Higher Education Primer Updated March 2022

By Eric Dice , Assistant Executive Director | 3 years ago

Higher Education Analysts: Sean Brandon - Assistant Executive Director , Emma Eglinton - Budget Analyst

Pennsylvania’s diverse higher education sector - consisting of public and private colleges and universities - helps students gain the knowledge and skills they need to pursue their ambitions. Because educated citizens are crucial to the commonwealth’s vitality, the people of Pennsylvania annually invest sizable budgetary resources in the form of institutional support and financial aid grants, which help to make a quality postsecondary education more affordable.

This briefing surveys the different types of higher education activities supported by the commonwealth and looks at budgetary trends. Over the years, the General Assembly has not used a consistent methodology to distribute funding between the different types of institutions. However, change may be on the horizon. Act 70 of 2019 established the Public Higher Education Funding Commission, which will examine a host of higher education-related goals, issues, and metrics to recommend a formula to distribute state appropriations to public institutions.

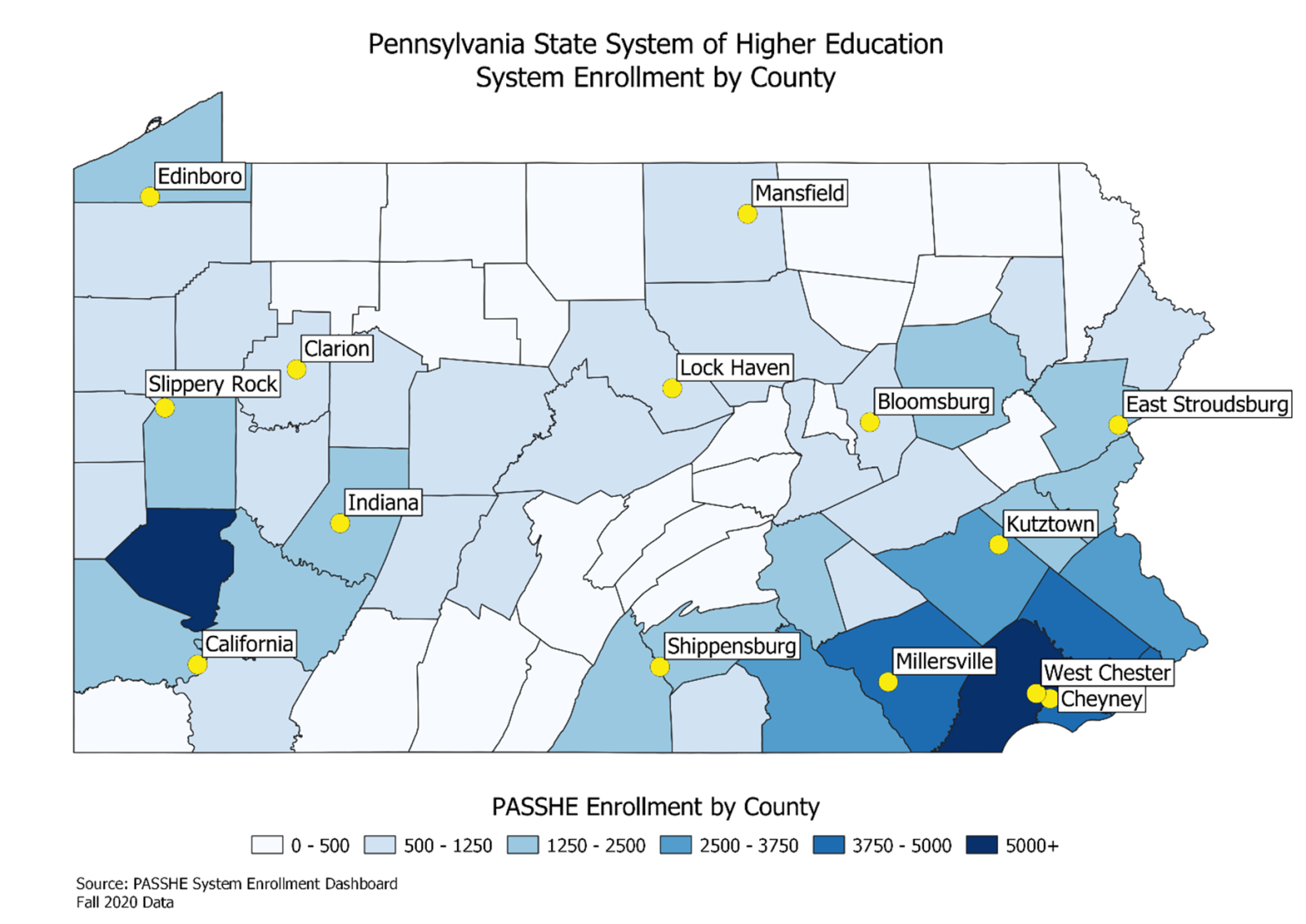

Pennsylvania State System of Higher Education

The Pennsylvania State System of Higher Education consists of 14 state-owned universities across the commonwealth. Formally established in 1982 by Act 188, PASSHE’s purpose is to provide high quality education at the lowest possible cost to students. Many of the system’s institutions were initially set up to train teachers and evolved into state colleges and universities that now offer a wide range of associate’s, bachelor’s, and master’s degrees, as well as limited doctoral programs.

In recent years, the General Assembly has made a single annual appropriation to the system through the General Appropriations Act; PASSHE then distributes the support to member universities through a formula set by the system’s Board of Governors. The formula accounts for factors such as enrollment, instructional costs, support services, and building and grounds costs.

