2021/22 Budget-in-Depth

By House Appropriations Committee Staff , | 4 years ago

The General Assembly passed a 2021/22 General Appropriations bill in late June. A day before the new fiscal year was set to begin on July 1, the governor signed SB 255, but line-item vetoed a portion of funds provided to the Auditor General.

Included with the General Appropriations bill were the “housekeeping” bills involving agencies such as the PUC, Gaming Control Board, Small Business Advocate, SERS and PSERS, and the non-preferred appropriations.

Gov. Wolf also signed the Fiscal Code, Administrative Code, Tax Code and Public School Codes into law, which have budget related implications.

The General Assembly did not enact a capital budget for 2021/22, which is required to be annually enacted by the Pennsylvania Constitution. The commonwealth last enacted a capital budget in 2020/21.

The 2021/22 budget package includes the following, which were all signed by the governor June 30:

- General Appropriations (Act 1A/SB 255),

- “Housekeeping” Appropriations (Acts 7A-15A/HBs 1508-1516),

- Non-Preferred Appropriations (Acts 2A-6A/SBs 265-269),

- Fiscal Code (Act 24/HB 1348),

- Administrative Code (Act XX/HB 336),

- Tax Code (Act 25/HB 952),

- Public School Code (Act 26/SB 381).

General Fund revenues for the 2020/21 fiscal year finished $3.44 billion above the official estimate, with total revenues of $40.39 billion. About $1.8 billion of total revenue collected this fiscal year were due to the pandemic-related timing shifts of due dates for PIT and CNIT final payments from April and May 2020 into July and August of the new fiscal year. These shifts will not recur in 2021/22.

The official revenue estimate for 2021/22 certified by the Secretary of Revenue and the Secretary of the Budget is $42.536 billion, an increase of $2.14 billion or 5.3 percent. This increase is driven by miscellaneous non-tax revenues, which includes $3.841 billion transferred to the General Fund from federal American Rescue Plan Act resources, as appropriated in the General Appropriations Act.

Tax revenues are projected to decline by $1.17 billion year over year, or -3.0 percent as the timing of payments returns to a more normal pattern.

The Fiscal Code amendments require a transfer of 100 percent of the 2020/21 General Fund ending balance to the Budget Stabilization Reserve Fund instead of the normal statutory 25 percent transfer. The transfer is estimated to be about $2.6 billion. The current balance in the Rainy Day Fund is $243.6 million, following a $100 million transfer out of the fund in Dec. 2020 to help balance the 2020/21 budget.

Pennsylvania’s Rainy Day Fund has ranked as one of the lowest among other states for many years following the Great Recession. The highest amount in the fund was $755 million at the end of 2007/08, which was transferred out in its entirety in 2009. The fund remained near zero, and there were no transfers into the account until 2018 when $22.4 million was transferred in, followed by an additional $316.9 million in 2019. At the start of 2020/21 the median amount among states was enough to cover 28.5 days’ worth of General Fund spending, or 7.8 percent according to Pew. This transfer of $2.6 billion would give Pennsylvania 27.1 days’ worth of spending, or 7.4 percent of expenditures. This is much closer to recommended levels for a Rainy Day Fund; however, these levels of savings are usually accumulated over many years.

Tax Code amendments that accompany the budget package include a variety of changes, but no broad-based changes to rates or base. The most notable changes are:

- Sales tax exemption for computer data center equipment,

- Sales tax exemption on helicopter simulators,

- Sales tax exemption on breastfeeding supplies,

- Tax credit integrity language in response to a 2019 grand jury investigation, and

- An apportionment change to the Manufacturing Innovation and Reinvestment Deduction.

Additional changes include restructuring of internal qualifications of the film tax credit and concert tour tax credit, date changes to Keystone Opportunity Expansion Zones and several other minor changes and technical fixes.

The net cost of these changes is estimated at $33.9 million in 2021/22 and $92.9 million in 2022/23. For more detail, please see the Appendix for a Tax Code summary.

The budget took steps to repay loans incurred by the General Fund from other special funds.

Workers’ Compensation Security Fund Loan Repayment

In January 2021, the General Assembly borrowed $145 million from the Workers’ Compensation Security Fund (WCSF) to support the Hospitality Industry Recovery Program (CHIRP) established by Act 1 of 2021 (SB 109), which provided grants to counties to provide support to hotels, restaurants, bars and taverns. The loan was initially structured to be repaid by 2029. With the supplemental appropriation, this loan is now fully repaid.

While the most recent loan will be repaid through the enacted budget, the commonwealth has two other loans from the WCSF outstanding. The first loan, $165 million that helped backstop the underfunding of the Medical Assistance budget by the General Assembly in 2016/17, has seen its repayment extended twice and is currently due by July 1, 2024. The second $185 million loan was part of a budget-balancing transfer package enacted with the second part of the 2020/21 budget in November 2020.

Underground Storage Tank Indemnification Fund Repayment

A loan of $100 million was made from the Underground Storage Tank Indemnification Fund (USTIF) to the General Fund on October 15, 2002, in accordance with Act 91 of 2002. Repayment of the loan was deferred several times, and Act 72 of 2013 changed the repayment of the $100 million loan to the General Fund to before July 1, 2029.

As of June 2021, $67.5 million was owed in principal and an additional $18.979 million was owed in interest. The budget included a $86.479 supplemental appropriation in 2020/21 for the full repayment of the $100 million loan and outstanding interest.

Special Fund Transfer Repeals

Before it became clear that tax revenues would recover strongly from the pandemic, the General Assembly included $431 million in transfers from special funds and $100 million from the Rainy Day Fund to help ensure the budget was balanced. The 2021/22 budget repeals $59.5 million of these transfers, specifically:

- Historical Preservation Fund - $4 million

- Racing Fund - $10 million

- PENNVEST Fund - $10 million

- PENNVEST Drinking Water Revolving Fund - $26.5 million

- PENNVEST Water Pollution Control Revolving Fund - $9 million

As proposed in the executive budget, the amounts allocated from PENNVEST funds will still be used to assist in budget balancing. Instead of being transferred, they will accelerate debt service payments into the Capital Debt Fund. This lowers the debt service appropriation requirements for the 2020/21 fiscal year. The accelerated debt service payments will be recouped over four years back to the PENNVEST Redemption Fund (which pays the debt service on general obligation bonds issued for PENNVEST).

The American Rescue Plan Act included a total of $350 billion for state and local fiscal recovery assistance. Funds can be used in four domains:

- To respond to the COVID-19 pandemic and its economic effects,

- To replace revenue loss for the provision of government services due to COVID-19 relative to revenues collected in the most recent full fiscal year prior to the emergency,

- To provide premium pay up to $13 per hour above regular wages for workers performing essential work, and

- To invest in water, sewer, and broadband infrastructure.

Pennsylvania received $7.291 billion for State Fiscal Recovery and $6.149 billion was allocated to local units of government, either directly or indirectly, for their recovery activities.

Of the $7.291 billion, the 2021/22 enacted budget provides $759 million in relief, transfers $3.841 billion to the General Fund to replace lost revenues in the 2021/22 fiscal year, and reserves the remaining $2.691 billion to transfer to the General Fund in future fiscal years.

| COVID-19 Response Restricted Account |

| American Rescue Plan Act Appropriations - SB 255 |

| ($ amounts in thousands) |

| Agency |

Appropriation |

Amount |

| State Fiscal Recovery Funds |

|

7,291,328 |

| Executive Offices |

COVID Relief - ARPA - Transfer to General Fund |

3,841,000 |

| Executive Offices |

COVID Relief - ARPA - Transfer to EMS Operating Fund |

5,000 |

| Executive Offices |

COVID Relief - ARPA - Pandemic Response |

372,000 |

| PASSHE |

COVID Relief - ARPA - State System of Higher Education |

50,000 |

| Human Services |

COVID Relief - ARPA - Long Term Living Programs |

282,000 |

| PHFA |

COVID Relief - ARPA - Construction Cost Relief |

50,000 |

| |

Subtotal - State Fiscal Recovery |

4,600,000 |

| |

Remaining Balance - State Fiscal Recovery |

2,691,328 |

Pennsylvania’s school funding system suffers from inadequate and inequitable state support. The 2021/22 budget represents another incremental step toward fixing these issues, but many policymakers lament a missed opportunity to make the structural changes proposed by the governor.

