Tobacco Settlement Fund

By Ronni Burkhart , Assistant Executive Director | 4 years ago

Tax & Revenue Analyst: Adrian Buckner, Budget Analyst

Summary

The Tobacco Master Settlement Agreement (MSA) is a settlement between 46 states, Washington D.C., and five U.S. Territories; and the nation’s largest tobacco companies that settled outstanding class action lawsuits by several states’ attorneys general arguing the tobacco industry’s deliberate misinformation about tobacco’s negative health effects inflated states’ healthcare costs.

Pennsylvania received its first MSA payment in 1999. Since then, Pennsylvania has received $8.29 billion in receipts. In 2001, the commonwealth passed Act 77, which established the Tobacco Settlement Fund (TSF) to receive MSA payments. The law also created several programs funded by those payments.

In 2017, Act 43 directed the governor to securitize up to $1.5 billion worth of future MSA payments to address the 2017/18 General Fund deficit. The debt service payments on that securitization total $2.3 billion over 20 years.

This primer describes the creation and evolution of the TSF and the various programs that it funds.

Master Settlement Agreement

Mississippi’s attorney general filed the first state lawsuit against tobacco companies in 1994. Many states would eventually initiate litigation against the major tobacco companies as well. Four states (Florida, Minnesota, Mississippi, and Texas) settled with the tobacco companies individually prior to the MSA, while the remaining 46 states (including Pennsylvania) entered into the MSA in 1998, along with Washington D.C. and several U.S. territories. The MSA established a series of payments from the tobacco companies in perpetuity. The purpose of the MSA is to reduce smoking in the U.S., especially among youth, and is accomplished through:

- Raising the cost of cigarettes by imposing payment obligations in the MSA,

- Restricting tobacco advertising, marketing, and promotions,

- Eliminating practices that mask the health risks of tobacco,

- Providing funds to states so that they may invest in smoking prevention and cessation programs, and

- Establishing and funding the Truth Initiative - an organization committed to making tobacco use and nicotine addiction a thing of the past.

However, the MSA places no requirements or restrictions on how states spend their MSA receipts.

Non-Participating Manufacturers

As of May 11, 2021, 56 manufacturers are party to the MSA either as an original participating manufacturer (OPM) or a subsequent participating manufacturer (SPM). Remaining manufacturers are considered non-participating manufacturers (NPM). To ensure fair competition between OPM/SPM and NPM, the MSA encourages states to enact legislation requiring NPM to pay an amount into an escrow account that is roughly equivalent to what they would have paid under the MSA.

Pennsylvania enacted the Tobacco Settlement Agreement Act, Act 54, in 2000 requiring every manufacturer who sells tobacco products in Pennsylvania to either join the MSA or to set up a qualified escrow account. Payments that go into the escrow account are based on each cigarette, or unit, sold in Pennsylvania. Money in the escrow account reverts to the NPM in 25 years if no lawsuits are filed against the NPM.

MSA Receipts

The MSA commits participating manufacturers to make annual payments to party states and territories. The amount allocated to each state is in accordance with a distribution formula based on the estimated tobacco-related Medicaid expenditures and the number of smokers in each state.

Annual payments are subject to change depending upon criteria outlined in the agreement. Major adjustment factors include:

-

| Pennsylvania MSA Receipts |

| Year |

$ Millions |

| 1999 |

$123.6 |

| 2000 |

$452.3 |

| 2001 |

$348.5 |

| 2002 |

$410.9 |

| 2003 |

$338.3 |

| 2004 |

$361.3 |

| 2005 |

$366.4 |

| 2006 |

$335.2 |

| 2007 |

$348.8 |

| 2008 |

$382.0 |

| 2009 |

$419.2 |

| 2010 |

$349.8 |

| 2011 |

$330.8 |

| 2012 |

$337.4 |

| 2013 |

$337.2 |

| 2014 |

$233.3 |

| 2015 |

$352.5 |

| 2016 |

$339.1 |

| 2017 |

$369.3 |

| 2018* |

$805.5 |

| 2019 |

$243.7 |

| 2020 |

$345.6 |

| 2021 |

$362.4 |

| Total |

$8,293 |

| *Includes $357 million NPM settlement for prior years |

Inflation – payments are adjusted each year based on an inflation factor, which is the greater of three percent or the Consumer Price Index.

- Volume of Sales – payments are adjusted each year based on the number of cigarettes shipped within the U.S. by the MSA participating manufacturers. Therefore, declining cigarette sales will decrease MSA payments to states.

