comes from the Motor License Fund (MLF). With changing driver behavior, MLF revenues are going to be affected, and the General Assembly needs to consider diversification of revenue sources. It is worth noting that while federal stimulus dollars provided short-term solution to the challenges that the Highway and Bridge Construction/Reconstruction program faced due to COVID-19, and Federal Infrastructure dollars are going to further assist the program, a long-term revenue solution remains outstanding. The challenges include unfunded needs as highlighted by the recent Transportation Revenue Options Commission (TROC) report. As provided by the report the annual unmet needs are:

- Interstate/Other National Highway System (NHS) modernization - $2.1 billion

- Interstate/Other National Highway System (NHS) repair - $1.9 billion

As we review the Highway and Bridge Construction program’s duties, it is also necessary to highlight some other items that guide its activities and are completed by PennDOT.

- Publication 408 – provides construction specifications for PennDOT projects and is updated semiannually, with each new change containing all the previous edition changes in their entirety. Contained within are:

- Standard Special Provisions (SSP) and Master Construction Items – which are maintained on PennDOT’s Engineering and Construction Management System (ECMS).

- Use of Dimension Values – a single set of construction specifications, which contain measurements in English values. Those values are utilized on design drawings, renderings, or in specific instructions that are project specific.

- Changes and their Effective Dates – while the document only exists in virtual form, each semiannual change contains new pages incorporated into the document and includes all previous edition changes.

- Construction Bulletins

- Publication 34 (Bulletin 14) - the Aggregate Producers is a list of producers who have met the department’s specification requirements to produce materials of different types and sources.

- Publication 35 (Bulletin 15) – the Qualified Products List for Construction provides a list of materials that are eligible for use on PennDOT projects. It gives contractors, consultants, manufacturers, and others a product listing by manufacturers who have been certified by PennDOT. PennDOT also provides the opportunity for manufacturers to submit new products to be listed within Bulletin 15. This process includes applying through the New Product Evaluation and Tracking System (NPETS), done through eCAMMS

- Publication 41 (Bulletin 41) – the Asphalt Electronic State Book contains a list of bituminous producers who have demonstrated ability to comply with the department’s specification requirements under Publication 408M, Sec. 401.3(b) and Publication 27, Ch. 1 & 1(a)

- Publication 42 (Bulletin 42) – the Ready-Mix Concrete Book includes a list of ready-mix concrete producers who have demonstrated ability to comply with department’s specification requirements under Publication 408M, Sec. 704

- Steel Products Procurement

- as provided under Pennsylvania’s Act 3 of 1978, purchasing agencies are required to include a contract provision in every contract that provides for the use or furnishing of steel products produced in the United States. Act 3 further provides for several documentation requirements related to:

- Identifiable Steel

- Steel Products with In-Plant Inspection

- Unidentified Steel

- Federal Highway Administration (FHWA) Buy American requirements:

- Projects are required to utilize steel and iron products manufactured in the United States. The application of coatings on steel or iron, must also occur in the United States.

- Applies to projects that are either partially or totally funded by federal funds

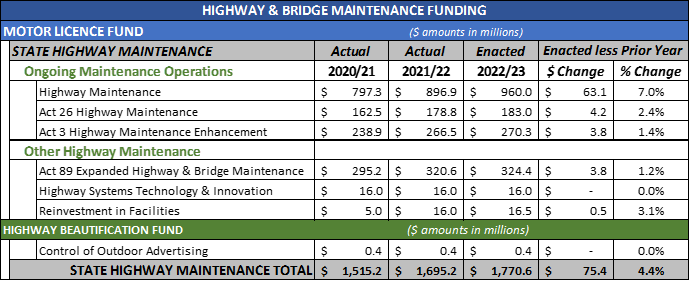

State Highway and Bridge Maintenance

Pennsylvania experiences high volumes of traffic and is subject to inclement weather. Roadway treatments that prolong the useful life of infrastructure range from crack sealing and seal coats to more extensive surface treatments that may include resurfacing. Bridge activity ranges from deck washing and cleaning drainage outlets, to repair and preventive maintenance of deck surfaces and structural components.

Unscheduled maintenance services must be performed in response to flooding, windstorms, landslides, sinkholes, and similar acts of nature. These include clean-up and repair of storm damage, which can range from isolated low-cost work to significant restoration projects across many counties. An event that is declared a national disaster becomes eligible for federal assistance, which typically covers approximately half of the total costs incurred.

A base level of state highway and bridge maintenance activity is funded by ongoing annual appropriations and executive authorizations from the Motor License Fund (MLF). These appropriations are supplemented by a dedicated share of the Oil Company Franchise Tax (OCFT).