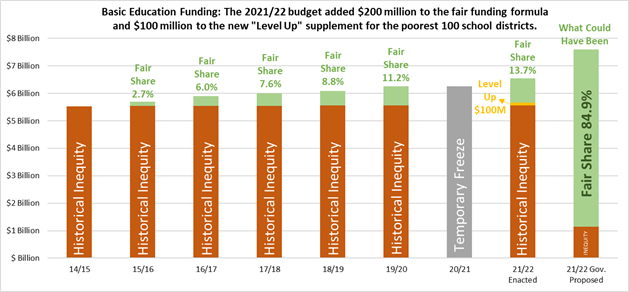

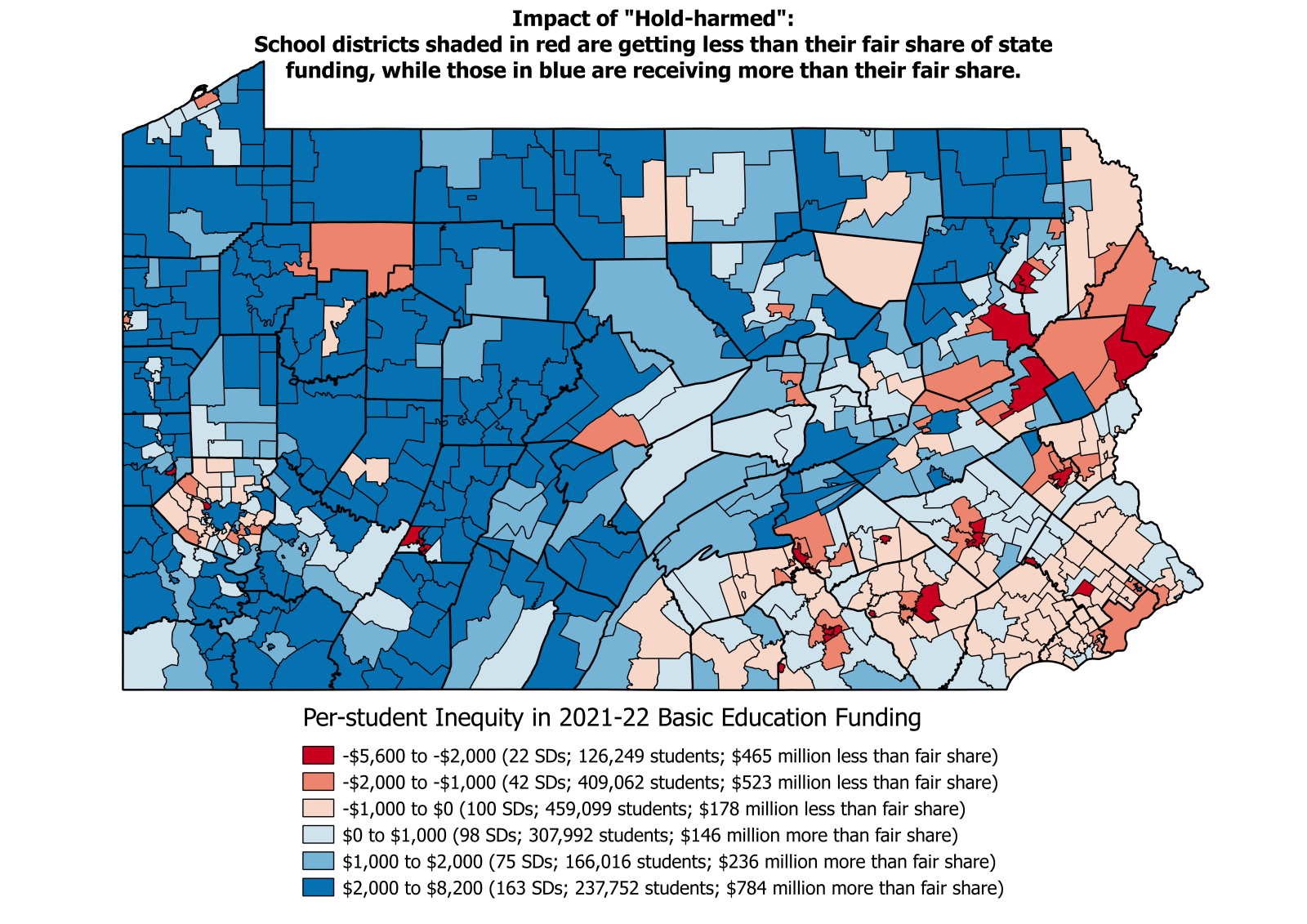

Basic education funding is the largest state education subsidy, representing about half of all the funds the state sends to school districts each year.

The 2021/22 budget increases funding for basic education by $300 million, or 4.8 percent. The Public School Code (SB 381) specifies that $200 million of this increase will be added to the funds distributed through the fair funding formula. The Fiscal Code (HB 1348) distributes the other $100 million through a new mechanism, referred to as “Level Up”, that provides targeted funding for the 100 school districts (bottom 20th percentile) with the lowest spending per weighted student. Weighted students are a more apples-to-apples way to compare spending since it takes into account the fact that some students (e.g., those living in poverty or who speak English as a second language) require more resources in order to meet academic standards.

The Fair Funding Formula

Since 2015/16, new basic education funding has been distributed through the bipartisan fair funding formula. In 2021/22, $899 million, or 13.7 percent, of the $6.56 billion basic education funding total will be distributed through the fair funding formula’s annually updated factors (e.g., enrollments, poverty levels, and household income). The other $5.56 billion is subject to “hold-harmed,” where all the historical inequities that were in place in 2014/15 get locked into the distribution.

Generally, it is the school districts that have seen growing enrollments, have high taxes, or concentrated poverty that continually get shortchanged by the state not distributing all funds through the fair formula. Students of color disproportionately attend school districts not receiving their fair share of state funding. Redistributing all of the funding fairly without growing the pie would create significant winners and losers, which is the largest barrier to 100 percent fair funding.

In his budget proposal, Gov. Wolf called for a $1.3 billion, or 22 percent, increase to bypass the winners and losers predicament. An investment of this size would enable all existing basic education funding to be distributed through the fair formula while ensuring every school district would get an increase. By the end of 2020/21, with strong state revenues generating a surplus north of $3 billion, it was clear that the governor’s proposal could be implemented without the tax increase on which it was initially predicated.

Ultimately, the enacted budget only marginally increased the amount of funds being distributed through the fair funding formula. However, for the first time since the fair funding formula took effect, a new distribution method has been added to the mix.

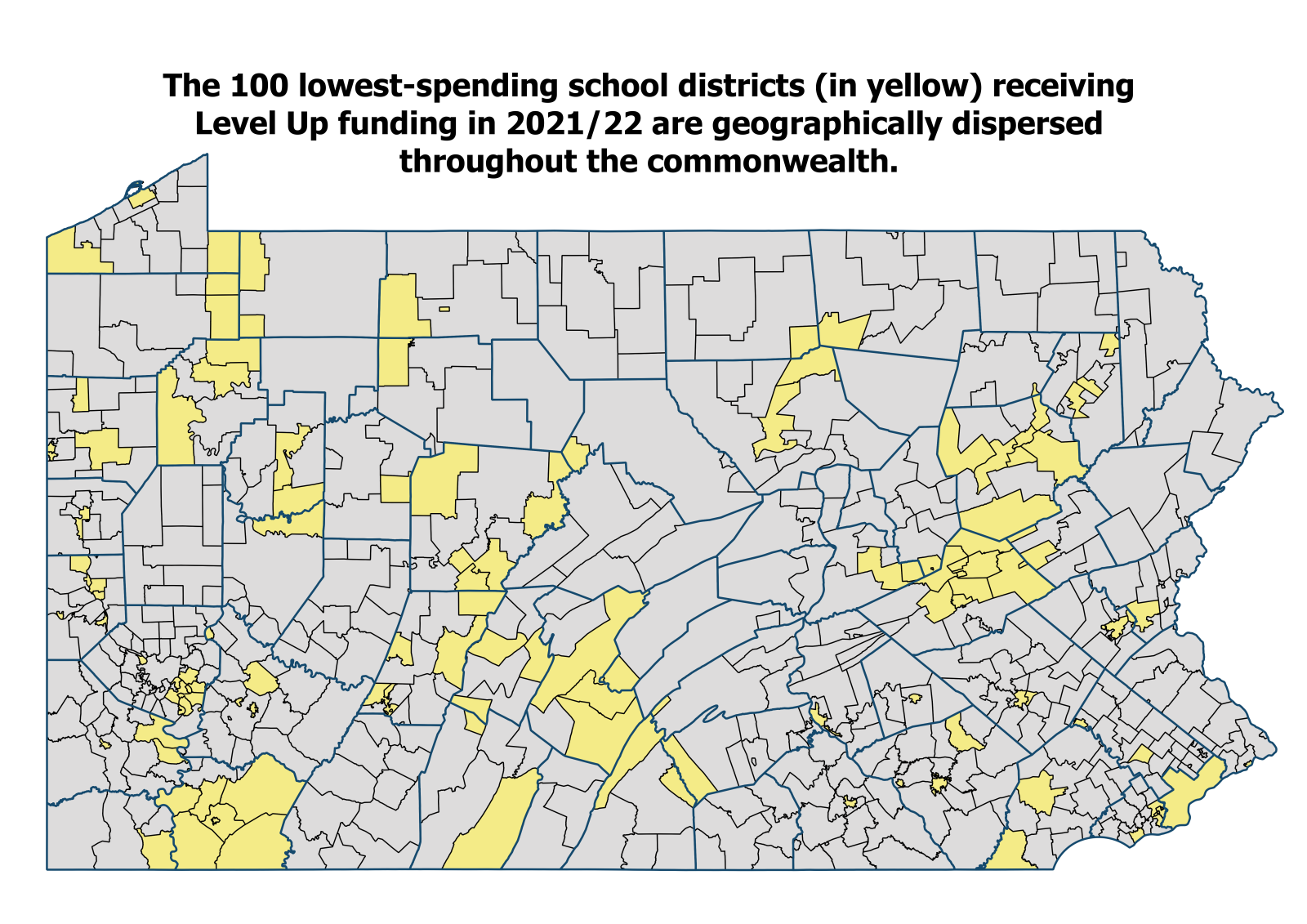

Level Up

The Level Up supplement uses elements of the fair funding formulas for basic and special education to direct funding to the 100 school districts (PA has 500 total) that have the lowest spending per weighted student. Weighted student is defined as the sum of the following add-on weights in the basic education formula: acute poverty, poverty, concentrated poverty, English Language Learners, and charter school students; plus the three weighted tiers of special education students.

The Level Up funds are geographically dispersed, impacting rural and urban areas alike.

Other

The budget increased the Ready to Learn Block Grant by $20 million, or 7.5 percent, but there was no statutory distribution of these added funds. Per Section 2599.6 of the Public School Code, the $268 million total from 2020/21 will be distributed to school districts and charter schools in 2021/22 in the same amount as in 2018/19.

A note on the appropriation for School Employees’ Social Security:

The state reimburses school districts, Intermediate Units, Area Career and Technical Centers, and Community Colleges for at least half of their employer costs for social security and Medicare. Beginning in 2019/20, the school district portion of this reimbursement was folded into the basic education funding appropriation. There is no apparent benefit to this move, but the drawbacks include less budget transparency and added administrative hurdles.

According to a news report, the House Republican caucus insisted on this change, making the unsubstantiated claim that PA was not getting credit for this state spending in national comparisons. The methodology in the U.S. Census’ Annual Survey of School System Finances, a frequently cited national comparison for education funding that ranks PA as 45th nationally (6th worst) in terms of the state share of education spending, indicates that social security contributions by the state fall under “staff improvement programs” and are counted in revenue from state sources regardless of where they are appropriated.