The 14 PASSHE universities are:

- Bloomsburg University

- California University of Pennsylvania

- Cheyney University

- Clarion University

- East Stroudsburg University

- Edinboro University

- Indiana University of Pennsylvania

- Kutztown University

- Lock Haven University

- Mansfield University

- Millersville University

- Shippensburg University

- Slippery Rock University

- West Chester University

Act 50 and University Consolidation

Changing demographics across significant parts of the commonwealth and corresponding declines in university enrollment, along with cost pressures and cuts to state funding led to significant financial challenges at the State System. In response, the General Assembly passed Act 50 of 2020, which laid out a process by which the system’s Board of Governors could consolidate multiple universities.

After initial evaluation by the chancellor and staff, two sets of three universities were proposed to be integrated into two new universities with multiple campuses. Bloomsburg, Lock Haven and Mansfield Universities were proposed to merge in a northeast group, while California, Edinboro and Clarion were proposed in western Pennsylvania.

Working groups at the universities in conjunction with the chancellor’s office prepared preliminary integration plans to outline the steps and work necessary to integrate the universities. The board approved the preliminary plans in April 2021, which opened a statutorily-required public comment period. On July 14, 2021, the Board of Governors unanimously approved the final integration plans, clearing the way for the largest changes to the structure of PASSHE since its inception almost 40 years ago.

Each integrated university will have a single administration, but multiple campuses. The faculty will develop a phased-in integrated curriculum for a new shared program array. The plans anticipate the first class of students at the new institutions will enroll for fall 2022.