- Non-Participating Manufacturers (NPM) – MSA participating manufacturers are able to adjust their payments to MSA party states to address market share losses attributable to the MSA. If an economic consulting firm determines that the provisions of the MSA were a significant factor contributing to the market share loss of participating manufacturers, the annual payment to states may be reduced. However, no NPM adjustment may be made to a state that passed and is diligently enforcing its model statute.

Beginning in 2003, an independent firm determined that participating manufacturers started losing market share to NPM. Pursuant to this finding, tobacco companies applied the downward NPM adjustment to annual state payments and deposited the disputed amounts into holding accounts as required under the MSA. The Pennsylvania Attorney General’s office pursued legal action arguing that Pennsylvania diligently enforced its model statute and is therefore entitled to full payment. On June 21, 2018, Attorney General Shapiro announced a settlement that released $357 million in disputed funds to Pennsylvania for outstanding disputes.

The MSA contains a complex methodology for calculation of the annual state payments. Therefore, each year an independent auditor calculates the aggregate payments due under the MSA, determines how the aggregate payment is to be allocated among participating manufacturers, and authorizes disbursement of the payment to the states in accordance with each state’s allocable share.

Through June 30, 2021, Pennsylvania has received more than $8.29 billion in MSA payments.

Program Allocations

The TSF funds a number of important programs in whole or in part. Since Act 77, the allocation formula for MSA receipts has been amended several times. Recent practice has been to write the allocation formula in the omnibus Fiscal Code amendment passed each year as part of the budget package. Over time, some allocations and programs were eliminated while others have been added. Appendix A outlines the detail of historical programmatic allocations.

TSF used for two health-related programs – Community HealthChoices and Life

Science Greenhouses – are appropriated from the TSF by the General Assembly as part of the General Appropriations Act. The remaining annual appropriations are issued via executive authorization according to the formula included in the Fiscal Code each year.

The following list describes programs that are currently receiving a TSF allocation:

Tobacco Use Prevention and Cessation

The Department of Health (DOH) uses MSA funds to support several programs around the state designed to reduce tobacco product use. About 70 percent of these dollars are used for grants to entities operating local programs and the balance is used for statewide programs.

Commonwealth Universal Research Enhancement (CURE)

The CURE program, administered by DOH, provides grants to researchers and research institutions throughout the commonwealth. The statutory formula beginning in 2021/22 allocates:

- one percent of the MSA receipt to National Cancer Institute awardees to be distributed based on federal awards

- 12.6 percent of the MSA receipt for broad-based research

- 70 percent to National Institute of Health awardees to be distributed based on federal awards

- 30 percent to be allocated as follows:

- $1 million is to be used for spinal cord injury research

- Of the remainder, 75 percent is to be used for pediatric cancer research and 25 percent for capital and equipment grants to biotechnology research entities

Prior to 2021/22, the 30 percent portion, now specifically allocated, was competitively awarded based on the research priorities determined by the Secretary of Health and the Health Research Advisory Committee.

Hospital Uncompensated Care

The Department of Human Services (DHS) compensates hospitals for a portion of their costs to treat patients with inadequate, or no, health insurance. Most funds are allocated for uncompensated care (85 percent), while the balance (15 percent) is for reimbursements to hospitals of extraordinary expenses for uninsured patients whose cost of care exceeds twice a hospital’s average cost per stay. Hospitals can receive either an uncompensated care payment or an extraordinary expense payment, but not both. TSF funds spent on hospital uncompensated care and extraordinary expenses qualify as the non-federal match to draw federal Medicaid matching funds.

Medical Assistance for Workers with Disabilities (MAWD)

MAWD is a health insurance purchase program administered by DHS for individuals between the ages of 16 and 65 with incomes below 250 percent of the federal poverty income guidelines (FPIG) and with countable resources less than $10,000. Program participants must be working and are required to pay a premium toward their cost of care equal to 5 percent of their monthly income. New for 2021, eligibility for MAWD was expanded via Act 69 to allow individuals to remain eligible for MAWD if their income exceeds 250 percent of the FPIG so long as their income does not exceed 600 percent of FPIG. MAWD program expenditures that cannot be covered by the TSF are paid through the General Fund. TSF funds spent on MAWD qualify as the non-federal match to draw federal Medicaid matching funds.

Health-Related Purposes

Life Sciences Greenhouse

The Department of Community and Economic Development supports three life science greenhouses around the commonwealth that act as incubators for new technologies and new companies in areas such as biomedical research. After allocating $100 million in start-up funds in 2001/02, the General Assembly has continued to appropriate $3 million annually to the greenhouses.