Basic Education Funding (BEF) Appropriation

($ amounts in thousands) |

Actual

FY18-19 |

Actual

FY19-20 |

Enacted

FY20-21 |

Revised

FY20-21 |

Enacted

FY21-22 |

21-22 Enacted

less

20-21 Revised |

| Basic Education Funding |

$6,095,079 |

$6,742,838 |

$6,810,389 |

$6,794,489 |

$7,066,773 |

$272,284 |

4.0% |

| BEF Portion |

$6,095,079 |

$6,255,079 |

$6,255,079 |

$6,255,079 |

$6,555,079 |

$300,000 |

4.8% |

| Social Security Portion |

$0 |

$487,759 |

$555,310 |

$539,410 |

$511,694 |

-$27,716 |

-5.1% |

| Note: 2020/21 amounts include $37.6 million to cover prior years' shortfalls; 2020/21 current year costs are $501.8 million. |

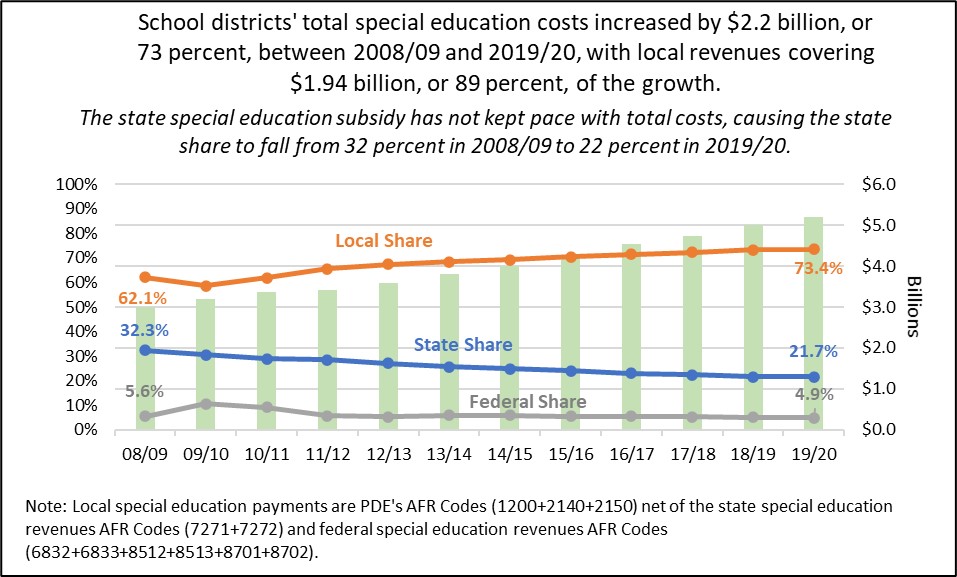

Special education is consistently identified as a top cost-driver for school districts. The state subsidy has simply not kept pace with the growing costs of providing services. Since 2008/09, local taxpayers have picked up 89 percent of the increased special education costs, and the state share has fallen from 32 percent to 22 percent. In order to reverse this trend, the $50 million, or 4.2 percent, increase in the enacted 2021/22 budget must be the start of a sustained investment.

The enacted 2021/22 budget provides a $30 million, or 11 percent, increase in funding for high quality early learning. Under Gov. Wolf's tenure, the number of state-funded slots has more than doubled.

| The enacted 2021/22 budget provides a $30 million, or 11 percent, increase in funding for high quality early learning. Under Gov. Wolf's tenure, the number of state-funded slots has more than doubled. |

Actual |

Available |

Enacted |

Enacted Increase

FY21-22 Less FY20-21 |

Gov. Wolf's Record

FY21/22 Less FY14-15 |

| FY14-15 |

FY20-21 |

FY21-22 |

Δ |

%Δ |

Δ |

%Δ |

| Pre-K Counts |

Funding Level |

$97.3 M |

$217.3 M |

$242.3 M |

$25.0 M |

11.5% |

$145.0 M |

149.0% |

| Estimated # of State-Funded Students |

13,456 |

26,461 |

29,261 |

2,800 |

10.6% |

15,805 |

117.5% |

| Head Start Supplemental Assistance |

Funding Level |

$39.2 M |

$64.2 M |

$69.2 M |

$5.0 M |

7.8% |

$30.0 M |

76.6% |

| Estimated # of State-Funded Students |

4,781 |

7,790 |

8,261 |

471 |

6.0% |

3,480 |

72.8% |

| Early Childhood Education Subtotal: |

Funding Level |

$136.5 M |

$281.5 M |

$311.5 M |

$30.0 M |

10.7% |

$175.0 M |

128.2% |

| Estimated # of State-Funded Students |

18,237 |

34,251 |

37,522 |

3,271 |

9.6% |

19,285 |

105.7% |

| Source: HACD analysis of Governor's Executive Budget 2021-2022, page E15-14 |

There are still 103,455 eligible (living below 300 percent of the federal poverty line) Pennsylvania children that do not have access to high-quality pre-kindergarten. At a cost of $8,750 per child, it would take an additional $905.2 million meet this need.

The state’s Pupil Transportation subsidy reimburses school districts (one-year lag) and Intermediate Units (current year) based upon actual transportation activity (e.g., miles driven, pupils transported, etc.). Therefore, reduced transportation activity due to COVID-19 translates to lower state payments. The 2021/22 budget makes a downward revision of 10.3 percent, or $62.5 million, to the 2020/21 funding level to reflect the decreased transportation activity by school districts in 2019/20 and by IUs in 2020/21. Looking ahead, it is difficult to estimate the amount needed for 2021/22, as it will be largely based on transportation provided in the disrupted 2020/21 school year. Additionally, Act 136 of 2020 included provisions to incentivize continued payments to bus contractors, which will impact the 2021/22 subsidy. The enacted amount for 2021/22 is $597 million, which is in line with the amount provided for current year costs in 2019/20. Data reports for the 2020/21 school year that will provide a better picture for estimates will start to be filed in September 2021.

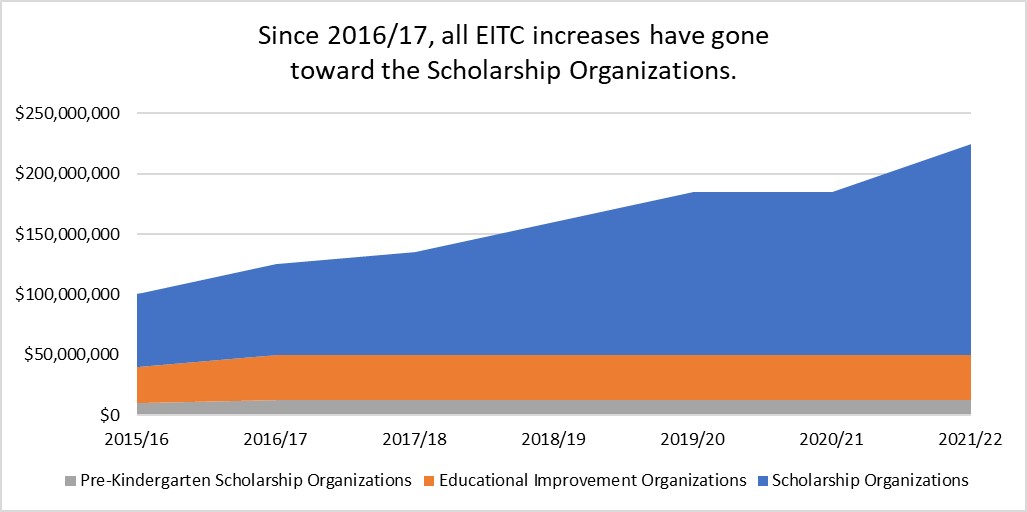

The school code increased the total cap for the EITC program by $40 million, or 21.6 percent. EITC is the collective name for three distinct programs:

- Scholarship Organizations (SOs) – benefits tuition-paying students (i.e., private school students)

- Educational Improvement Organizations (EIOs) – benefits innovative education programs (e.g., libraries, museums, civic clubs, community centers, school districts, charters, private schools, etc.)

- Pre-Kindergarten Scholarship Organizations (Pre-K SOs) – benefits public and private pre-k students

As has been the case since 2016/17, the entire increase in 2021/22 is allotted to the scholarship organization cap, rather than spread proportionally between all three programs. The 2021/22 Scholarship Organization credit limit is rising from $135 million to $175 million, a 30 percent increase.

Tax credits for SOs have grown by $100 million or 133 percent since 2016/17, while tax credits for EIOs and Pre-K SOs have remained flat. This has caused the EITC funding ratio of these programs to go from 60 percent for SOs, 30 percent for EIOs, and 10 percent for Pre-K SOs in 2016/17 to 78 percent for SOs, 17 percent for EIOs, and 6 percent for Pre-K SOs in 2021/22.

No charter school reforms were included as part of the 2021/22 budget package.

Gov. Wolf's charter school reform proposal is reflected in House Bill 272. The bill would generate savings to school districts by implementing a statewide cyber charter tuition rate and by applying the fair funding formula for special education to the way school districts pay charter schools. Had these reforms been in place in 2019/20, school districts would have saved $396 million, or 18 percent, of the $2.2 billion in tuition paid to charter schools.

The final data is not in yet, but PASBO anticipates a $450 million increase in the total amount of charter school tuition paid by school districts in 2020/21, which is more than double the typical annual change and driven by the COVID-19 induced 59 percent increase in cyber charter enrollment.

The 2021/22 budget package appropriated and provided the distribution for federal relief funding for education from the American Rescue Plan Act (ARPA). Follow this link for more information about these funds.

The State Board of Education approved the establishment of Erie County Community College last summer, which is the 15th community college in the commonwealth, and the first new community college created in decades.

The 2021/22 budget reflects this new institution by dedicating the $1.4 million increase in the community college operating appropriation to Erie. Other community colleges will receive flat funding in the upcoming fiscal year.