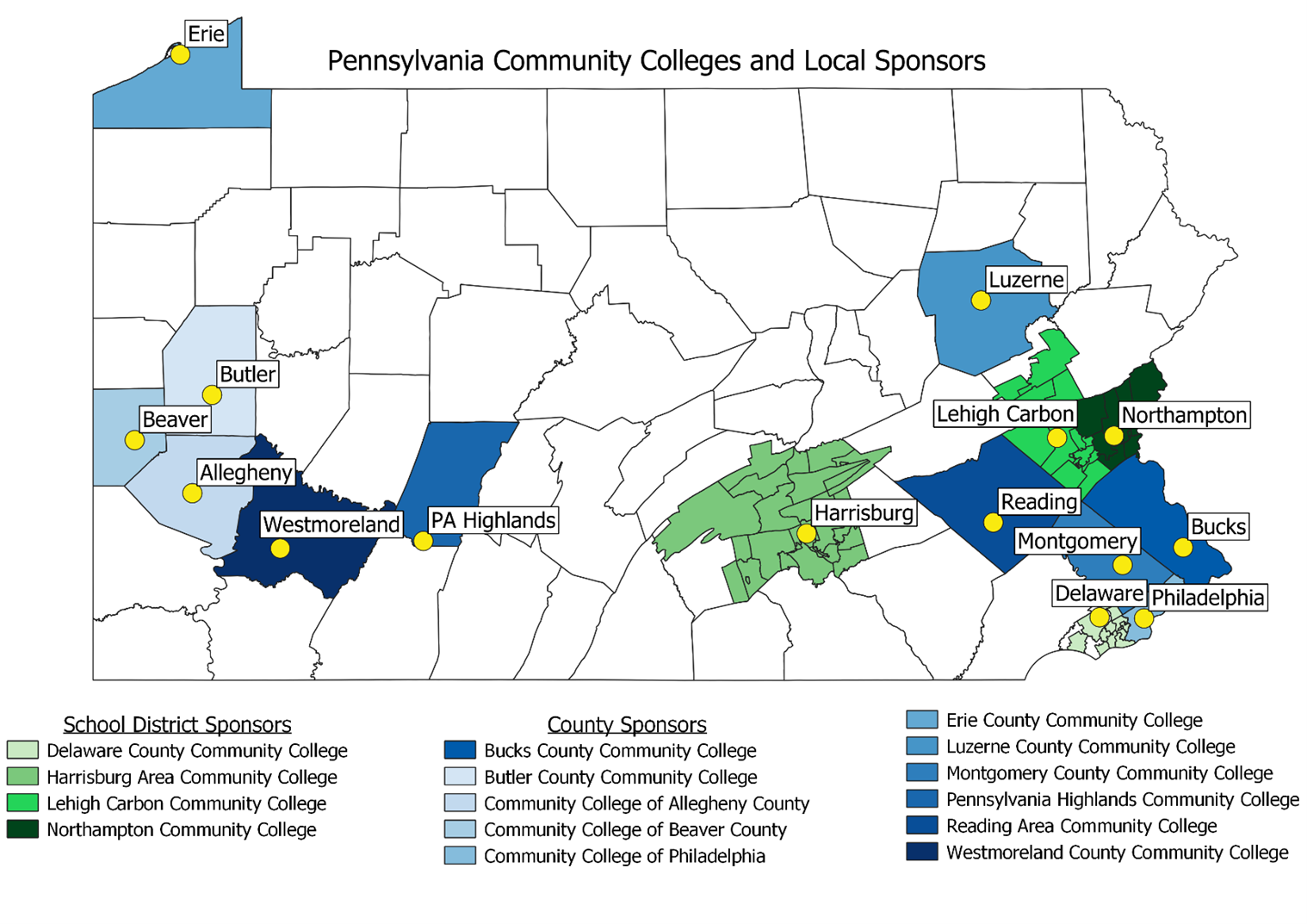

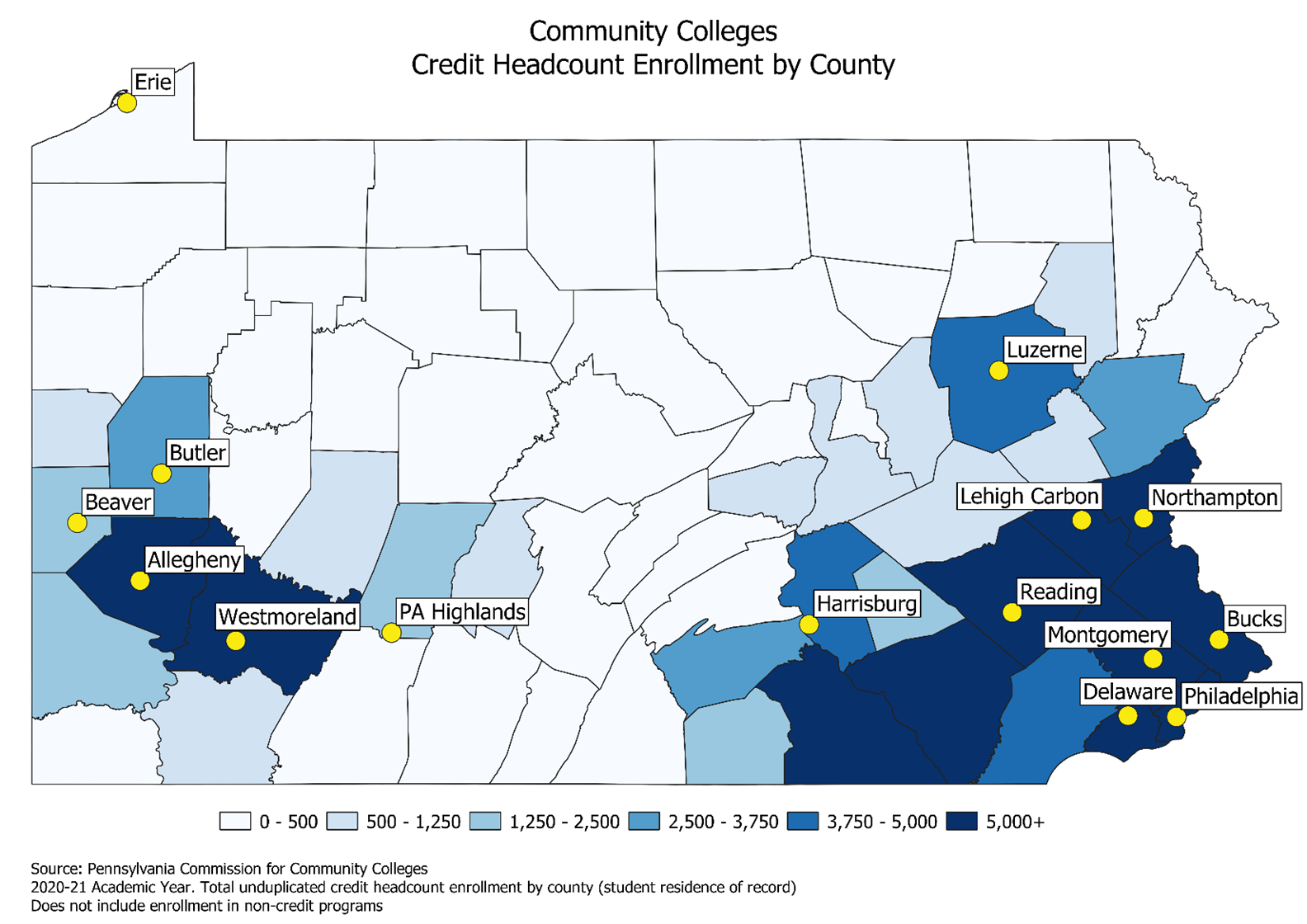

Community Colleges

Community colleges offer two-year and non-degree programs and were designed as a partnership between the state and local sponsors to make higher learning more affordable for students. Community college local sponsors tend to be county governments, although some are supported by groups of school districts. Students who reside in a sponsored area pay lower tuition than students from a non-sponsored location.

The Pennsylvania Department of Education distributes community college funding in the budget through a grant program, and the distribution formula is usually set each year by budget implementation legislation.

The 15 community colleges are:

- Community College of Allegheny County

- Community College of Beaver College

- Bucks County Community College

- Butler County Community College

- Delaware County Community College

- Erie County Community College

- Harrisburg Area Community College

- Lehigh Carbon Community College

- Luzerne County Community College

- Montgomery County Community College

- Northampton Community College

- Community College of Philadelphia

- Pennsylvania Highlands Community College

- Reading Area Community College

- Westmoreland County Community College

In June 2020, the State Board of Education approved a new community college located in Erie County in northwestern Pennsylvania. This is the first new community college to be approved in 25 years in Pennsylvania.

Even with this expansion, the commonwealth does not have full geographic coverage with its community colleges, meaning many students in different parts of the state do not have access to this mode of learning, despite the need.

