Affordable Housing Tax Credit

- Establishes the Affordable Housing Tax Credit within the Pennsylvania Housing Finance Agency (PHFA) to encourage the development, rehabilitation and preservation of low-income housing in the commonwealth.

As a budget balancing measure, the enacted budget includes $1.115 billion of lapses within the 2024/25 fiscal year. For a comparison, the amount of lapses for 2023/24 was $587 million. The following table highlights the 2024/25 lapses by agency and appropriation fiscal year:

| 2024/25 Lapses |

| ($ amounts in thousands) |

| Agency |

Appropriation FY |

| 2020 and Older |

2021 |

2022 |

2023 |

| Corrections |

$ - |

$ - |

$ 443 |

$ 959 |

| Labor & Industry |

$ 868 |

$ 79 |

$ 384 |

$ 19 |

| Military & Veterans Affairs |

$ 1,562 |

$ 103 |

$ 230 |

$ 45 |

| Attorney General |

$ - |

$ - |

$ - |

$ 147 |

| General Services |

$ - |

$ - |

$ 275 |

$ 226 |

| Education |

$ 21,293 |

$ 26,546 |

$ 2,296 |

$ 174,983 |

| Revenue |

$ 1,400 |

$ 158 |

$ 32,211 |

$ 75,340 |

| State Department |

$ - |

$ 1,052 |

$ - |

$ - |

| State Police |

$ - |

$ - |

$ 1,091 |

$ 1,378 |

| Human Services |

$ 4,073 |

$ 1,754 |

$ 296,703 |

$ 450,320 |

| Community & Economic Develop |

$ 3 |

$ - |

$ - |

$ 473 |

| Historical & Museum Commission |

$ 0 |

$ 0 |

$ - |

$ - |

| Environmental Protection |

$ - |

$ 9 |

$ - |

$ - |

| Health |

$ 1,160 |

$ 1,373 |

$ 5,823 |

$ 9,850 |

| Executive Offices |

$ 110 |

$ 828 |

$ 35 |

$ - |

| FY Subtotals |

$ 30,469 |

$ 31,901 |

$ 339,491 |

$ 713,739 |

The Fiscal Code bill authorized the following fund transfers which impact the General Fund:

- Environmental Stewardship Fund – $3.016 million from Personal Income Tax (PIT) revenue to the fund

- Special Funds and Restricted Accounts – $670 million from available amounts in special funds and restricted accounts to the General Fund.

Gov. Shapiro’s 2024/25 and 2025/26 budget proposals included increasing the proportion of Sales and Use Tax (SUT) revenues that are transferred to the Public Transportation Trust Fund (PTTF) from 4.4% to 6.15%. Several proposals were put forward this session, but neither received the support of both chambers.

Following an adverse ruling from the Philadelphia Court of Common Pleas prohibiting the reduction of service to address its funding crisis, on September 5, 2025, the Southeastern Pennsylvania Transit Authority (SEPTA) requested approval from Pennsylvania Department of Transportation (PennDOT) for the one-time use of state capital assistance funding allocated under 74 Pa.C.S. § 1514(e.1)(1) to fund its operations. On September 11, 2025, Pittsburgh Regional Transit (PRT) made a similar request to PennDOT.

The Shapiro Administration provided $394 million to SEPTA and $106.7 million to PRT for operating expenses over two years, from PTFF funds reserved for capital projects. Additionally, SEPTA was required to comply with a safety order from the Federal Railroad Administration regarding its Silverliner trains. In December 2025, Governor Shapiro directed $219.9 million to address safety issues and repairs on SEPTA’s transit system’s regional rail lines, from funds within the PTTF dedicated to SEPTA.

Similarly, when the 2024/25 proposal failed to move forward, on November 22, 2024, Gov. Shapiro flexed $153 million in federal highway funding to SEPTA to avoid service cuts and fare increases.

The majority of PennDOT’s operating budget is derived from the Motor License Fund (MLF). PennDOT’s 2025/26 MLF appropriations, summarized in the table below, are $2.56 billion, which represents $76.9 million or 3.1% increase over 2024/25.