Community HealthChoices

DHS administers Community HealthChoices (CHC), a mandatory managed care program for individuals dually eligible for Medicare and Medical Assistance and individuals with physical disabilities needing long-term services and supports. TSF partially funds this program. Most of the cost of CHC is funded by state General Funds and federal Medicaid matching funds.

Securitization

Act 43 of 2017 authorized the Commonwealth Financing Authority (CFA) to issue up to $1.5 billion in bonds backed by future receipts due to Pennsylvania under the MSA. In February 2018, CFA issued $1.487 billion worth of bonds with a term of 20 years and an interest rate of five percent. The annual debt service payments (principal and interest) for these bonds totals $115 million, which is roughly one-third of the recent annual payments Pennsylvania received under the MSA.

While MSA receipts were pledged as security for the bonds and identified as one source for debt service payments, Act 43 also permitted other revenues (from general taxes, etc.) to be used for debt service. However, the annual Fiscal Code bills since Act 43 have required funds equal to the debt service payment to be transferred from cigarette tax revenues to the TSF, essentially holding the TSF harmless for each year’s debt service payment. If this transfer provision is not reauthorized each year, however, it would lead to a direct reduction in the amount of TSF receipts that can be allocated to programs funded through the TSF.

Notable Legislation

Act 77 effectuated the MSA in Pennsylvania by creating the TSF to serve as the repository for all MSA receipts. The law also specified which programs would be eligible for TSF funding.

This act requires all tobacco manufacturers selling certain tobacco products in Pennsylvania to either become a participant of the MSA or place funds in an escrow account for potential payment of future claims.

Authorizes the Attorney General to publish and maintain a directory of all tobacco product manufacturers offering cigarettes for sale in Pennsylvania. Manufacturers must certify they are either a party to the MSA or are continuously maintaining the required escrow account required of NPM. The act also made it unlawful to sell, distribute, possess, or transport cigarettes of a manufacturer that is not listed in the directory.

In 2013, Act 71, an omnibus amendment to the Fiscal Code, repealed the original distribution formula for TSF funded programs and created a new formula.

Expanded the definition of “units sold” to include roll your own tobacco containers.

Expanded the definition of “units sold” to include roll your own tobacco containers.

Act 43 authorized the governor to securitize future MSA payments and issue bonds worth up to $1.5 billion to address the 2017/18 budget deficit. The bonds were issued the following year.

The omnibus Fiscal Code amendment passed as part of the budget package for 2019/20 by repealing and replacing the TSF funding allocation formula in Act 71 of 2013 with a new formula.

As part of the 2021/22 budget, the omnibus Fiscal Code amendment replaced the previous TSF funding allocation formula retaining the primary allocation methodology of the most immediate prior years; however, sub allocations within health and related research were added removing the discretion of the Secretary of Health to determine the research topics of a portion of the funds.

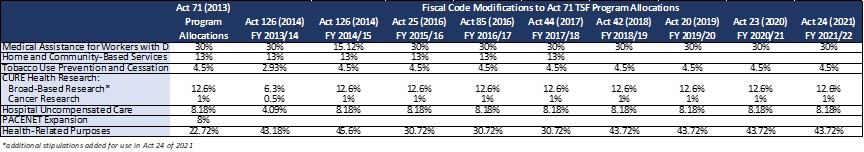

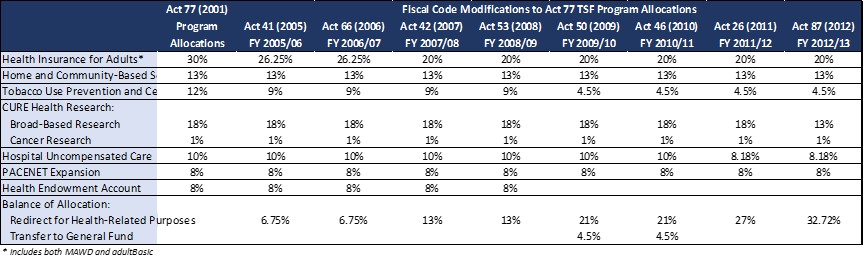

Appendix A – Historical Tobacco Settlement Fund Program Allocations

The following table shows the allocation percentages in the Tobacco Settlement Act, Act 77 of 2001, used to distribute annual MSA payments among programs beginning in 2001/02 and subsequent changes via Fiscal Code amendments. The funding provision in Act 77 were repealed July 1, 2013.

The following table shows the funding formula rewritten in Act 71 of 2013 and the subsequent changes via additional Fiscal Code amendments.