In response to some of the challenges in creating new community colleges and access gaps, the General Assembly passed legislation in 2014 to establish a “rural regional college” similar to a community college but without the requirement for local sponsor support. This new institution, the Northern Pennsylvania Regional College, began operations in 2017, combining open enrollment with a remote delivery model. The college has no main campus, and courses are simulcast to different sites across a nine-county region in northwestern Pennsylvania. Currently, the college offers six associate’s degrees, two certificate programs, and sixteen non-credit workforce development programs.

Community education councils are another effort to try to help fill the regional gaps of full community colleges in certain parts of the state. CECs are non-profit organizations that act as facilitators and brokers of employer-driven educational programs, working to help get needed educational programs to students in the area in partnership with other colleges and universities. Community education councils receive state support through a specific appropriation to the Pennsylvania Department of Education, which distributes the grants to the councils.

Thaddeus Stevens College of Technology

Thaddeus Stevens College of Technology in Lancaster is a two-year technical college owned by the commonwealth. Originally founded in 1905 to serve orphans, the college now provides associate’s degrees in 23 high-skill technical education programs and 4 certificate programs to help meet workforce needs with special emphasis on serving economically and socially disadvantaged students. Thaddeus Stevens College is funded as part of the General Appropriations Act each year.

State-Related Universities

Pennsylvania has four universities that, while not owned by the commonwealth, have a special status conferred by law. These “state-related” universities receive direct appropriations and, in turn, offer in-state tuition rates for Pennsylvania students.