| MLF PENNDOT STATE APPROPRIATIONS |

| ($ amounts in thousands) |

| |

Actual |

Enacted |

Enacted less Actual |

| Appropriation |

2024/25 |

2025/26 |

$ Chng |

% Chng |

| General Government Operations |

|

| |

General Government Operations |

$ 85,476 |

$ 92,250 |

$ 6,774 |

7.9% |

| |

Welcome Centers |

$ 4,807 |

$ 4,822 |

$ 15 |

0.3% |

| General Gov't Operations Subtotal |

$ 90,283 |

$ 97,072 |

$ 6,789 |

7.5% |

| Safety Administration & Licensing |

|

| |

Driver and Vehicle Services |

$ 231,055 |

$ 274,540 |

$ 43,485 |

18.8% |

| |

Homeland Security - Real ID |

$ 32,535 |

$ - |

$ (32,535) |

-100.0% |

| Safety Admin & Licensing Subtotal |

$ 263,590 |

$ 274,540 |

$ 10,950 |

4.2% |

| State & Local Hwy/Bridge |

|

| |

Highway Safety & Improvement |

$ 630,000 |

$ 650,000 |

$ 20,000 |

3.2% |

| |

Highway Maintenance |

$ 1,144,293 |

$ 1,185,500 |

$ 41,207 |

3.6% |

| |

Highway Systems Technology & Innovation |

$ 20,000 |

$ 20,000 |

$ - |

0.0% |

| |

Reinvestment - Facilities |

$ 16,500 |

$ 16,500 |

$ - |

0.0% |

| |

Municipal Roads and Bridges |

$ 30,000 |

$ 30,000 |

$ - |

0.0% |

| |

Local Road Maintenance & Constr Pmts |

$ 243,911 |

$ 236,886 |

$ (7,025) |

-2.9% |

| |

Supplemental Local Rd Maintenance & Constr Pmts |

$ 5,000 |

$ 5,000 |

$ - |

0.0% |

| |

Maintenance & Constr of County Bridges |

$ 5,000 |

$ 5,000 |

$ - |

0.0% |

| |

Municipal Traffic Signals |

$ 40,000 |

$ 45,000 |

$ 5,000 |

12.5% |

| State & Local Hwy/Bridge Subtotal |

$ 2,134,704 |

$ 2,193,886 |

$ 59,182 |

2.8% |

| MLF STATE TOTAL |

$ 2,488,577 |

$ 2,565,498 |

$ 76,921 |

3.1% |

The 2025/26 budget includes a $710 million or 6.9% increase across three major educational subsidies:

Ready to Learn Block Grant (RTLBG)

- $565 million increase to the Ready to Learn Block Grant (RTLBG) for $1.4 billion in total RTLBG funding. The $565 million increase is for:

- $526.4 million in new adequacy supplements.

- $32.2 million in new tax equity supplements.

- $6.4 million in additional supplements to ensure that each school district receives an increase of at least $50,000 in their RTLBG allocation.

Basic Education Funding

- $105 million or 1.3% increase to Basic Education Funding (BEF) for $8.2 billion in total BEF.

- Last year’s budget reset the BEF base, locking in the $2 billion added between fiscal years 2015/16 (initial base year) and 2023/24. The base allocation for FY 2025/26 is $7.9 billion, which is equal to the sum of the FY 2023/24 total allocation, the FY 2024/25 hold-harmless supplement, and an additional $5 million for William Penn School District.

- Additional funding on top of the base allocation is distributed through the fair funding formula. With the funding increases in fiscal years 2024/25 and 2025/26, $325 million or 3.9% of BEF funding will be distributed using the fair funding formula in FY 2025/26.

Special Education Funding

- $40 million or 2.7% increase to Special Education Funding (SEF) for $1.4 billion in total SEF.