As we explore the Highway and Bridge Maintenance program, next we can delve into to the appropriations that are included (information provided by PennDOT Staff):

- Highway Maintenance - This appropriation provides for operation, management, and safety of the State highway system, which includes maintenance resurfacing, surface repairs and structural restoration necessary to preserve the quality of State-administered roads. This appropriation also provides for prompt winter services to enable safe passage of traffic.

- Highway Maintenance – Excise Tax - The authorization receives nineteen percent of the Oil Company Franchise Tax receipts authorized in Act 26 of 1991 and supplements the Highway Maintenance appropriation. Funds are distributed to counties based on the ASHMA formula (as defined in Act 3 of 1997) as stipulated by Act 26 of 1991.

- Highway Maintenance Enhancement - This authorization currently receives forty percent of the 38.5 mills fuels tax authorized in Act 3 1997 and supplements the Highway Maintenance appropriation. Funds are distributed to counties based on the ASHMA formula as stipulated by Act 3 of 1997.

- Expanded Highway and Bridge Maintenance - The executive authorization’s funds are distributed to counties in accordance with Act 3 of 1997. The authorization receives forty-eight percent of the 38.5 mills fuels tax authorized in Act 3 of 1997.

- Highway Systems Technology and Innovation - The purpose of this appropriation is to provide greater visibility for the management of traffic operations on the state highway network. Providing more efficient and safer use of existing infrastructure through technology is an increasingly important aspect of PennDOT’s mission. The appropriation covers costs associated with PennDOT’s Traffic Management Centers, operation and maintenance of intelligent transportation equipment, traveler information provided to the public, and other key traffic operations efforts. In addition, the appropriation provides funding for 511 services including the 511 PA Website, the Alert Service, and a mobile application to communicate with PA traveler.

- Reinvestment in Facilities - The appropriation provides funding for renovations and modernization of PennDOT's facilities, including improvements to Maintenance Stockpile facilities and updates to Driver Examination sites. Statutory authority for this appropriation is Act 120 of 1970, which established the Department of Transportation.

- Control of Outdoor Advertising - The Highway Beautification Fund, created by Act 5 of Special Session Three of 1966, is the funding source for this appropriation. Activities include control of outdoor advertising and junkyards. Initially General Fund monies were initially appropriated to establish the fund, highway beautification activities are now supported by licenses, fees, fines, penalties, and interest.

In addition to the appropriations listed previously, special maintenance-related appropriations may be approved for accelerated restoration, preventive maintenance, and emergency repair based on the financial status of the MLF. In the context of the Highway and Bridge Maintenance program, we also need to highlight the unmet annual needs that the program faces. As highlighted by the recent Transportation Revenue Options Commission (TROC) report, those needs amount to $4.1 billion annually.

Having explored the funding aspect of the maintenance program, we can now explore the range of activities that it provides. The list includes:

- Surface Treatment – this operation commonly known as “oil and chip” is utilized to lengthen the lifespan of low-traffic-volume roads by three to five years. As part of this activity, performed between April and October, oil is sprayed on the road surface, which is then covered with fine stone, and finally loose aggregate swept from road surface is then rolled in place.

- Shoulder Cutting – this activity takes out excess material and debris from unpaved shoulder areas, which in turn provides for faster water drainage from road surfaces.

- Shoulder Grading – provides for the shaping and stabilizing of unpaved roadway shoulder areas. Traditionally performed between April and November, this maintenance operation grades shoulders to reduce the drop-off between the roadway and the shoulder. This activity improves water drainage as well as removes ruts from shoulder surfaces.

- Pipe Replacement and Cleaning – one of the most important components of the maintenance process, controlling flow of water away from road surface is essential. This replacement activity includes the cutting or sawing of pavement, digging a trench, pipe installation, backfilling and compacting, and resurfacing. Furthermore, in cases where only cleaning is required, the activity is performed utilizing high-velocity sewer cleaner.

- Patching

- Mechanized – operations of this type are utilized to patch roadway areas with a considerable number of potholes, large scale pavement cracking, and/or depression. Traditionally performed in the summer, this activity involves marking and cleaning, filling holes and low laying areas with patching material, compacting, and application of asphalt followed by rolling the area in question.

- Manual a.k.a. pothole patching – commonly performed in the spring, this activity can be one of two types:

- Cold patching – where asphalt is mixed with soap, water, and fine stones and subsequently applied to the problem area. This type of patching is considered temporary, however it could last up to a couple of years.

- Hot Mix – is deemed permanent and is an activity where pure asphalt is mixed with fine stone and heated to about 300 degrees Fahrenheit. In applying this method, the pothole is cut square, cleaned, treated with asphalt tack-coat, filled with the heated mixture, and compacted.