Three of the state-related universities, Penn State University, the University of Pittsburgh, and Temple University, are major research universities. The fourth, Lincoln University, is a historically Black university in Chester County and is the oldest degree-granting historically Black institution of higher education in the United States.

The state-related universities operate branch campuses in different areas of the commonwealth. Penn State, in particular, has a large network of campuses statewide. While many students study at a branch campus and transfer to the main campus to complete their studies, full four-year programs are also offered at some locations.

The direct appropriations to the state-related universities fall into a special category called non-preferred appropriations. Under the Pennsylvania constitution, any direct appropriation to an educational or charitable institution not under the absolute control of the commonwealth is subject to more stringent rules. Such appropriations must be made in separate bills and receive a two-thirds vote from each chamber of the General Assembly to become law. Currently, there are five institutions that receive non-preferred appropriations: the four state-related universities, and the University of Pennsylvania, which receives support to operate the only veterinary school in the state.

Pennsylvania Higher Education Assistance Agency (PHEAA)

Since 1963, the Pennsylvania Higher Education Assistance Agency (PHEAA) has helped students pay for college with grants, loans, and work-study opportunities and is one of the largest student financial aid organizations in the country.

PHEAA’s flagship is the State Grant Program, which provides need-based financial aid to Pennsylvania students attending public and private colleges. PHEAA also provides institutional support to private colleges and a number of smaller programs.

PHEAA receives no state appropriations to pay for its costs to administer the State Grant Program and other financial aid programs. Instead, these costs are covered by its business earnings from different enterprises. Through its subsidiaries’ contracts with the federal government, PHEAA grew to become the largest student loan servicer of federal direct loans by volume. However, the agency announced in July 2021 that it will not extend its servicing contract with the US Department of Education’s Office of Federal Student Aid and will exit the federal student loan servicing business starting in December 2021. The impact of PHEAA’s changing business is discussed near the end of this document.

While PHEAA will no longer service federal loans, it will still act as a lender. PHEAA’s PA Forward loan program offers undergraduate, graduate and parent loans to help finance postsecondary education, separate from federal student loans.

PHEAA State Grant Program

The largest PHEAA offering is the state grant program, which provides money to students who demonstrate financial need and attend a PHEAA-approved postsecondary institution. To qualify for aid, students must be Pennsylvania residents and enrolled at least half-time. Over 118,000 Pennsylvania students received a PHEAA state grant in the 2020/21 program year. The number of recipients is dramatically lower than it was just ten years ago, when over 205,000 students received grants in 2011/12.

Aid primarily goes to students whose families earn less than the median household income, consistent with the program’s need-based philosophy. Around 73 percent of students who received a PHEAA grant during the 2020/21 academic year were from households who earned less than the statewide median household income.

A goal of the State Grant Program is to help provide access to an array of institutions. Students can receive a grant to attend public and private institutions. Over 200 Pennsylvania institutions are approved by PHEAA. Award amounts under the grant formula adopted by the PHEAA board primarily vary based on student need, as measured by the Expected Family Contribution used for federal student aid. But in addition, maximum awards vary by institution cost. Students attending more expensive institutions can receive more aid than those attending lower-cost schools. Part-time students can receive a partial grant.

The combination of award variation based on cost and different amounts of part-time students leads to divergence between the headcount of PHEAA grant recipients attending different types of institutions and amount of aid distributed.

Other Student Aid Grants – Ready to Succeed Scholarship and the PA Targeted Industry Program (PA-TIP)

PHEAA administers two other student grant programs aside from the State Grant Program.

The General Assembly created the Ready to Succeed grant program in 2014. The program is partially merit-based, in contrast to the State Grant Program. Students must maintain a 3.25 GPA and be nominated by their postsecondary institution. Students can receive up to $2,000 annually, often as a wrap-around award along with a state grant. A student’s family income cannot exceed $110,000, and they cannot have received a state grant of more than $1,501.

The Pennsylvania Targeted Industry Program, or PA-TIP, provides grants to students enrolled in programs shorter than two years in length in select high-priority fields, like energy, health, agriculture, food production, advanced materials and diversified manufacturing. Courses of study must be between 10 weeks and two years long.

Institutional Assistance Grants for Private Colleges and Universities

Although it makes up a comparatively small part of direct institutional support, Pennsylvania has a program to help more than 80 private institutions.