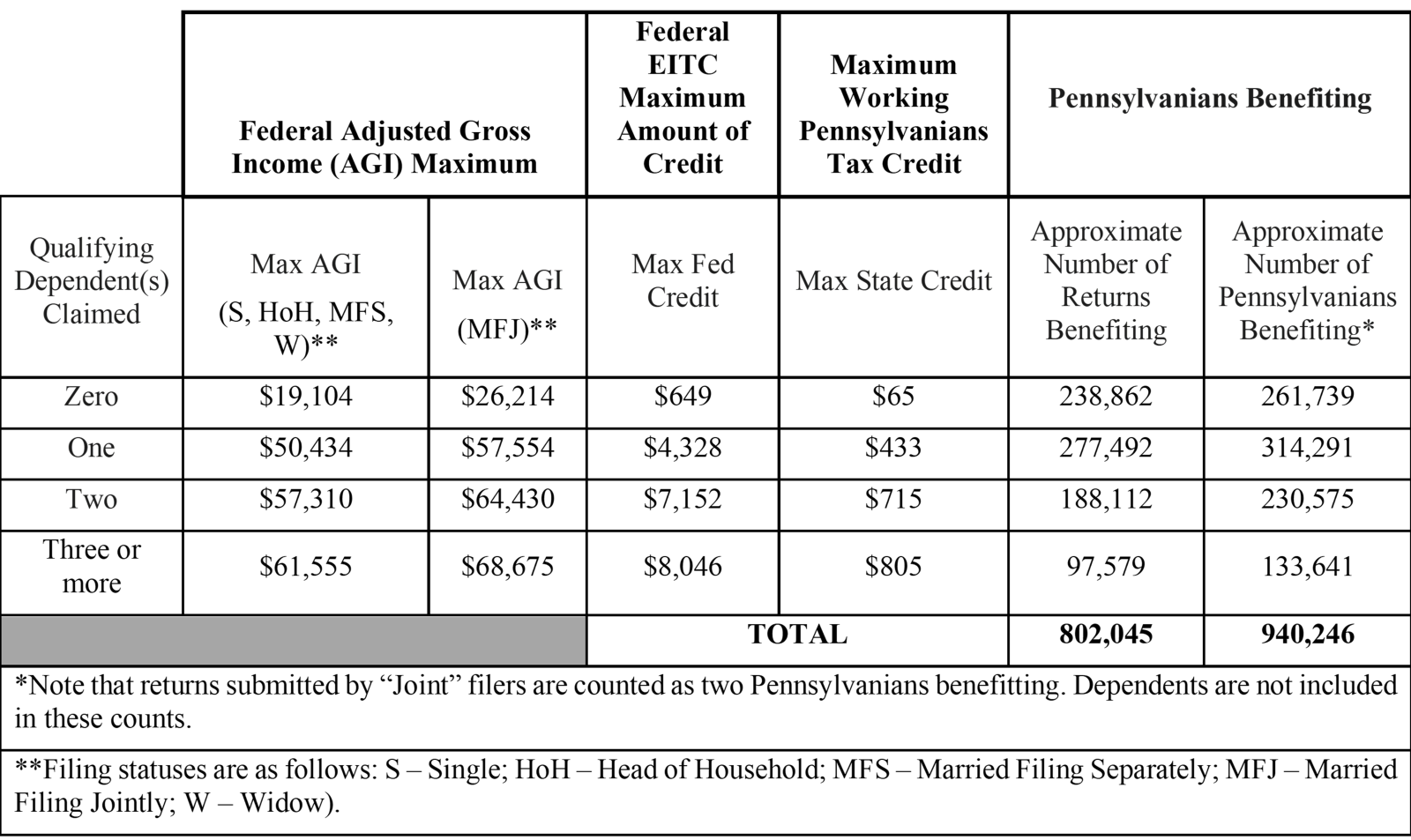

In response to William Penn School District v. PA Dept. of Education, 294 A.3d 537 (Pa. Commw. Ct. 2023), the Commonwealth Court’s case which declared Pennsylvania’s public school funding system unconstitutional, the legislature passed a new adequacy formula as part of the 2024/25 budget package. The formula calculated a total statewide adequacy gap of $4.8 billion, then assigned a state and local share of that gap. Thus, the formula had a built-in expectation (but not a mandate) that growing and low-tax-effort school districts would be responsible for a portion of their respective gaps. In 2024/25, the money available for adequacy supplements ($493.8 million) was prorated against the state share of the adequacy gap ($4.5 billion).

The 2025/26 budget package reformed the adequacy formula to remove the local share expectation. As a result, the money available for adequacy supplements was prorated against the total adequacy gap ($4.8 billion). 132 school districts benefit from this change. To ensure that no school district receives a supplement less than the amount they received in the prior year, the General Assembly increased the amount of money available for adequacy payments in 2025/26 to $526.4 million. View the total adequacy gap and payments by school district here.

Adequacy supplements build on each other year-over-year, meaning that a school district’s 2024/25 adequacy supplement is baked into its base RTLBG payment for 2025/26. The General Assembly is currently following a nine-year timeline for addressing the adequacy gap.

Tax equity funding is for school districts with a “local tax effort” above the 90th percentile. With 500 school districts, the 90th percentile cutoff means the 50 highest taxing school districts. “Local tax effort” is calculated by dividing each district’s local taxes collected (e.g., real estate taxes and other local school taxes) by the sum of its total market value and total personal income. The tax equity formula never included a local share expectation, and no changes were made to the formula in 2025/26. Therefore, the 2025/26 tax equity supplement received by a school district is roughly equal to the supplement the district received in 2024/25.

Like adequacy supplements, tax equity supplements build on each other year-over-year. The General Assembly is currently following an eight-year timeline for paying the adequacy gap.

In 2024/25, cyber charter schools enrolled 63,850 students, which is about 3.8% of the 1.68 million public school students in Pennsylvania. When a student enrolls in a cyber charter school, the student’s school district of residence is responsible for paying the cyber charter school the statutorily set tuition rate. In 2023/24 (latest data available), school districts spent $1.2 billion on cyber charter school tuition.

Last year’s budget included a new $100 million appropriation for cyber charter transition, which reimbursed school districts for about 9.2% of their cyber charter expenditures. It also included reforms to the cyber charter school tuition rate calculation for special education students -- the updated estimates for which place the full-year savings to school districts at $94 million.

This year’s budget package eliminated the cyber charter transition appropriation and provided new cyber charter school tuition rate reforms. If these new reforms had been in place in 2024/25, school districts would have saved an additional $178 million in aggregate, or 14.6% of estimated cyber charter costs. Depending upon the growth in school districts’ expenditures or changes in cyber charter school enrollments, the total dollar amount of savings from new reforms in 2025/26 may be greater than what is reflected in the $178 million estimate (which is based on data from 2024/25, the most recent year available). However, the proportion of savings in 2025/26 is likely to be similar to the estimated 14.6% figure.

The cyber charter school tuition reforms enacted this year under the omnibus School Code bill, Act 47 of 2025, make changes to both the nonspecial education and special education tuition rate calculations. The nonspecial education tuition rate is based upon the school district of residence’s selected expenditures per student. Selected expenditures are the total expenditures net of deductions for spending categories that cyber charter schools receive directly (e.g., federal funding), that are accounted for separately (i.e., special education), or that cyber charters are not responsible for (e.g., pupil transportation). Act 47 of 2025 reduced the cyber charter nonspecial education tuition rate by adding additional spending category deductions for tax assessment and collection services, 60% of student activities, and 60% of operations and maintenance of plant services. Additionally, nonspecial education cyber charter school costs and cyber charter school average daily membership are excluded from the calculation.