On the facilities side, the community college capital appropriation increased by $3.2 million. While not specifically directed to Erie like the operating allocation, the budget’s Public School Code bill removed a provision that prohibited Erie County Community College from receiving any capital support. Both operating and capital support will help the new school move toward opening its doors, expanding educational opportunities, and help meet workforce development needs in Erie.

State funding for other public institutions of higher education, including the state-related universities (Penn State University, University of Pittsburgh, Temple University, Lincoln University, and the Thaddeus Stevens College of Technology) is the same as last fiscal year.

The Pennsylvania State System of Higher Education (PASSHE) received level state funding. In addition to state funding, the budget allocated $50 million in federal American Rescue Plan Act (ARPA) dollars to PASSHE for COVID Relief.

Under PHEAA, institutional assistance grants for private colleges and universities remain level funded.

The PHEAA State Grant program is the largest need-based aid program for postsecondary students in the commonwealth. The budget appropriates level funding of $310.7 million to the program. Although state support is not increasing, the maximum PHEAA grant award is expected to increase to $5,000 in 2021/22. This is a $321 increase over last year’s maximum grant and will be the highest amount in the history of the program, eclipsing the previous high of $4,700.

A decline in the number of applications for aid is the primary driver for the increase in award amounts, as the grant pool is not spread as far. This continues a trend from 2020/21, when the number of grant recipients fell short of the forecasted amount. PHEAA will carry forward and redeploy $23.5 million in unspent resources from the 2020/21 fiscal year into the next year to help increase grant amounts, while also contributing $15 million in business earnings to augment the state appropriation.

Other PHEAA programs received level funding in the budget, including:

- $800,000 for the Bond-Hill scholarships,

- $3.5 million for the Cheyney Keystone Academy - separately, the Fiscal Code requires PHEAA to continue to augment the appropriation with $500,000 from its business earnings,

- $2.36 million for Act 101 programs,

- $5.55 million for the Ready to Succeed merit-based scholarships, and

- $6.3 million for the PA-TIP program, supporting students enrolled in shorter certificate programs in high-demand fields.

Last year, the General Assembly appropriated $42.2 million in federal CARES Act Coronavirus Relief Fund resources to help bolster PHEAA programs, including the state grant program, the institutional assistance grants, Act 101 programs and a short-term student loan interest forbearance for PHEAA-held loans. In the 2021/22 budget, no additional federal relief dollars were appropriated to support PHEAA programs.

This budget continued to fully fund the actuarially required contributions to the Public School Employees’ Retirement System (PSERS) and the State Employees’ Retirement System (SERS). This marks six consecutive years of full funding for the commonwealth’s two largest public pension funds after fifteen years of systematic underfunding.

Approximately half of employer contributions to PSERS comes from the commonwealth, with the other half paid by local school districts. The commonwealth appropriation for contributions to PSERS is contained within the budget for the Department of Education. State contributions to PSERS increased by $32 million, or 1.2 percent, to a total of $2.734 billion.

Funding for SERS is contained within the personnel costs of the various state agencies and other covered employers, rather than appearing as a single appropriation within the budget. Approximately 40 percent of employer contributions to SERS come from the General Fund, with 52 percent coming from various special and federal funds and an additional 8 percent coming from non-state employers. Total employer contributions for SERS increased slightly, to just under $2.2 billion.

During the 2020/21 fiscal year, one SERS covered employer – Penn State - contributed just over $1 billion in excess contributions to prepay its share of the unfunded liabilities of SERS. To do so, Penn State took advantage of its own favorable borrowing costs. This transaction provided cost savings to Penn State while also improving the overall financial health of SERS. PASSHE has also prefunded $825 million of its share of the unfunded liability resulting in annual savings. Other employers may explore conducting similar transactions with SERS in the future.

In addition to the employer contributions detailed above, the enacted budget package also included the “housekeeping bills” - separate appropriations bills passed each year for agencies with funding sources outside the General Fund - that appropriate funds for the general operations of the two pension systems. These bills each make two separate appropriations: one for the administration of traditional defined benefit pension system and another for the administration of the defined contribution plan established by Act 5 of 2017.

The appropriation for PSERS’ defined benefit administration was flat-funded at $52.3 million, while the appropriation for its administration of the defined contribution system decreased by $128,000, to $955,000 - these appropriations were made in Act 11A. The defined benefit administration appropriation for SERS increased by $2.4 million, to $33.1 million, while its defined contribution appropriation decreased by $159,000, to $4.4 million - these appropriations were made in Act 12A.

| Final 2021/22 State Appropriations - Health and Human Services |

| ($ amounts in thousands) |

| |

Department |

| Fund |

Aging |

Health |

Drug & Alcohol Programs |

Human Services |

| General Fund |

|

$209,815 |

$47,729 |

$16,136,498 |

| Lottery Fund |

$470,267 |

|

|

$352,466 |

| Tobacco Settlement Fund |

|

|

|

$152,457 |

| Emergency Medical Services Operating Fund |

|

$13,500 |

|

|

| Opioid Settlement Restricted Account |

|

|

$5,000 |

|

| Total 2021/22 State Appropriations |

$470,267 |

$223,315 |

$52,729 |

$16,641,421 |

The enacted budget includes funding for two new local health departments, Delaware County and Lackawanna County, effective January 1, 2022. From the Local Health Departments appropriation, Delaware County is estimated to receive up to $1.41 million in 2021/22 and Lackawanna County is estimated to receive up to $531,000 in 2021/22, based on currently available census data. Delaware and Lackawanna Counties will also be eligible for disbursements from the Local Health – Environmental appropriation estimated at $127,000 and $48,000, respectively.

The governor’s executive budget also requested funding to pay all local health departments at the maximum amount allowed under Act 315 of 1951, or $6 per capita. Funding was not included to provide for the maximum level of reimbursement.

After accounting for a change in enhanced Federal Medical Assistance Percentage (FMAP) earning assumption outlined in further detail under Human Services, Department of Health’s General Fund administrative and programmatic appropriations are funded at the governor’s requested amounts for 2021/22. This includes funding updates submitted in April for funding to fill several critical positions essential to public health. Funding for legislative initiative items is restored to the 2020/21 levels except for Bio-Technology Research, which received an increase of $850,000, to $8.55 million.

The Emergency Medical Services Operating Fund (EMSOF) received $5 million from the State Fiscal Recovery Funds provided in the American Rescue Plan Act. The EMSOF has been experiencing a trend of decreasing revenues compounded by the impact the COVID-19 pandemic had on reducing the number of moving traffic violations and Accelerated Rehabilitation Disposition (ARD). Act 93 of 2020, increased the fee for ARD from $25 to $50 and moving traffic violations from $10 to $20; however, it will take time to build the balance of the fund. The $5 million transfer will allow for $9.2 million to support Emergency Medical Services, $1 million more than proposed by the governor, and $4.3 million to support catastrophic medial and rehabilitation services.

General Fund appropriations to the Department of Drug and Alcohol Programs (DDAP) are enacted as requested by the governor.

In addition, the Fiscal Code establishes the Opioid Settlement Restricted Account requiring money received by a state agency that is the result of a legal action related to opioids to be deposited in the account. Additionally, money must be appropriated by the General Assembly from the account. To date, the Commonwealth has received $21.3 million in opioid related settlement funds. The General Appropriations Act provides DDAP $5 million from the account in 2021/2022.

The final enacted budget appropriates $16.1 billion in state General Funds to the Department of Human Services (DHS). This is a $2.5 billion, or 19 percent increase, over 2020/21.

The Families First Coronavirus Response Act provided an additional 6.2 percent FMAP on Medicaid eligible costs, reducing state funds needed in the programs. The enhanced FMAP is available through the end of the quarter that contains the end of the federal public health emergency (PHE). The federal PHE currently ends July 19, 2021, however, the Federal Department of Health and Human Services has indicated the PHE will remain in place at least through December 31, 2021.

The governor’s executive budget proposal assumed enhanced FMAP would be available through June 30, 2022; however, the enacted budget assumes extensions only through December 31, 2021, and all General Funds have been restored for the change in assumption. The enacted budget assumption of six months of enhanced FMAP for 2021/22 fiscal year is estimated to be $1.2 billion, which reduces state General Fund need by the same amount.

The enacted budget assumes $200 million in revenues from the Joint Underwriting Association (JUA) in 2021/22. This revenue has been assumed for several years and when it has not been received by June 30 each year, it has been backfilled with General Funds and the revenue is assumed in the subsequent year. The court case is still pending. If the revenue is not received by June 30, 2022, this will once again need backfilled with General Funds.

In total, that equates to $1.4 billion in 2021/22 General Fund one-time reductions that will need replaced in 2022/23.

Medical Assistance

After several years of relatively flat Medical Assistance (MA) enrollment, as of May 2021, MA enrollment has grown more than 13 percent since February 2020, the month prior to the pandemic impacting Pennsylvania. Enrollment changes can be seen across the various categories of eligibility, but growth is most pronounced in the Medicaid Expansion group. States are prohibited from terminating Medicaid eligibility for the duration of the PHE, except in specific cases, contributing significantly to the increased enrollment.

The appropriation Payments to Federal Government – Medicare Drug Program is used to pay the state share of prescription drug coverage for individuals dually eligible for Medicare and Medicaid. The rate billed by the federal government to states is reduced by the FMAP, unlike other MA programs that pay 100 percent of the costs and receive the FMAP as a reimbursement. Therefore, funding for this program has been reduced due to the enhanced FMAP lowering the state share of costs billed by the federal government. It is not offset by increased federal funds like other MA programs. However, the change in assumption related to the duration of the enhanced FMAP still impacts this appropriation. Additionally, the Centers for Medicare and Medicaid Services (CMS) is projecting a 7.3 percent increase in state contributions to Medicare Part D coverage effective January 1, 2022, after several years of relatively flat contribution rates. The estimated state contribution increase is also reflected in the enacted amount for this appropriation.