Non-profit, non-denominational colleges and universities that are not state-owned, state-related or a community college and do not receive direct state aid through a non-preferred appropriation are eligible to receive an institutional assistance grant from PHEAA. Grants are distributed based on the number of students who receive individual PHEAA state grants at eligible schools. Once a per capita amount is determined, each school receives its apportionment based on the number of PHEAA grant recipients enrolled at the institution.

Grants are made to the institution, not the student, although many schools use them to help augment student financial aid packages.

Other PHEAA Programs

PHEAA administers other state-funded programs including:

- Matching payments – help institutions maximize student financial aid resources from federal work-study programs, and other programs that require a state or local match.

- Act 101 Program - provides grants to institutions to provide tutoring, counselling, and enrichment services to undergraduate students from economically or educationally underserved backgrounds.

- Higher Education of Blind or Deaf Students Program – up to $500 grants to Pennsylvania resident students who are blind or deaf.

- Bond-Hill Scholarships – provide full scholarships for graduates of Pennsylvania’s two historically black colleges – Cheyney University and Lincoln University – who are pursuing select graduate degrees at another state-related university or PASSHE university. Fields include medicine, law, dentistry, doctorate in education, MBA, MPA, health administration, STEM-H and social work.

- Cheyney Keystone Academy – supports the honors program at Cheyney University

- Internship program grant – supports a non-profit that facilitates student internships in Washington, D.C.

Other University Activities and Special Circumstances

Because of the breadth of activities with which they are involved, universities often intersect with other parts of the state budget.

Some universities with academic medical centers and other teaching hospitals receive funding through the Department of Human Services as part of the Medical Assistance budget.

As Pennsylvania’s land-grant institution, Penn State University has an important role in supporting agriculture in the state. It receives funding for agricultural research and for its county extension offices. These programs help bring cutting-edge research into the field and help farmers and other agricultural industries be more productive and efficient.

Along with the Pennsylvania Department of Agriculture’s State Veterinary Laboratory, the commonwealth leverages two university-based facilities as part of its Pennsylvania Animal Diagnostic Laboratory System (PADLS). The Penn State Animal Diagnostic Laboratory and the University of Pennsylvania’s New Bolton Center help perform animal health, research, and diagnostic programs. This partnership helps ensure that Pennsylvania maintains rapid and precise diagnostic capabilities to deal with animal-related disease outbreaks and ensure a safe food supply.

The University of Pennsylvania’s School of Veterinary Medicine is the only veterinary institution in the commonwealth. Penn Vet has educated the majority of practicing veterinarians in the commonwealth and delivers research and medical solutions to the agricultural industry.

From time-to-time, policymakers address special circumstances with other appropriations in the state budget. For example, the General Assembly appropriated money to help pay for the installation of fire sprinklers in dorms following the Seton Hall fire in 2000.

Capital Funding

Capital funding helps institutions with their buildings and infrastructure needs. The way in which the commonwealth helps institutions varies by sector. Generally, for its public four-year institutions, Pennsylvania uses general obligation debt to provide capital allocations to the institutions or system, depending on the type of university (e.g., state-related or PASSHE). The institution retains autonomy to make project decisions.

Community colleges receive debt service support subsidies for approved projects from the state’s operating budget. Generally, this program pays for one-half of the debt service or lease costs for approved projects.

The PASSHE universities also receive dedicated funding for deferred maintenance through a portion of the realty transfer tax as part of the Keystone Recreation, Park and Conservation Fund (Key ’93). This funding also flows from the commonwealth to the system, and then is allocated through a formula by the Board of Governors to the universities.

Budgetary Trends

Higher education operating appropriations from the General Fund were just over $1.72 billion in 2021/22. Adding to this total, the General Assembly appropriated $50 million in federal American Rescue Plan dollars specifically to PASSHE, which Congress made available to states to help respond to challenges caused by the COVID-19 pandemic.

This total includes all operating appropriations for community colleges, PASSHE, state-related universities, Thaddeus Stevens College of Technology, community education councils, regional community college services, and all appropriated PHEAA programs, but excludes community college capital, non-appropriated PHEAA business earnings, and other activities like the University of Pennsylvania veterinary school, agriculture-related transfers to Penn State, and medical school appropriations.

Looking at appropriations trends over the years can be difficult because many different things have been grouped under “higher education” in the past. As time passed, the funding mechanisms have changed as well, with appropriations being moved to different departments and into special funds.