For each special education student, the tuition rate paid by the student’s school district of residence for the 2025/26 school year will be the lesser of the following:

- Last year’s calculation method: Sum the nonspecial education rate (not including the new deductions) and the special education add-on rate. The add-on rate is based upon the school district of residence’s selected special education expenditures per special education student.

- New calculation method under Act 47 of 2025: Multiply the nonspecial education rate (including the new deductions) by 1.89.

- The 1.89 multiplier reflects a three-year average of the statewide ratio of the weighted student count to the actual student count for special education students. The weighted student count is based on three categories of need for special education students, with a 1.64 multiplier for lower cost students (about 90% of those with an IEP), a 3.08 multiplier for middle cost students (about 7% of those with an IEP), and a 6.34 multiplier for higher cost students (about 3% of those with an IEP).

The 2025/26 budget provides a $9.5 million increase for Pre-K Counts to support a 2.36% increase in the reimbursement rate the state pays to providers, raising the full-time reimbursement rate by $248 per student -- from $10,500 in FY 2024/25 to $10,748 in FY 2025/26.

Act 1A of 2025 provided a prior-year supplemental appropriation of $25.9 million for Early Intervention, bringing the total revised 2024/25 appropriation to $424.8 million. It also provided $453.3 million in Early Intervention funding for this year, which is an increase of $28.5 million, or 6.7%, over the revised 2024/25 total.

The 2025/26 budget provides $125 million for the Public School Facility Improvement Grant Program, which represents a $25 million increase over the 2024/25 appropriation. Like last year, $25 million of the total Public School Facility appropriation is set aside for the Solar for Schools program established under Act 68 of 2024.

The opening of PlanCon 2.0 and the maintenance program is delayed until July 1, 2026. The commonwealth continues to pay legacy costs associated with PlanCon 1.0. This year, $190 million was provided for PlanCon. Of this, $165 million was appropriated from the General Fund under Act 1A of 2025, and $25 million was provided via a one-time transfer from Commonwealth Financing Authority (CFA) accounts under Act 45 of 2025.

Act 47 of 2025 provides a $50 million increase in the Educational Improvement Tax Credit (EITC) program, which is all directed toward the supplemental scholarship for students attending economically disadvantaged schools. The total cap between EITC and the Opportunity Scholarship Tax Credit (OSTC) programs has increased from $280 million in 2021/22 to $680 million in 2025/26.

| Educational Tax Credits Summary |

2024/25 Cap |

24/25 credits unused as of

December 10, 2025 |

% unused |

2025/26 Cap |

Increase in 25/26 |

| EITC - Scholarship Organizations |

$375,000,000 |

$75,500,000 |

20.1% |

$375,000,000 |

$0 |

0.0% |

| EITC - Supp. Scholarships for Econ. Disadvantaged |

$60,000,000 |

$500,000 |

0.8% |

$110,000,000 |

$50,000,000 |

83.3% |

| EITC - Educational Improvement Organizations |

$74,500,000 |

$0 |

0.0% |

$74,500,000 |

$0 |

0.0% |

| EITC - Pre-Kindergarten Scholarship Organizations |

$30,500,000 |

$10,500,000 |

34.4% |

$30,500,000 |

$0 |

0.0% |

| Educational Improvement Tax Credit (EITC) Total: |

$540,000,000 |

$86,500,000 |

16.0% |

$590,000,000 |

$50,000,000 |

9.3% |

| Opportunity Scholarship Tax Credit (OSTC) Total: |

$90,000,000 |

$29,000,000 |

32.2% |

$90,000,000 |

$0 |

0.0% |

| Educational Tax Credits (EITC and OSTC) Total: |

$630,000,000 |

$115,500,000 |

18.3% |

$680,000,000 |

$50,000,000 |

7.9% |

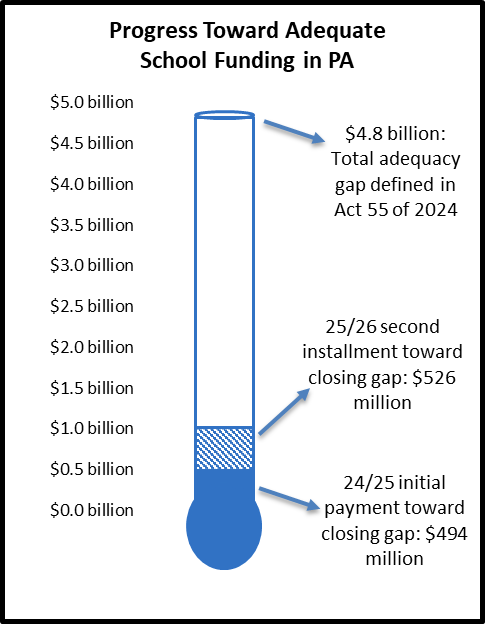

The Public Library Subsidy increased by $5 million or 7.1% in 2025/26. Act 47 of 2025 provides that each library’s 2025/26 allocation will be proportional to its share of total funding in 2024/25. In other words, the allocation formula will provide each library or library system that receives state funding with a 7.1% increase. The allocation of state funds within a local library system is controlled by the local library system’s board.

This year’s investment restores the Public Library Subsidy to its nominal 2006/07 funding level of $75.5 million. However, the appropriation still remains far below what it would be if it had tracked with inflation since 2002/03.