The Critical Access Hospitals appropriation is used to pay Medicare designated critical access hospitals up to 101 percent of their MA allowable costs. The appropriation was increased above the governor’s request based on industry estimates of the amount necessary to provide 101 percent of MA allowable costs in 2021/22.

The budget fully restores funding for hospitals and medical centers in the Physician Practice Plans and Academic Medical Centers appropriations in line with historical funding amounts.

Senate Bill 156 to expand the Medical Assistance for Workers with Disabilities (MAWD) program unanimously passed the full House of Representatives on June 25, 2021, as budget related bills were also moving through the process. The bill is estimated to cost $10.1 million, including $4.8 million in state funds, in 2021/22. Due to the timing of the passage of SB 156 relative to the budget bills, funding was not included in the enacted budget for the program. Therefore, DHS will need to monitor ongoing program enrollments and costs and may need to request supplemental funding in the governor’s 2022/23 budget.

Long Term Living

Enrollment in Community HealthChoices (CHC) continues to steadily grow. As of April 2021, there were 384,175 individuals enrolled in CHC, an increase of nearly 5 percent over April 2020. Funding for continued enrollment growth is included in the enacted budget. However, the CHC appropriation does not include any consideration for a calendar year 2020 risk corridor payment, which may lead to a supplemental funding need within the 2021/22 fiscal year.

Enrollment in the Living Independence for the Elderly (LIFE) program has grown by 2 percent between February 2020 and February 2021. In addition to funding for normal program growth, the 2021/22 budget includes funding for a LIFE rate increase. It is estimated that the additional funding will provide for an approximate 2 percent rate increase.

Growth in the two remaining fee-for-service programs, Act 150 and OBRA Waiver, have declined over the past year. Act 150 enrollments have decreased by 2 percent and OBRA Waiver enrollments have decreased by 3 percent.

Senate Bill 108 amended the Human Services Code to provide a $130 per diem payment for ventilator and tracheostomy care provided to MA residents in qualified nonpublic and county nursing facilities. Typically, Medicaid managed care rates must be sufficient to cover all costs for services provided under a managed care delivery model. Since Senate Bill 108 creates a new fee-for-service payment for services covered under CHC, it is unlikely that DHS will receive approval for federal Medicaid matching funds. The annual fiscal impact is estimated at $13.5 million. Due to the timing of the passage of the bill relative to the budget bills, funding was not included in the Long-Term Living appropriation and are unbudgeted for 2021/22. DHS may need supplemental funding in the governor’s 2022/23 budget.

Long-Term Living programs will receive $282 million in COVID State Fiscal Recovery funding provided to the Commonwealth from the American Rescue Plan Act (ARPA). This includes $247 million for nonpublic and county nursing facilities, $5 million for a long-term care facility indoor air management grant program and $30 million for assisted living residences and personal care homes.

Intellectual Disabilities and Autism

The enacted budget includes $13.8 million requested by the governor to serve 832 individuals with intellectual disabilities or autism waiting for services. The initiative will serve 100 individuals in the Consolidated Waiver (uncapped waiver that includes residential services) and 732 individuals in the Community Living Waiver ($75,000 annual cap and no residential services). The enacted budget also contains sufficient funding to serve special education graduates in the Person/Family Directed Services Waiver ($33,000 annual cap and no residential services) through attrition.

Child Development

The enacted budget maintains state funds for childcare and evidence-based home visiting programs at 2020/21 levels and funds early intervention at the governor’s requested level after accounting for the change in enhanced FMAP assumption.

Federal funds in the amount of $728.9 million and Fiscal Code language were included in the budget package to create the Child Care Stabilization program in Pennsylvania. The funding was provided to states in the ARPA to assist states in stabilizing their childcare sector.

Other

After adjustments for the change in enhanced FMAP assumption, the enacted budget provides funding for Mental Health Services at the amount requested by the governor, including $1.25 million to discharge 20 individuals from state hospitals through the Community Hospital Integration Project Program (CHIPP).

The enacted budget includes the governor’s requested increase of $1 million for Legal Services to expand legal services to low-income individuals and families, plus an additional $500,000 above the request. The Domestic Violence and Rape Crisis lines also received $1 million each in increased funding in the enacted budget.

The County Child Welfare appropriation was funded as requested by the governor less the two proposed initiatives.

Funding for Breast Cancer Screening, Human Services Development Fund, Homeless Assistance, Expanded Medical Services for Women, 211 Communications, and Services for the Visually Impaired appropriations are maintained at the 2020/21 levels.

Funding to the DHS administrative and facility appropriations are funded at the amounts requested by the governor after accounting for enhanced FMAP assumption change, except for Intellectual Disabilities - State Centers, which is funded at the 2020/21 level. The appropriation for Youth Development Centers was increased by $30 million to reflect the one-time use of CARES Act Coronavirus Relief Funds in the program in 2020/21.

The Children’s Health Insurance Administration appropriation was dissolved as proposed by the governor’s executive budget. The funding for personnel costs is now included in the County Administration - Statewide appropriation and operating costs of the program are included in the Children’s Health Insurance Program appropriation.

Finally, new federal appropriations and associated Fiscal Code provisions were included in the enacted budget package for the Emergency Rental Assistance Program from the ARPA and the Low-Income Home Water Assistance Program from both the Consolidated Appropriations Act of 2021 and the ARPA.

Act 43 of 2017 authorized the governor to issue $1.5 billion in bonds backed by future revenues from the Tobacco Master Settlement Agreement (MSA). The act established procedures for the resulting debt payments, which allowed for repayment either from MSA revenues or from general tax revenues.

The Fiscal Code continues the requirement that MSA revenues sufficient to make annual debt service payments must be deposited into the debt service account established by Act 43. Debt service payments will total $115 million in 2021/22, representing approximately one-third of expected MSA revenues for the fiscal year. However, the Fiscal Code also continues to require revenues equal to the debt service amount to be transferred from cigarette tax collections and deposited into the Tobacco Settlement Fund. Consequently, the Fund is again held harmless in 2021/22.

The Fiscal Code also outlines how funds are to be distributed. Primary level allocations are unchanged at:

- 4.5 percent for tobacco use prevention and cessation programs,

- 12.6 percent for health and related research,

- 1 percent for health and related research (National Cancer Institute grantees, formula based),

- 8.18 percent for hospital uncompensated care,

- 30 percent for Medical Assistance for Workers with Disabilities, and

- 43.72 percent for health-related purposes (allocated to life science greenhouses and Community HealthChoices).

New for this year is a prescriptive distribution included under the 12.6 percent allocated for health and related research. Previously, 70 percent of that amount was distributed via formula to National Institute of Health grantees and 30 percent was allocated at the discretion of the Secretary of Health, in consultation with the Health Research Advisory Committee. In 2021/22, the 70 percent portion of the allocation remains unchanged. However, the 30 percent portion is dictated by the Fiscal Code. First, $1 million is to be directed to spinal cord injury research. Then, the remaining amount is to be split 75 percent for pediatric cancer research and 25 percent for biotechnology research.

The Lottery Fund includes $1.2 billion for senior programs in 2021/22. On the surface, this appears to be an increase of $141 million compared to 2020/21. However, Act 20 allowed for the payment of calendar year 2019 property tax and rent rebate claims to be paid based on an approved claim for calendar year 2018 and to be paid prior to June 30, 2020, due to the pandemic. This shifted $239.1 million in payments originally planned in the 2020/21 year back to 2019/20 year. If not for the expediting of these payments, Lottery Fund appropriations for 2021/22 would have decreased by $98 million. Most of this decrease is related to the one-time use of an additional $90 million in Lottery Funds in the 2020/21 Community HealthChoices appropriation.

The table on the following page details Lottery Fund programmatic expenditures by agency and program. Funding for programs administered by the Departments of Aging and Human Services are appropriated from the Lottery Fund as part of the General and Supplemental Appropriations Acts. Programs administered by the Departments of Revenue and Transportation receive their funding through executive authorizations.

| Lottery Fund Expenditure for Senior Programs |

| ($ amounts in thousands) |

| |

2020/21 |

2021/22 |

Increase/ |

| Agency/Program |

Revised |

Enacted |

(Decrease) |

| Department of Aging: |

| PennCARE |

285,726 |

281,993 |

(3,733) |

| Pharmaceutical Assistance Fund |

155,000 |

155,000 |

- |

| Pre-Admission Assessment |

8,750 |

8,750 |

- |

| Caregiver Support |

12,103 |

12,103 |

- |

| Grants to Senior Centers |

2,000 |

2,000 |

- |

| Alzheimer's Outreach |

250 |

250 |

- |

| Department of Human Services: |

| Medical Assistance Transportation |

3,500 |

3,500 |

- |

| Community HealthChoices |

438,966 |

348,966 |

(90,000) |

| Department of Revenue: |

| Property Tax and Rent Rebate (PTRR) * |

- |

234,900 |

234,900 |

| Department of Transportation: |

| Transfer to Public Transportation Trust Fund * |

95,907 |

95,907 |

- |

| Shared Ride * |

75,000 |

75,000 |

- |

| TOTAL LOTTERY FUNDS |

1,077,202 |

1,218,369 |

141,167 |

| Act 20 PTRR Payment Expedite |

239,100 |

- |

(239,100) |

| TOTAL LOTTERY FUNDS (if not for Act 20) |

1,316,302 |

1,218,369 |

(97,933) |

| * Executive Authorizations |

Within the Department of Labor and Industry, general government operations increased by $220,000. This increase, as proposed in the executive budget, will support the deaf-blind support service provider program.

The budget also increased funding for assistive technology financing by $25,000 to a total of $500,000, which supports the commonwealth’s alternative loan program through the Pennsylvania Assistive Technology Foundation. This appropriation helps ensure access to expensive assistive technology devices, equipment and home modifications for Pennsylvanians who need them.

Other programs supporting Pennsylvanians with disabilities were level-funded in the budget, including state funding for the Office of Vocational Rehabilitation (OVR), Centers for Independent Living, supported employment, and the assistive technology demonstration lending library.

