General Fund Revenue Report - August 2023

By Brittany Van Strien , Budget Analyst | one year ago

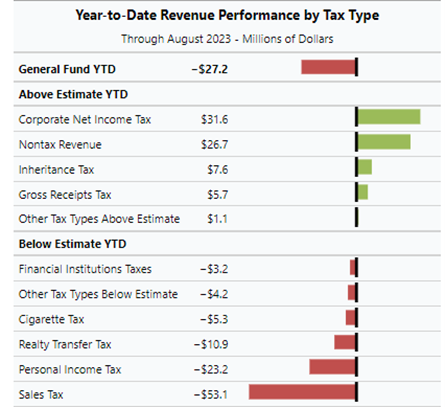

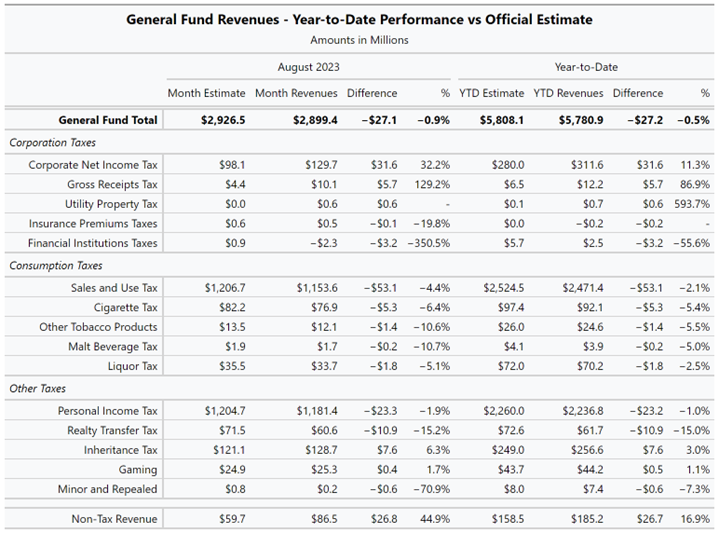

General Fund revenues in August were $27.1 million or 0.9% lower than expected.

For the year-to-date, General Fund revenues are $27.2 million or 0.5% below estimate.

Business taxes collectively performed well for the month. Corporate net income tax revenue was $31.6 million or 32.2% higher than projected for the month. Gross receipts tax revenue also finished the month $5.7 million more than estimated in August while taxes on financial institutions were $3.2 million under estimate. Both of these tax types had small overall collections in August.

In addition, inheritance tax revenue was $7.6 or 6.3% higher than expected in August. Non-tax revenues were $26.8 million above expectation, or 44.9%

On the downside, sales and use tax revenue in August was $53.1 million or 4.4% below projections. Collections on motor vehicle sales were $1.2 million below estimate, or 1.0%, while revenues from non-motor vehicle sales were $51.8 million less than anticipated, or 4.8%

Personal income tax revenue in August was $23.3 million or 1.9% less than expected. Both withholding and non-withholding payments finished the month below estimate by $20.6 million (1.8%) and $2.7 million (3.5%), respectively.

Realty transfer tax revenue for August was similarly $10.9 million or 15.2% under estimate.