A more nuanced formula for driving out Public Library Subsidy funding (24 Pa. C.S. §§ 9333) has not been in use since fiscal year 2002/03. When the formula is in use, a library may qualify for certain types of aid depending on the services it provides, and money is allocated based on the number of persons residing in the library’s service area.

Act 90 of 2024 established the Performance Based Funding Council for the purpose of recommending, by a two-thirds vote, a process to distribute state funding to Penn State University, the University of Pittsburgh, and Temple University that is predictable, transparent, outcomes-driven, and considerate of student access and attainment needs.

The Council shared its recommendations on May 5, 2025. Act 47 of 2025 implemented the recommendations of the Council related to a new performance-based funding model for Pennsylvania State University, University of Pittsburgh, and Temple University. Funds appropriated from the newly established State-related University Performance Fund by a two-thirds vote will be distributed to these three universities using the performance-based funding formula.

The Performance-Based Funding Council is reconstituted to oversee the performance-based funding formula by annually assigning performance goals and weights. The Council is also charged with making further legislative recommendations related to performance-based funding.

Each year, from 95% of the available funds, the Council will establish a maximum allocation that each university can earn. A university’s maximum allocation will be based upon its share of the total weighted student count and an equal share of the funding. Using in-state students, the weighted student count includes: full-time, undergraduate students; Pell-grant recipients; community college transfers; students from low matriculation high schools; students who earned a high-demand degree; and students who have earned 60 credits by the start of their third year. The portion of the maximum allocation that each university earns is based upon its performance (i.e., its progress toward the goals set by the Council) in the following metrics: 4- year graduation rate, 6-year graduation rate, 6-year graduation rate of Pell-grant recipients, and the high demand degree rate.

The remaining 5% of the available funds is designated as the improvement and affordability allocation. Universities earn points by improving in the identified metrics and keeping tuition increases below the higher education price index. The share of these funds is based upon each university’s share of the total improvement and affordability points.

Act 1A of 2025 provided funding increases to several financial aid programs administered by PHEAA:

- $12 million or 3% increase to the State Grant Program -- PHEAA’s largest financial aid program -- for maintaining the maximum grant award level at $5,750.

- Needs-based program; the amount of money a student may receive depends on their financial situation and the type of school they choose to attend in Pennsylvania.

- In 2024/25, there were approximately 112,900 State Grant recipients.

- $30 million total for the Student Teacher Support Grant Program

- Grant amounts are $10,000 for student teachers and $2,500 for cooperating mentor teachers (see Article XII-B of the Public School Code).

| Student Teacher Support Program |

2024-25 |

Estimated

2025-26 |

| Appropriated Funds1 |

$30,000,000 |

$30,000,000 |

| Student Teacher Applicants |

4,222 |

3,578 |

| Selected Student Teacher Applicants |

2,164 |

2,348 |

| Estimated Award Volume to Student Teachers |

$21,640,000 |

$23,480,000 |

| Estimated Award Volume to Cooperating Teachers |

$5,410,000 |

$5,870,000 |

| Student Teachers that Did Not Receive an Award |

2,058 |

1,230 |

| 1The $10 million appropriated in 2023-24 and the $20 million appropriated in 2024-25 were combined and distributed in 2024-25 due to the delayed passage of Act 33 of 2023. |

| Notes: PHEAA has not implemented the $5,000 supplement for student teachers working in high vacancy schools. An equitable method for identifying schools that either attract few student teachers or have a high rate of open teaching positions is still being evaluated. Award volumes for 2024-25 are still be being reconciled, and award volumes for 2025-26 are estimated as of 12/9/25. It is anticipated that there will be more selected applicants for 2025-26 due to the availability of carryover funds from 2024-25 as the result of 2024-25 selected applicants being determined ineligible late in the award year. |

- $7.5 million or 30% increase for the Grow Pennsylvania Scholarship Program.

- Provides $5,000 grants to in-state students earning degrees related to in-demand occupations. After graduation, students must live and work in PA for one year for each grant award received or return the funds.

- The program was established in 2024/25 alongside a $25 million appropriation with which PHEAA began administering grants in 2025/26. The 2025/26 budget included a $32.5 million appropriation for Grow PA.

- As of October 30, 2025, application demand totaled 11,087, meaning total demand for 2025/26 is around $55 million depending upon final eligibility determinations.

- $500,000 or 6.7% increase for the Higher Education for the Disadvantaged Program (Act 101)

- Provides funding to postsecondary institutions with Act 101 Programs to help fund services that assist disadvantaged students so that they can complete their postsecondary study.

- $500,000 or 9.1% increase for the Cheyney University Keystone Academy Scholarship Program

- Provides scholarships and special programming for high-achieving students.

Act 47 of 2025 established a Nursing Shortage Assistance Program to be administered by PHEAA to award grants to qualified nursing servicers to assist nurses with securing employment and repaying student loan expenses. Any available funding will be used to provide grants of up to $10,000 per year per individual employed by a partner hospital.

The 2025/26 budget level funded PASSHE’s operations at $620.8 million. On July 17, 2025, the PASSHE Board of Governors approved the first tuition rate increase since 2018. The in-state undergraduate tuition rate for the 2025/26 academic year increased by $139 per semester to $3,997 per semester.