The budget includes $750,000 for New Choices/New Options, which is the same amount as 2020/21.

Funding for industry partnerships ($2.8 million) and apprenticeship training ($7 million) remains unchanged for the coming fiscal year.

The appropriations for occupational disease payments and workers compensation payments are funded at the amounts recommended in the executive budget. Both of these appropriations are declining over time, as the eligible populations decrease.

The 2021/22 budget does not differ immensely from the 2020/21 budget for the Department of State. One of the most notable differences is the $11.791 million allocation to the Statewide Uniform Registry of Electors (SURE) appropriation. This appropriation received a $4.486 million increase compared to 2020/21. The increase in funding will support continuous system upgrades that will promote election modernization.

In addition, the enacted budget establishes a $2.5 million appropriation to support the publication of the state reapportionment maps and a $400,000 appropriation to publish the federal reapportionment maps.

Furthermore, the enacted budget allocates $9.275 million to fund the election code debt service, pursuant to Act 77 of 2019.

Lastly, the enacted budget also provides an $1.5 million increase to support the general government operations for the department.

The 2021/22 budget for the Department of Community and Economic Development (DCED) was mostly flat funded compared to 2020/21; nevertheless, there are several differences. One of the most noteworthy differences is the $1.678 million decrease in the Local Municipal Relief appropriation. The $18.775 million appropriation is used to assist people or political subdivisions directly affected by disasters or public safety emergencies that do not qualify for federal assistance. Grants are made available for reimbursement when an area is not covered under a Presidential disaster declaration or DCED determines a public safety emergency has occurred.

Additionally, the enacted budget eliminates the $5 million State Facilities Closure Transition appropriation. This appropriation provided grants and loans to local municipalities impacted by the permanent closure of a state-operated or owned facility.

Moreover, the enacted budget eliminates the $750,000 Public Television Technology appropriation. This appropriation provided funding to Pennsylvania public television organizations for technology needs and operating expenses.

DCED’s state General Government Operations appropriation received an allocation of $21.032 million, which is a $1.949 million increase compared to 2020/21.

Under executive offices, $5 million is appropriated for transfer to the Commonwealth Financing Authority to support the Unserved High-Speed Broadband Funding Program Act (Act 132 of 2020), the same amount made available in 2020/21. Under this program, any non-governmental entity may apply for funds to support the deployment of wired and/or fixed wireless high-speed broadband service infrastructure in unserved areas of the Commonwealth. An unserved area is defined as a designated geographic area in which households or businesses do not have access to at least 25 megabits per second downstream speeds and 3 megabits per second upstream speeds.

For 2021/22, the Department of Environmental Protection was funded as proposed by the governor. The department’s General Fund total of $169.04 million represents a $12.7 million, or 8 percent, increase over 2020/21.

Consistent with other administrative appropriations, General Government Operations received $1.66 million increase, in order to provide for continuing needs.

In a similar fashion, Environmental Program Management (EPM) and Environmental Protection Operations (EPO), received increases. In the case of EPM, the appropriation received a $2.11 million increase and EPO received a $3.83 million increase.

Akin to 2020/21, Water Commissions are not funded to their Fair Share and are not provided with any changes.

The Black Fly Control appropriation was provided with a notable increase of $4.29 million. This increase will make black fly spraying available throughout the entire season, as well as provide for an increase in treated acres and allow more areas to be treated.

Lastly, as Pennsylvania continues the implementation of the Phase 3 Water Implementation Plan (WIP), the Chesapeake Bay Agricultural Source Abatement receives a significant increase, in terms of a percentage change, but small in terms of total dollars. The appropriation increase of $526,000 above 2020/21 is needed in order to achieve the targets set by the WIP.

| 2021/22 DEP STATE GENERAL FUNDS |

| ($ amounts in thousands) |

| Appropriation |

Available |

Enacted |

Enacted less Available |

| 2020/21 |

2021/22 |

$ diff |

% diff |

| General Government Operations |

$ 15,095 |

$ 16,759 |

$ 1,664 |

11.0% |

| Environmental Program Management |

$ 32,041 |

$ 34,160 |

$ 2,119 |

6.6% |

| Environmental Protection Operations |

$ 94,202 |

$ 98,036 |

$ 3,834 |

4.1% |

| Transfer to Conservation District Fund |

$ 2,506 |

$ 2,506 |

$ - |

0.0% |

| Chesapeake Bay Agricultural Source Abatement |

$ 2,935 |

$ 3,461 |

$ 526 |

17.9% |

| Black Fly Control |

$ 3,347 |

$ 7,645 |

$ 4,298 |

128.4% |

| West Nile Virus Control |

$ 5,345 |

$ 5,609 |

$ 264 |

4.9% |

| Water/Mining Commissions |

$ 866 |

$ 866 |

$ - |

0.0% |

| STATE GF TOTAL |

$ 156,337 |

$ 169,042 |

$ 12,705 |

8.1% |

| |

|

|

|

|

| Environmental Hearing Board |

$ 2,554 |

$ 2,593 |

$ 39 |

1.5% |

| |

|

|

|

|

| DEP GF TOTAL |

$ 158,891 |

$ 171,635 |

$ 12,744 |

8.0% |

The department’s budget was mostly level-funded to 2020/21. DCNR’s General Fund budget of $139.05 million represents an increase of $4.24 million, or 3.1 percent.

Consistent with the overall budget theme, General Government Operations (GGO) received a $1.63 million increase, which is in line with continuing personnel needs.

In a similar fashion, State Forests Operations also received an increase in the amount of $2.55 million. Unlike the GGO, however, the increase falls $1 million short of the governor’s February proposal.

Last of the year-over-year General Fund changes is related to the Annual Fixed Charges – Forest Lands. Those in-lieu-of-tax payments increased by $39,000 in accordance with Act 85 of 2016.

Another component of the department’s budget worth noting is the decrease in utilization of the Oil and Gas Lease Fund (OGLF). The $1.037 million decrease is driven by the expected drop in revenues generated by rents and royalties which flow into the fund.

The following table provides details of DCNR’s major appropriations, by funding source.

| 2021/22 DCNR Major Appropriations Summary |

| General Fund and Oil & Gas Lease Fund Comparison |

| ($ amounts in thousands) |

| Funding Source / FY |

Actual |

Avail |

Enacted |

2020/21 Less 2019/20 |

| 2019/20 |

2020/21 |

2021/22 |

$ diff |

% diff |

| General Fund (GF) |

| General Gov't Ops |

$ 25,804 |

$ 26,717 |

$ 28,350 |

$ 1,633 |

6.1% |

| State Parks Ops |

$ 55,311 |

$ 54,326 |

$ 54,326 |

$ - |

0.0% |

| State Forests Opts |

$ 25,742 |

$ 40,635 |

$ 43,187 |

$ 2,552 |

6.3% |

| GF Subtotal |

$ 106,857 |

$ 121,678 |

$ 125,863 |

$ 4,185 |

3.4% |

| |

|

|

|

|

|

| Oil & Gas Lease Fund (OGLF) |

| General Gov't Ops |

$ 37,786 |

$ 14,827 |

$ 14,790 |

$ (37) |

(0.2%) |

| State Parks Ops |

$ 17,706 |

$ 17,000 |

$ 16,500 |

$ (500) |

(2.9%) |

| State Forests Opts |

$ 14,282 |

$ 17,000 |

$ 16,500 |

$ (500) |

(2.9%) |

| OGLF Subtotal |

$ 69,774 |

$ 48,827 |

$ 47,790 |

$ (1,037) |

(2.1%) |

| |

|

|

|

|

|

| GF/OGLF Total |

$ 176,631 |

$ 170,505 |

$ 173,653 |

$ 3,148 |

1.8% |

For 2021/22, Agriculture’s enacted budget was mostly level-funded to 2020/21. The department’s total General Fund budget of $174.5 million represents a $4.824 million increase, or 2.8 percent.

Two appropriation changes provide for the department’s total General Fund increase:

- General Government Operations received a $1.824 million, or 5.5 percent, increase. Of that increase, $1.324 million was the result of the necessary increase related to ongoing personnel costs as proposed under the executive budget proposal. Furthermore, there was $500,000 of additional support, for which the 2021/22 Fiscal Code provided spending guidance: $250,000 for Commission of Agricultural Education Excellence and $250,000 for the administration of the Dog Law.

- The enacted budget also provided a $3 million increase for the State Food Purchase appropriation. The appropriation provides funding for:

- State Food Purchase Program (SFPP) - $2 million increase

- Pennsylvania Agricultural Surplus System (PASS) - $1 million increase

- Emergency Food Assistance Program (TEFAP) – no change

- TEFAP Distribution – no change

| State Food Purchase Appropriation |

| $ amounts in thousands |

| |

Avail |

Enacted |

$ Diff |

| Program |

FY 20/21 |

FY 21/22 |

21/22 less 20/21 |

| State Food Purchase Program (SFPP) |

$ 16,688 |

$ 18,688 |

$ 2,000 |

| Pennsylvania Agricultural Surplus Program (PASS) |

$ 1,500 |

$ 2,500 |

$ 1,000 |

| Emergency Food Assistance Program (TEFAP) |

$ 1,000 |

$ 1,000 |

$ - |

| TEFAP Distribution |

$ 500 |

$ 500 |

$ - |

| State Food Purchase Appropriation |

$ 19,688 |

$ 22,688 |

$ 3,000 |

The 2021/22 budget also included level funding for the components of the PA Farm Bill (see the list on the following page).

