General Fund Revenue Report - July 2025

By Adrian Buckner - Budget Analyst , Gueorgui Tochev - Senior Budget Analyst | 7 months ago

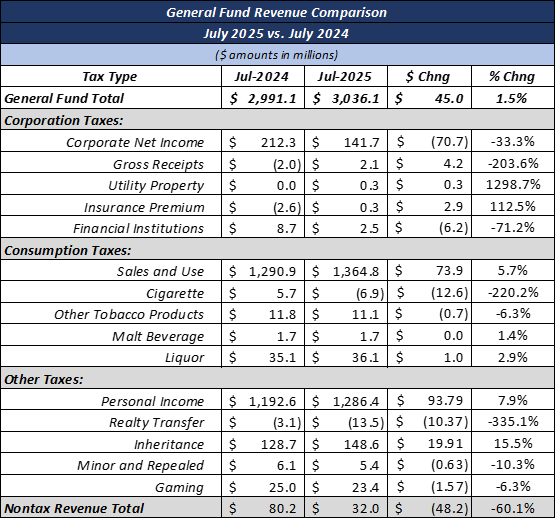

The commonwealth collected $3.03 billion in General Fund revenues in July, a 1.5% increase over July of 2024.

The official revenue estimate for FY 2025/26 has not yet been certified since the budget has yet to be finally enacted[1]. Revenues continue to be collected and once the official estimate is certified, the Department of Revenue will prepare a monthly revenue projection.

Overall, monthly tax revenue for the General Fund was 3.2% higher than last year. Corporate net income tax (CNIT) revenues for the month totaled $141.7 million, or $70.7 million less than July of 2024. Sales and use tax (SUT) revenues were $1.36 billion, or $73.9 million higher year-over-year. Similarly, personal income tax (PIT) brought in $1.28 billion for July of 2025, or $93.7 million above last year.

For other tax types:

- Financial institution taxes

- July 2025 revenues were $2.5 million, which was $6.2 million lower than July of 2024

- Inheritance tax

- July 2025 revenues were $148.6 million, or $19.9 million more than July of 2024

- Cigarette tax[2]

- July 2025 net revenues were a negative $6.9 million, or $12.6 million lower than July of 2024

- Realty Transfer Tax[3]

- July 2025 net revenues were a negative $13.5 million, or $10.3 million lower than July of 2024

- Total nontax revenue

- July 2025 revenues were $32 million, or $48.2 million less than July of 2024

Includes transfers for Philadelphia Cigarette Tax Act (Act 84 of 2016), Children’s Health Insurance Program (CHIP), Agricultural Conservation Easement Purchase Fund, and Tobacco Settlement Fund.

General Fund Revenue Comparison