The $5 million increase in the PASSHE appropriation is directed by the Fiscal Code for Cheyney University to develop and implement an enhanced transfer and workforce development initiative in partnership with Community College of Philadelphia.

The formula for distributing Community Colleges funding is determined annually in the School Code. The Community Colleges appropriation is level-funded this year, and Act 47 of 2025 provided that each community college shall receive an amount equal to the reimbursement received in 2024/25.

The Community College Capital Fund appropriation is level-funded at $54.2 million. This funding helps support community colleges’ capital debt service payments for construction, renovations, facilities improvements, and lease payments.

| Community Colleges |

2023/24 FTE Enrollment |

2025/26

Funding |

| Allegheny |

9,336 |

$40,103,265 |

| Beaver |

1,225 |

$5,462,301 |

| Bucks |

6,739 |

$22,969,370 |

| Butler |

2,362 |

$9,545,492 |

| Delaware |

6,422 |

$22,056,271 |

| Erie |

388 |

$3,267,262 |

| Harrisburg |

9,726 |

$38,346,309 |

| Lehigh Carbon |

4,994 |

$15,975,747 |

| Luzerne |

3,298 |

$13,862,847 |

| Montgomery |

7,147 |

$22,774,358 |

| Northampton |

6,448 |

$19,427,993 |

| PA Highlands |

1,222 |

$3,417,565 |

| Philadelphia |

9,893 |

$36,079,660 |

| Reading |

3,716 |

$10,247,228 |

| Westmoreland |

3,046 |

$13,802,331 |

| Total: |

75,962 |

$277,338,000 |

The Pennsylvania Constitution requires appropriations to education or charitable institutions that are not under the absolute control of the commonwealth to receive the support of two-thirds of each chamber rather than a simple majority. This is called a non-preferred appropriation, and Act 11A of 2025 is the non-preferred appropriation bill for the state-aided universities for 2025/26.

Pennsylvania has four “state-related” universities that receive direct state appropriations in return for providing in-state tuition rates for commonwealth students. General support funding for Penn State, Pitt, and Temple has been level since 2019/20. The Pennsylvania College of Technology, Pitt’s Rural Education Outreach program, and Lincoln University each received a funding increase of 5% for 2025/26.

Act 11A of 2025 also provides funding for the University of Pennsylvania Veterinary School, a private university. University of Pennsylvania’s Veterinary Activities and Center for Infectious Disease appropriations have received varying levels of funding since 2022/23.

| Entity |

2022/23 |

2023/241 |

2024/25 |

2025/26 |

1-Year Change |

| Penn State University - General Support |

$242,096,000 |

$242,096,000 |

$242,096,000 |

$242,096,000 |

$0 |

0.0% |

| Pennsylvania College of Technology |

$26,736,000 |

$29,971,000 |

$33,971,000 |

$35,670,000 |

$1,699,000 |

5.0% |

| University of Pittsburgh - General Support |

$151,507,000 |

$151,507,000 |

$151,507,000 |

$151,507,000 |

$0 |

0.0% |

| University of Pittsburgh - Rural Education Outreach |

$3,346,000 |

$3,346,000 |

$3,791,000 |

$3,981,000 |

$190,000 |

5.0% |

| Temple University - General Support |

$158,206,000 |

$158,206,000 |

$158,206,000 |

$158,206,000 |

$0 |

0.0% |

| Lincoln University - General Support |

$15,166,000 |

$18,401,000 |

$20,848,000 |

$21,890,000 |

$1,042,000 |

5.0% |

| University of Pennsylvania - Veterinary Activities |

$31,660,000 |

$100,000 |

$31,560,000 |

$31,560,000 |

$0 |

0.0% |

| University of Pennsylvania - Center for Infectious Diseases |

$1,893,000 |

$100,000 |

$1,793,000 |

$1,793,000 |

$0 |

0.0% |

| Total: |

$630,610,000 |

$603,727,000 |

$643,772,000 |

$646,703,000 |

$2,931,000 |

0.5% |

| 1 2023/24 amounts for the University of Pennsylvania were appropriated as a supplemental appropriation in Act 11A of 2024. |

The 2025/26 enacted budget appropriates $259.6 million in state General Funds to the Department of Health, an increase of $7.5 million, or 3%, over 2024/25. The budget maintains administrative funding at $32 million.

The budget includes $5 million in new funding for qualifying institutions researching neurodegenerative diseases.

Funding for School District Health Services is maintained at $37.6 million. The School Code designates $3 million in appropriated funds for menstrual hygiene product grants.

The Health promotion and disease prevention appropriation maintains funding at $5 million. This appropriation supports the expansion of maternal health programming and the implementation of prevention strategies aimed at reducing maternal mortality and morbidity.

Funding for quality assurance is increased by $925,000 or 3%, for a total of $31.7 million. These funds help the department monitor regulatory and grant compliance for the department and its grantees and the increase includes $765,000 to provide additional resources for increased monitoring for facilities identified as at risk.

The Primary health care practitioner appropriation is funded at the same level as fiscal year 2024/25, which totals $8.35 million. This appropriation includes:

- $3,451,000 for Primary Care Loan Repayment grant awards;

- $1,500,000 for Pennsylvania Academy of Family Physicians Family Medicine Residency Expansion program; and

- $1,300,000 for Pennsylvania Academy of Family Physicians Family Medicine Physician Recruitment and Retention Programs.