- Sealing – is usually performed March through November and can be one of two activities:

- Joint sealing – utilized to seal joints on concrete roads

- Crack sealing – utilized to seal cracks on asphalt roads

- Winter Operations – these activities involve snow and/or ice removal and application of deicing materials to roadway surfaces.

- Vegetation Management – as part of the overall road management strategy, PennDOT strives to maintain roadways beautifully. Such efforts include mowing, tree thinning, and pesticide or herbicide applications.

- Line Painting – as part of this process, the department paints road and highway dividing lines, including STOP road and railroad crossing markers. Applications of this nature are normally performed during warm and dry weather periods.

- Bridge Maintenance & Cleaning – part of a pressing funding need, many Pennsylvania’s bridges are in poor structural condition. Department efforts encompass bridge inspections at least once every two years. As determined by those inspections, PennDOT performs replacements or structural repairs. Furthermore, bridge cleaning of deck and substructure is performed annually on most bridges. Signing – roadway signs are a major component of roadway safety and keeping drivers informed. PennDOT is responsible for reviewing signs and acting if their condition is deemed unacceptable. The department maintains approximately 1.3 million signs.

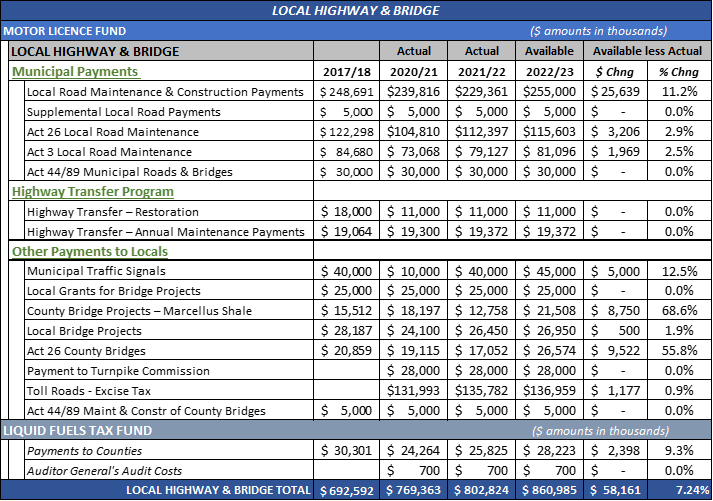

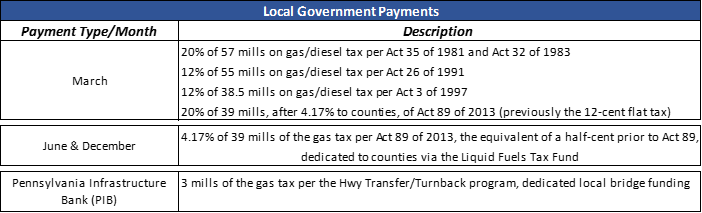

By law, a portion of the revenues from motor fuel taxes, certain Vehicle Code fines, and other sources are directed to municipal payments. Grants may be used for a broad range of highway and bridge activities. The department provides technical assistance to local governments and is responsible for assuring expenditures are made in accordance with the law.

Dedicated Motor License Fund revenues are received from a portion of the Oil Company Franchise Tax and registration fees of commonwealth-registered vehicles having a gross weight of more than 26,000 pounds. For the local program, municipalities and counties are eligible for grants on approximately 6,500 bridges greater than 20 feet long owned by these political subdivisions. Projects are selected by the Metropolitan and Rural Planning Organizations and must be approved in the commonwealth’s capital budget.

The Highway Transfer program is a voluntary program in which the department pays to upgrade a road segment to acceptable standards, transfers ownership to the political subdivision, and provides a $4,000 per mile per year subsidy for future maintenance. Dedicated Motor License Fund revenues are received from a portion of the Oil Company Franchise Tax receipts.

There are three programs specifically directed toward county governments. General assistance for highway maintenance and construction, and assistance for economically distressed counties with the local share of bridge improvement projects are each funded from a portion of the Oil Company Franchise Tax. A third program for maintenance and construction of county bridges specifies the distribution of an annual appropriation based on each county’s percentage of the total county-owned bridge deck area in the state.

As we continue the discussion of the Local Highway and Bridge Assistance program, it is necessary to highlight the unmet funding needs, just like the State Highway/Bridge Construction and Maintenance programs. Specifically, as highlighted in the Transportation Revenue Option Commission’s (TROC) report, those needs currently amount to approximately $3.86 billion annually.

Source: TROC Final Report

The subsequent section provides a detailed description of the different funding components of the programs, including their funding sources (information provided by PennDOT staff):

Payments to Municipalities program

- Local Road Maintenance and Construction – the appropriation, which derives its statutory authority from Act 655 of 1956, reflects revenue estimates for Liquid Fuels Tax receipts and the requirements of Act 655. Payments of the funds to municipalities are monitored to determine that monies are expended for maintenance/construction of roads according to law. Beginning January 1, 2014, per Act 89 of 2013, additional funding for this appropriation was made available through the uncapping of the average wholesale price, which is used to calculate the Oil Company Franchise Tax.