PA FARM BILL COMPONENTS

($ amounts in thousands) |

Available |

Enacted |

| 2020/21 |

2021/22 |

| Agricultural Business and Workforce Investment |

|

|

|

| |

PA Business Development Center |

$ 2,000 |

$ 2,000 |

| |

PA Farm to School Grant Program |

$ 500 |

$ 500 |

| |

Incentivizing Access to Meat Processing Inspections |

$ 500 |

$ 500 |

| |

State-Level Specialty Crop Block Grant Program |

$ 500 |

$ 500 |

| |

Urban Agriculture Infrastructure |

$ 500 |

$ 500 |

| |

Agriculture & Youth Grant Program |

$ 500 |

$ 500 |

| |

Appropriation Farm Bill Components Subtotal |

$ 4,500 |

$ 4,500 |

| Transfer to Nutrient Management Fund* |

|

|

|

| |

Agriculture Linked Investment Program |

$ 500 |

$ 500 |

| |

Conservation Excellence Grant Program |

$ 2,500 |

$ 2,500 |

| |

Appropriation Farm Bill Components Subtotal |

$ 3,000 |

$ 3,000 |

| PA Preferred* |

|

|

| |

PA Preferred Organic |

$ 1,600 |

$ 1,600 |

| |

PA Preferred and Homegrown by Heroes Programs |

$ 1,000 |

$ 1,000 |

| |

Appropriation Farm Bill Components Subtotal |

$ 2,600 |

$ 2,600 |

| Agricultural Preparedness & Response |

|

|

| |

PA Rapid Response Disaster Readiness Account |

$ 3,000 |

$ 3,000 |

| |

Appropriation Farm Bill Components Subtotal |

$ 3,000 |

$ 3,000 |

| Agricultural Excellence* |

|

|

| |

Center for Animal Agriculture Excellence |

$ 1,000 |

$ 1,000 |

| |

Appropriation Farm Bill Components Subtotal |

$ 1,000 |

$ 1,000 |

| PA FARM BILL BUDGETARY COMPONENTS |

$ 14,100 |

$ 14,100 |

| |

| PA FARM BILL NON-BUDGETARY COMPONENTS |

|

|

| |

Resource Enhancement & Protection Tax Credit (REAP)* |

$ 3,000 |

$ 3,000 |

| PA FARM BILL NON-BUDGETARY COMPONENTS |

$ 3,000 |

$ 3,000 |

| |

| PA FARM BILL 2021/22 COMBINED COMPONENTS |

$ 17,100 |

$ 17,100 |

| *Only components of the PA Farm Bill displayed, not entire appropriation or tax credit |

The Motor License Fund (MLF) revenues have rebounded for the most part, after being dealt a major blow in 2020/21. As pandemic mitigations decreased, travel resumed and consequently led to a rise in MLF revenues. The 2021/22 budget provides for an increase of $125.78 million, or 7.7 percent, over 2020/21. The majority of MLF programs, saw increases in relation to 2020/21:

- Highway Safety & Improvement - $20 million increase

- Plus, an allocation of $279 million in American Rescue Plan Act (ARPA) funds through the Coronavirus Capital Projects Fund

- Highway Maintenance - $56 million increase

- Facilities Reinvestment – $11 million increase

- Driver & Vehicle Services - $17 million increase

- Municipal Traffic Signals - $30 million increase

| 2021/22 MOTOR LICENSE FUND |

| |

PENNDOT STATE APPROPRIATIONS |

| ($ amounts in thousands) |

| |

Available |

Enacted |

Enacted less Available |

| Appropriation |

2019/20 |

2020/21 |

$ Chng |

% Chng |

| General Government Operations |

|

| |

GGO |

$ 63,900 |

$ 68,600 |

$ 4,700 |

7.4% |

| |

Welcome Centers |

$ 4,115 |

$ 4,115 |

$ - |

0.0% |

| General Gov't Operations Subtotal |

$ 68,015 |

$ 72,715 |

$ 1,479 |

2.2% |

| Safety Administration & Licensing |

|

| |

Driver and Vehicle Services |

$ 208,403 |

$ 225,834 |

$ 17,431 |

8.4% |

| |

Homeland Security - Real ID |

$ 25,901 |

$ 25,901 |

$ - |

0.0% |

| Safety Admin & Licensing Subtotal |

$ 234,304 |

$ 251,735 |

$ 17,431 |

7.4% |

| State & Local Hwy/Bridge |

| |

Highway Safety & Improvement |

$ 170,000 |

$ 190,000 |

$ 20,000 |

11.8% |

| |

Highway Maintenance |

$ 840,546 |

$ 896,879 |

$ 56,333 |

6.7% |

| |

Highway Systems Technology & Innovation |

$ 16,000 |

$ 16,000 |

$ - |

0.0% |

| |

Reinvestment - Facilities |

$ 5,000 |

$ 16,000 |

$ 11,000 |

220.0% |

| |

Municipal Roads and Bridges |

$ 30,000 |

$ 30,000 |

$ - |

0.0% |

| |

Local Road Maintenance & Constr Pmts |

$ 239,816 |

$ 229,361 |

$ (10,455) |

-4.4% |

| |

Supplemental Local Rd Maintenance & Constr Pmts |

$ 5,000 |

$ 5,000 |

$ - |

0.0% |

| |

Maintenance & Constr of County Bridges |

$ 5,000 |

$ 5,000 |

$ - |

0.0% |

| |

Municipal Traffic Signals |

$ 10,000 |

$ 40,000 |

$ 30,000 |

300.0% |

| State & Local Hwy/Bridge Subtotal |

$ 1,321,362 |

$ 1,428,240 |

$ 106,878 |

8.1% |

| MLF STATE TOTAL |

$ 1,623,681 |

$ 1,752,690 |

$ 125,788 |

7.7% |

The budget appropriates $2.7 billion to the Department of Criminal Justice. The vast majority ($2.1 billion) is for state correctional institutions.

In 2020/21, the General Assembly appropriated federal CARES Act Coronavirus Relief Fund dollars to fund Inmate Medical Care and State Correctional Institutions:

- $99 million for Medical Care

- $1.156 billion for State Correctional Institutions

This funding source shifted back to the state General Fund in 2021/22. After accounting for the 2020/21 Coronavirus Relief Funds, Medical Care was level funded and State Correctional Institutions had a $10 million, or 0.5 percent, decrease in funding.

State Field Supervision received a $4.8 million increase and the Parole Board received a $262,000 increase.

| Major Department of Criminal Justice Appropriations |

| ($ amounts in thousands) |

2020/21 Available |

2021/22 Enacted |

Change |

Percent Change |

| |

| General Government Operations |

$ 44,268 |

$ 42,268 |

$ (2,000) |

-5% |

| Medical Care - State |

$ 232,486 |

$ 331,486 |

$ 99,000 |

43% |

| Medical Care - CRF |

$ 99,000 |

$ - |

$ (99,000) |

-100% |

| Medical Care - Total |

$ 331,486 |

$ 331,486 |

$ - |

0% |

| Correctional Education |

$ 41,621 |

$ 42,597 |

$ 976 |

2% |

| State Correctional Institutions - State |

$ 936,532 |

$ 2,083,044 |

$ 1,146,512 |

122% |

| State Correctional Institutions - CRF |

$ 1,156,647 |

$ - |

$ (1,156,647) |

-100% |

| State Correctional Institutions - Total |

$ 2,093,179 |

$ 2,083,044 |

$ (10,135) |

0% |

| State Field Supervision |

$ 141,527 |

$ 146,356 |

$ 4,829 |

3% |

| Parole Board |

$ 11,859 |

$ 12,121 |

$ 262 |

2% |

| Sex Offender Assessment Board |

$ 6,582 |

$ 6,582 |

$ - |

0% |

| CRF: Federal Coronavirus Relief Fund |

|

|

|

|

The appropriation for the Office of the Victim Advocate was eliminated as a line item in the budget in 2020/21 and is again eliminated in the current budget; the office will continue to exist, but will derive its funding through the Department of Criminal Justice’s General Government Operations appropriation.

Act 59 (Senate Bill 411) finalizes the consolidation of the Department of Corrections and the Board of Probation and Parole. In 2017, the two agencies combined operations through a memorandum of understanding (MOU), but the merger was not enacted into statute until 2021. The department achieved approximately $12.1 million in savings and operational efficiencies as a result of the MOU. It is estimated that the final passage of this legislation will save the department $10.5 million through 2023/2024 due to increased capacity in the State Drug Treatment Program (STDP) and a decline in overtime for transportation-related duties.

The General Fund appropriation for state police general government operations is $441.4 million. This amount is $258.1 million, or 140 percent, more than 2020/21 and $168.1 million, or 61 percent, more than the governor’s executive budget proposal.

A portion of this increase is needed to replace $226 in federal funding received in 2020/21 through the CARES Act Coronavirus Relief Funds. After accounting for Coronavirus Relief Funds, General Government Operations increased by $32.1 million from 2020/21. This amount is needed to cover the legislatively mandated decrease in state police use of the Motor License Fund.

A significant portion of the increase over the governor’s executive budget proposal is because the governor’s proposed fee on all municipalities for state police coverage of $168 million was not enacted. Additional state funding was appropriated in lieu of the proposal.

| Pennsylvania State Police: General Government Operations |

| ($ amounts in thousands) |

2020/21 Available |

2021/22 Executive Budget |

2021/22 Enacted |

Enacted Less 2020/21 |

Enacted Less Executive Budget |

| |

| General Government Operations |

$ 183,253 |

$ 273,338 |

$ 441,366 |

$ 258,113 |

$ 168,028 |

| Coroniavirus Relief Fund |

$ 225,970 |

$ - |

$ - |

$ (225,970) |

$ - |

| Total GGO |

$ 409,223 |

$ 273,338 |

$ 441,366 |

$ 32,143 |

$ 168,028 |

The Pennsylvania Instant Check System (PICS) provides instant background checks for sales and transfers of firearms through licensed dealers. PICS is primarily funded by two sources: the Firearms Records Check Fund and a General Fund appropriation for gun checks. The General Fund appropriation is level-funded at 2020/21 amounts but is $1.3 million less than what was requested in the governor’s executive budget proposal. For 2021/22, $3.8 million was appropriated from the Firearms Record Check Fund, an additional $677,000 over the $2.5 million in the governor’s executive budget, to make up a portion of the difference.