Funding for State Health Centers is increased by $1.8 million, or 5.8%, for a total of $33 million. Biotechnology Research appropriation increased by $150,000, or 1.3%, for a total of $11.4 million.

The department has several appropriations directed toward specific diseases and conditions. These funds are generally distributed by the department to grantees for research or to provide services related to those conditions. The enacted budget maintains fiscal year 2024/25 funding levels, and available funds are allocated using the same distributions of those funds as was used in 2024/25.

- Renal dialysis - $6.7 million

- Adult Cystic Fibrosis - $795,000

- Cooley’s Anemia - $106,000

- Hemophilia - $1 million

- Lupus - $106,000

- Sickle cell - $1.3 million

- Lyme disease - $3.2 million

- Epilepsy Support Services - $583,000

- Tourette Syndrome - $159,000

- Amyotrophic Lateral Sclerosis Support Services - $1.5 million

The budget appropriates a total of $48.3 million in state General Funds for the Department of Drug and Alcohol Programs (DDAP), which is an increase of $84,000, or 0.2%, over fiscal year 2024/25. The appropriation for General Government Operations is $3.59 million, which is an increase of $84,000, or 2.4%, over 2024/25. State funding for Assistance to Drug and Alcohol Programs is level funded at $44.7 million.

Funds appropriated to DDAP from the Opioid Settlement Restricted Account decreased by $3.9 million, or 16%, to a total of $20.2 million. These funds are used to support opioid rescue, treatment, and prevention efforts in accordance with the settlement agreements.

The 2025/26 enacted budget includes a $158.5 million increase for 2024/25 state General Funds for supplemental appropriations to result in total appropriated General Funds of $19.1 billion. Most of this supplemental increase relates to increased costs associated with the Medical Assistance (MA) Community HealthChoices program of $270.7 million. A portion of this increase is offset by reductions to MA – Capitation of $50 million and the Medicare Drug Program of $67.4 million.

The 2025/26 enacted budget appropriates $20.2 billion in state General Funds to DHS. This represents a $1.1 billion, or 5.7%, increase over 2024/25.

State General Funds increased by $124.6 million, or 3.5%, for MA-Capitation. Funding included in the prior year budget for MA – Critical Access Hospitals appropriation has been moved to the MA – Capitation appropriation and funds a State Directed Payment for Critical Access Hospitals in 2025/26. Hospital that previously received a Critical Access Hospital payment from the MA Fee-for-Service program are eligible hospitals under the Inpatient and Outpatient State Directed Payment.

MA Fee-for-Service also has a year-over-year increase of $3.1 million, or 0.4%. The 2025/26 MA Fee-for-Service appropriation also maintains payments at 2024/25 levels for certain hospitals, as follows:

- Community Access Fund grants;

- $405,000 for Cleft Palate and other Craniofacial Anomalies;

- $800,000 for clinical ophthalmological services located in the City of Philadelphia;

- $5 million to certain hospitals in Delaware County that are affected by a hospital closure in that County;

- $2 million to a university located in Philadelphia to research the impact of trauma informed programs;

- $3 million to an outpatient services provider located in the City of Pittsburgh that provides behavioral health and medical rehabilitation pediatric outpatient services;

- $1.25 million to a hospital in the City of Greensburg in Westmoreland County;

- $10 million for one-time payments to rural hospitals;

- $1 million for a one-time payment to a federally qualified health center provider in the City of Philadelphia that has service locations in a designated service area which has no federal grantee as of July 1, 2025;

- $2 million to a hospital located in the City of Allentown that operates campuses under the same license with hospitals in a county of the sixth class;

- $1 million to a hospital that provides emergency department of hospitals services in Delaware County that was impacted by a hospital closure in that County; and

- $500,000 to a nonpublic inpatient behavioral health facility located in Luzerne County.

Pennsylvania’s regular Federal Medical Assistance Percentage (FMAP) will increase, effective October 1, 2025, from 55.09% to 56.06%. The increase in FMAP results in increased federal funds available in 2025/26 for the MA program, which results in savings to state General Funds.

The state General funds increase by $622.5 million, or 10.7%, over 2024/25 for the MA – Community HealthChoices appropriation. This appropriation funds the MA managed care program for low-income older adults and individuals with eligible disabilities. The double digit year-over-year increase is primarily due to the growing number of aging individuals that have become eligible for this program and the increase in rates paid by the Department of Human Services to the participating Managed Care Organizations which increased effective January 1, 2025.

MA – Long-term Living has a year-over-year increase of $12.3 million, or 6.8%. This appropriation maintains funding for certain nursing home payments at 2024/25 levels, as follows:

- No less than the fiscal year 2014/15 amount ($2 million) to county nursing homes located in Delaware County, with more than 725 beds and a Medicaid acuity at 0.79 as of August 1, 2015.

- No less than the fiscal year 2020/21 ($1 million) to a nonpublic nursing home located in Philadelphia County with more than 395 beds and a Medicaid acuity at 1.06 as of August 1, 2022.