To compare apples to apples, the following chart focuses on operational funding by excluding capital funding, agricultural support, PHEAA business earnings and medical-related appropriations. It includes federal American Recovery and Reinvestment Act appropriations from 2008/09 through 2010/11 that supplemented operational funding. For the 2020/21 fiscal year, it includes federal Coronavirus Relief Fund appropriations allocated to higher education by the General Assembly, in 2021/22, federal American Rescue Plan appropriations for PASSHE. Amounts are in nominal dollars.

Higher education comprises one of the largest areas of discretionary spending in the General Fund budget. As a result, the sector is more susceptible to cuts during economic downturns and in times of budgetary pressure.

While support increased in the years leading up to the Great Recession, significant cuts were made during and immediately after the Great Recession, most notably in 2011/12. Overall expenditures remained essentially flat from 2012/13 through 2015/16.

In 2015/16, though institutions saw increased appropriations ranging from 3-5 percent, PHEAA’s appropriation declined. The impact of that reduced appropriation was offset, in part, by a greater reliance on business earnings.

The COVID-19 pandemic caused another recession, and the effect of this latest economic downturn on Pennsylvania’s higher education has not yet fully manifested. The General Assembly provided flat funding for state appropriations for the 2020/21 fiscal year, plus an additional $72.2 million in CARES Act federal funds for COVID-19 response. Avoiding cuts to state appropriations, plus other direct federal support helped stabilize the impact of the pandemic on the commonwealth’s universities.

For 2021/22, state appropriations were again level funded, except for an increase for community colleges to support the addition of Erie County Community College. While this analysis excludes capital support, community college capital also increased. The General Assembly again elected to use a portion of flexible federal funds to support higher education, allocating $50 million from the American Rescue Plan State Fiscal Recovery Fund to PASSHE. The net reduction in total funds is attributable to the changing use of federal recovery funds.

Changing PHEAA Resources

The PHEAA State Grant Program is predominantly funded by state appropriations, but other funding sources like its business earnings and federal dollars play an important part. The mix of appropriated, non-appropriated and non-state resources is important for policymakers to monitor, because it creates a risk that students will see their financial aid awards change dramatically between years.

In some years, PHEAA has been able to use its business earnings to augment the state appropriation for PHEAA grants. Of the total amount provided by business earnings and General Fund appropriations, PHEAA’s resources comprised almost one-third of the amount in 2015/16 and around 27 percent in 2018/19, but did so amidst declining net income at the agency. A cautionary example of what can happen when PHEAA is unable to contribute additional resources comes from 2008/09 to 2010/11, when underlying business pressures on PHEAA precluded any augmentations and dramatically reduced the total pool available for student aid, amidst growth in the number of students who qualified for a grant.

The 2019/20 fiscal year once again saw a significant reduction in the amount of augmentations due to increased financial pressure on PHEAA. In response, the General Assembly increased the state grant appropriation by $37.3 million, or 13.7 percent. The additional appropriated resources, along with a smaller applicant pool and carryforward resources were able to maintain the maximum state grant award, year-over-year.

In 2020/21, the General Assembly appropriated $30 million in Coronavirus Relief Fund dollars to augment PHEAA grants. This temporary boost from federal resources did not recur in 2021/22, but the maximum award actually increased despite flat state appropriations because the number of students applying for aid is expected to decline significantly.

Allocation Formulas and Appropriation Distribution Methodology

The commonwealth does not use a consistent, rational method to make allocation decisions between sectors, institutions within sectors, or the mix between institutions or student grants.

Act 70 of 2019 established the Public Higher Education Funding Commission. The nineteen-member commission is comprised of:

- sixteen legislators from the General Assembly, including the four Appropriations Committee chairs, the four Education Committee Chairs, and two additional members from each legislative caucus,

- the Secretary of Education,

- the Deputy Secretary for Postsecondary and Higher Education, and

- another individual appointed by the governor.

The commission is charged with developing a higher education funding formula and identifying factors that may be used to distribute funding among the public institutions of higher education, such as goals for higher education, enrollment, access, affordability, cost, student debt, institutional missions, and outcomes. The commission will look for efficiencies and consider how a formula could impact each public institution of higher education.

The commission held three hearings between October 2019 and February 2020 to start to gather information. However, the pandemic disrupted this work, and Act 26 of 2021 delayed the commission’s report until May 31, 2022.