The Statewide Public Radio System was appropriated $7.0 million from the General Fund, a 42 percent decrease from 2020/21. This was the amount requested in the executive budget proposal and is based on a projected decrease in the maintenance costs for the statewide radio system and the projected completion of the P25 radio system.

Law Enforcement Information Technology, Municipal Police Training, and the Automated Fingerprint Identification System (AFIS) are all flat funded.

The budget appropriates $11.4 million to the Pennsylvania Commission on Crime and Delinquency, a $1.8 million, or 18 percent, increase from 2020/21.

- $250,000 of this increase is for the Judicial Computer System Financial Audit Committee, established in the Administrative Code. The purpose of this committee is to review the policy goals, purpose, and annual revenues and expenditures of the system. The committee will submit a report to the chair and minority chair of the Appropriations Committee of the House and Senate and the chair and minority chair of the Judiciary Committee of the House and Senate by January 31, 2022. The committee will expire on June 30, 2023.

- The remaining $1.5 million increase is for a pilot program in Philadelphia and Allegheny County to hire additional assistant district attorneys designated as a Special United States Attorneys as part of the Project Safe Neighborhoods program to exclusively prosecute certain firearms crimes.

Most federal appropriations to PCCD were level funded. The federal appropriations that saw changes are listed in the table below.

| PCCD Federal Appropration Changes |

2020/21 Available |

2021/22 Enacted |

Change |

Percent Change |

| Comprehensive Opioid Abuse Site-based Program |

$ 2,200 |

$ 5,000 |

$ 2,800 |

127% |

| Body Worn Camera Policy and Implementation |

$ 1,000 |

$ 2,000 |

$ 1,000 |

100% |

| Statistical Analysis Center |

$ 300 |

$ 400 |

$ 100 |

33% |

| Criminal Identification Technology |

$ 8,000 |

$ 10,500 |

$ 2,500 |

31% |

| Residential Substance Abuse Treatment Program |

$ 1,400 |

$ 1,700 |

$ 300 |

21% |

| Assault Services Program |

$ 600 |

$ 700 |

$ 100 |

17% |

| Justice Assistance Grants |

$ 10,000 |

$ 11,500 |

$ 1,500 |

15% |

| Prosecutor and Defender Incentives |

$ 160 |

$ 180 |

$ 20 |

13% |

| Project Safe Neighborhoods |

$ 1,050 |

$ 1,000 |

$ (50) |

-5% |

| Crime Victims Assistance |

$ 130,000 |

$ 120,000 |

$ (10,000) |

-8% |

| Second Chance Act - Juvenile Offender Reentry |

$ 1,000 |

$ - |

$ (1,000) |

-100% |

| NICS Act Record Improvement Program (NARIP) |

$ 245 |

$ - |

$ (245) |

-100% |

| ($ amounts in thousands) |

|

|

|

|

In 2020/21, the Office of Safe Schools Advocate was shifted from the Department of Education to PCCD. The Office of Safe Schools Advocate was flat funded in 2021/22.

New for 2021/22, $30 million was appropriated for Violence Intervention and Prevention Programs to be used for Community Violence reduction programs. Community Violence Prevention Grants allow organizations like YMCAs and Boys and Girls Clubs, as well as municipalities and businesses to address the gun and school violence epidemics happening in neighborhoods across our commonwealth. In prior years, demand for grants has eclipsed available funds. The $30 million appropriated in 2021/22 would exceed the amount requested in 2020/21 (89 grants requesting $21.2 million). Funding for this program was previously transferred from the Judicial Computer System Augmentation Account.

Examples of funded programs include:

- The Pittsburgh Bureau of Police Community Engagement Office used Community Violence Prevention/Reduction funds to fund patrol officer participation in Youth Connections Programming, develop and train Youth Advisory Council members, and provide Implicit Bias training to teachers and staff of partner schools.

- The Temple University of the Commonwealth System of Higher Education used Community Violence Prevention/Reduction funds to provide a trauma informed, evidence-based violence prevention model that highlights a strong partnership between a high-risk public high school and the surrounding neighborhood and community.

| Summary of School Safety and Security Fund |

2018/19 |

2019/20 |

2020/21 |

2021/22 |

| Expenditures: |

|

| Guaranteed Minimum to SDs |

$12,500,000 |

$18,720,000 |

$0 |

$0 |

| Community Violence Prevention Grants |

$7,500,000 |

$7,500,000 |

$7,500,000 |

$30,000,000 |

| Competitive Grants for School Entities |

$40,000,000 |

$33,780,000 |

$0 |

$0 |

| COVID-19 School Health and Safety Grants |

$0 |

$0 |

$199,762,000 |

$0 |

| COVID-19 Non-public School Health and Safety Grants |

$0 |

$0 |

$7,500,000 |

$0 |

| SSSF Total Expenditures: |

$60,000,000 |

$60,000,000 |

$214,762,000 |

$30,000,000 |

| Revenues: |

|

|

|

|

| Transfer from the Personal Income Tax |

$15,000,000 |

$45,000,000 |

$0 |

$0 |

| Judicial Computer System Augmentation Account |

$15,000,000 |

$15,000,000 |

$15,000,000 |

$0 |

| Veto-Restored Legislative Funds |

$30,000,000 |

$0 |

$0 |

$0 |

| Federal Coronavirus Relief Funding (CARES Act) |

$0 |

$0 |

$150,000,000 |

$0 |

| Federal COVID ESSER-SEA funding |

$0 |

$0 |

$49,762,000 |

|

| PCCD's Community Violence Appropriation |

$0 |

$0 |

$0 |

$30,000,000 |

| SSSF Total Revenues: |

$60,000,000 |

$60,000,000 |

$214,762,000 |

$30,000,000 |

Support for grants to local criminal justice agencies and non-profits are all level funded. This includes programs to divert low-level offenders from incarceration, support drug courts, and provide for victim services.

This budget appropriated $355.4 million to the judiciary for 2021/22. With the exception of a small federal funding increase for the Supreme Court of $180,000 and salary and expenses increases of $37,000 and $88,000 for the Judicial Conduct Board and Court of Judicial Discipline respectively, all appropriations are at the same level as 2020/21. Funding for the judiciary has remained relatively flat for several fiscal years.

The Fiscal Code eliminated the $15 million transfer from the Judicial Computer System Augmentation Account to the School Safety and Security Fund. The elimination of this transfer averted the pending shutdown of the Common Pleas Case Management System (CPCMS).

The Fiscal Code did not extend the two Act 49 surcharges that are set to expire on December 31, 2021.

The JCJC was appropriated $2.98 million for 2021/22. This is the same amount that was appropriated in 2020/21 and matched the governor’s proposed executive budget. Grants for juvenile probation services are level funded at $18.9 million.

The budget appropriated $2.8 million to PEMA for General Government Operations, a 21 percent decrease in funding from 2020/21. Of this decrease, $2.0 million was for nonrecurring program costs.

The Office of the State Fire Commissioner was nearly flat funded, with just a $30,000 decrease.

State funding for Disaster Relief was unnecessary due to updated disaster relief requirements and a Federal Emergency Management Agency (FEMA) match increase from 75 percent to 100 percent of eligible costs.

Under the Executive Offices, $5 million of American Rescue Plan funds were appropriated as a transfer to the Emergency Medical Services Operating Fund.

This budget slightly decreased total appropriations for the Department of Military and Veterans Affairs. However, this decrease was mostly concentrated in the agency’s General Government Operation appropriation, which was reduced by $6.2 million, or 19 percent. This decrease reflects the completion of the department’s P25 radio upgrade project.

Funding for the commonwealth’s six veterans’ homes, conversely, increased by $8.3 million, or 8.3 percent. This increase compensated for reduced federal appropriations for operational costs as well as continued investment in the rollout of a new adult day health care program at the Southeastern Veterans Center.

Two of the three row offices – the Auditor General and the Treasurer – saw substantially increased appropriations for general government operations in this budget, while the Attorney General received a minor increase.

| General Government Operations (millions) |

FY 2020/21 |

FY 2021/22 |

$ Change |

% Change |

| Attorney General |

$46,657 |

$47,408 |

$751 |

1.6% |

| Auditor General |

$35,681 |

$38,341 |

$2,660 |

7.5% |

| Treasury |

$35,715 |

$37,206 |

$1,491 |

4.2% |

The governor line-item vetoed part of the General Government Operations appropriation for the Auditor General, reducing the amount from $41.441 million within the bill to the approved amount of $38.241 million.

This partial veto of the appropriation by $3.1 million was made to ensure that those funds could not be used to establish a Bureau of Election Audits. The creation of such a bureau was included in HB 1300, an election code bill that was also vetoed by the governor.

The budget included only minor increases or decreases for most other appropriations within the three row offices. Within the Office of the Attorney General, Drug Law Enforcement received a small increase of $401,000, or 0.8 percent, and the Joint Local-State Firearm Taskforce – a collaborative effort of the OAG, the Philadelphia Police Department and the Philadelphia County District Attorney’s Office – received an increase of $300,000, or 4.4 percent.

The budget also includes $500,000 for the Auditor General to conduct special financial audits of a number of Medical Assistance programs within the Department of Human Services.

Federal funds in the amount of $350.4 million and Fiscal Code language were included in the budget package to create the Homeowners Assistance Grant Program in Pennsylvania. The funding was provided to states in the ARPA to prevent mortgage delinquencies and defaults, foreclosures, loss of utilities or home energy services, and displacement of homeowners experiencing financial hardship.

Additionally, Fiscal Code language was included in this budget package to establish a Construction Cost Relief Program to support the production of developments by addressing financial deficiencies directly attributed to the effects of the COVID-19 pandemic.

Appendix – Tax Code Summary

Tax Code Summary - Act 25/House Bill 952

($ amounts in millions) |

| Tax Topic |

Bills |

Description |

Effective |

2021/22 |

2022/23 |

| Technical Fix |

HB 273 |

Corrects a scrivener's error from Act 77 of 1986 to replace the word "devises" with "demises" related to the realty transfer tax. |

Immediately |

$ - |

$ - |