- Supplemental Local Road Maintenance and Construction – the appropriation reflects the requirements of and derives its statutory authority from Act 68 of 1980. Payments of the funds to municipalities are monitored to determine that monies are expended for maintenance/construction of roads according to law.

- Local Road Payments – Excise Tax – this executive authorization reflects the requirements of Act 26 of 1991. Payments of the funds to municipalities are monitored to determine that monies are expended for maintenance and construction of roads according to law. Beginning January 1, 2014, per Act 89 of 2013, additional funding for this authorization was made available through the uncapping of the average wholesale price, which is used to calculate the Oil Company Franchise Tax.

- Payments to Municipalities – this executive authorization supplements the local highway assistance program and derives its statutory authority from Act 3 of 1997. Payments of the funds to municipalities are monitored to determine that monies are expended for maintenance and construction of roads according to law. Beginning January 1, 2014, per Act 89 of 2013, additional funding is available through the uncapping of the average wholesale price, which is used to calculate the Oil Company Franchise Tax.

- Municipal Roads and Bridges – the appropriation reflects the requirements of Act 44 of 2007 and, per Act 89 of 2013, was redirected from the PA Turnpike Contribution to non-restricted MLF revenue. Payments of the funds to municipalities are monitored to determine that monies are expended for maintenance and construction of roads according to law.

Highway Transfer program

- Restoration Projects - this authorization provides funding for the restoration and transfer to local jurisdiction of functionally local highways throughout the commonwealth. It derives its statutory authority from Act 120 of 1970, which established the Department of Transportation. Act 32 of 1983 established the State Highway Transfer Restoration Restricted Account, from which this authorization is funded, and provided the enabling legislation for the highway transfer program.

- Annual Maintenance Payments - this authorization provides funding to meet the $4000/mile annual maintenance payment (as stipulated by Act 70 of 2006) for highways transferred to local governments. The statutory authority for this authorization is Act 120 of 1970, which established the Department of Transportation. Act 32 of 1983 then established the State Highway Transfer Restoration Restricted account, from which this authorization is funded and provided the enabling legislation for the highway transfer program. Furthermore, Act 70 of 2006 stipulates that the first obligation of the restricted account is an annual maintenance payment of $4000/mile for each mile of highway transferred to local jurisdiction under the program.

Other Local Assistance

- Municipal Traffic Signals - this authorization receives funding through Act 89 of 2013 to replace, synchronize, time, operate, and maintain traffic signals. Funding for municipalities is based on approved applications for financial assistance.

- Local Grants for Bridge Projects - this executive authorization provides funding for the repair and replacement of local bridges itemized in the Highway-Railroad and the Highway Bridge Capital Budget Acts.

- Local Bridge Projects - this executive authorization provides funding for the repair and replacement of local bridges under Act 32 of 1983.

- County Bridges – Excise Tax - this executive authorization provides grant funds for the repair and replacement of county bridges. This program receives two percent of the Oil Company Franchise Tax receipts authorized in Act 26 of 1991.

- County Bridge Projects – Marcellus Shale - this executive authorization provides funding for Highway Bridge Improvements under Act 13 of 2012.

- Payment to Turnpike Commission - this executive authorization provides funding for toll road expansion projects constructed by the PA Turnpike Commission. This program received a flat $28 million from the 50% increase in registration fees authorized in Act 3 of 1997.

- Toll Roads – Excise Tax - this executive authorization provides funding for toll road expansion projects constructed by the PA Turnpike Commission. This program received fourteen percent of the Oil Company Franchise Tax receipts authorized in Act 26 of 1991.

- Maintenance and Construction of County Bridges – the appropriation reflects the requirements of and is authorized under Act 44 of 2007. Payments of the funds to municipalities are monitored to determine that monies are expended for maintenance/construction of roads according to law. Act 89 of 2013, redirected from PA Turnpike Contribution to non-restricted MLF.

- Payments to Counties - Liquid Fuels Tax Fund - revenue is distributed twice yearly to the counties of the commonwealth in accordance with the provisions of the Liquid Fuels Tax. The Liquid Fuels Tax Fund was created in 1931 to assist in the funding of local road systems. Effective July 1, 1999, responsibility for this fund, and the distribution of funds, was transferred from the Department of Revenue to the Department of Transportation.

- Auditor Generals Audit Costs - this executive authorization provides reimbursements for audits conducted for the Liquid Fuels Tax Fund. Effective July 1, 1999, responsibility for this fund was transferred from the Department of Revenue to the Department of Transportation.