- $5 million to a nonpublic nursing home located in Sullivan County with more than 119 beds and a Medicaid acuity at 1.11 as of August 1, 2022.

- $500,000 to nursing facilities that provide ventilator care and tracheostomy care with greater than 90% of MA residents who require this care.

- $250,000 paid to the nursing facility located in the City of Philadelphia which commenced operations after December 31, 2017, and remains open and has residents who require medically necessary ventilator care or tracheostomy care equal to or greater than 90% as of August 1, 2022.

- In addition to the nursing home payments listed above, the MA – Long-term Living appropriation includes $21 million for MA Day-One Incentive Payments.

- $1.5 million will be distributed to a nursing home located in Delaware County with more than 126 beds and a Medicaid Acuity at 0.89 as of February 1, 2023.

- $1.5 million will be distributed to a nonprofit skilled nursing home located in City of Scranton with a Medicaid acuity of 1.11 as of February 1, 2023.

Both the MA - Community HealthChoices and Long-Term Living appropriations include a total of $21 million for the governor’s initiative to increase rates for direct care workers participating in the participant-directed model of care. In this model, the MA eligible person that needs care directly employs their caregiver.

The Mental Health Services appropriation decreased by $17.9 million, or -1.9%, over 2024/25. This decrease is due to mostly to the updated administrative costs associated with the six state-owned and operated psychiatric and one long-term care facilities. This appropriation maintains funding for web portals that provide support for individuals with mental health or substance abuse conditions and for services and resources for veterans and their families. It also maintains the $40 million in prior fiscal years’ increases for county mental health funding ($20 million in 2023/24 and $20 million in 2024/25). However, it does not include the $20 million in increased funding for county-based mental health services which was proposed by the governor for 2025/26.

The 2025/26 budget includes a decrease of $6 million, or -5.2%, for Intellectual Disabilities (ID) State Centers and an increase of $5.2 million, or 2.9%, for ID - Intermediate Care Facilities. There is a $154.4 million, or 6.1%, increase for ID – Community Waiver Program, a $7 million, or 4.4%, increase for ID – Community Base Program, and a $4.3 million, or 12.9%, increase for Autism Intervention and Services. These appropriations maintain the increase for MA rates paid for Home and Community Based Services that took effect on July 1, 2024. The ID – Community Waiver Program also includes funding to annualize the additional waiver spots that were added in the 2024/25 budget. This included 250 Consolidated Waiver (uncapped waiver that includes residential services) and 1,250 Community Living Waiver spots to help reduce the number of individuals currently waiting for waiver services ($85,000 annual cap and no residential services).

The 2025/26 includes a new appropriation in amount of $25 million for Child Care Recruitment and Retention. This funding will provide grants in the amount of $450 to each child care worker employed by licensed child care providers that have an agreement to provide services to children in the commonwealth’s subsidized child care program.

The FY 2025/26 budget maintains state General Fund support for DHS’s subsidized child care programs at FY 2024/25 levels, with total appropriations of $421.3 million. The County Child Welfare appropriation is funded as requested by the governor at $1.5 billion, which is level funded to 2024/25. The Early Intervention program, which provides services to infants and young children experiencing developmental delays, increases by $13.2 million, or 7.1%, over 2024/25. This includes $10 million in state General Funds for the governor’s proposed rate increase for Early Intervention providers for children ages 0 to 3 years old.

The Rape Crisis appropriation increased by $250,000 over 2024/25 for a total appropriation of $12.2 million, and the Domestic Violence appropriation increased by $470,000 over 2024/25 for a total appropriation of $23 million.

The 2025/26 budget maintains funding at the same level as 2024/25 for the following appropriations:

- Behavioral Health Services - $57.1 million

- Blind and Vision Services - $4.7 million

- Breast Cancer Screening - $1.8 million

- Expanded Medical Services for Women - $8.3 million

- Homeless Assistance - $23.5 million

- Hospital Burn Centers - $4.4 million

- Human Services Development Fund - $13.5 million

- MA - Academic Medical Centers - $24.7 million

- MA - Obstetric and Neonatal Services - $10.7 million

- MA - Trauma Centers - $8.7 million

- Nurse Family Partnership - $14 million

- 211 Communications - $750,000

The 2025/26 budget does not include funding for the following initiatives, which were proposed by the governor:

- $20 million Patient Safety and Services – Hospitals,

- $5.8 million for expansion of mental health diversion and discharge programs,

- $10 million for the 988 crisis line network,

- $5 million for crisis walk-in centers, and

- $4.9 million in MA Reentry Services.

Act 43 of 2017 authorized the governor to issue $1.5 billion in bonds backed by future revenues from the Tobacco Master Settlement Agreement (MSA). The act established procedures for the resulting debt payments, which allowed for repayment either from MSA revenues or from general tax revenues.

The Fiscal Code continues the requirement that MSA revenues sufficient to make annual debt service payments must be deposited into the debt service account established by Act 43. Debt service payments will total $115.3 million in 2025/26, representing nearly 35% of expected MSA revenues for the fiscal year. However, the Fiscal Code also continues to require revenues equal to the debt service amount to be transferred from cigarette tax collections and deposited into the Tobacco Settlement Fund (TSF). Consequently, the TSF is again held harmless for debt service costs in 2025/26.

The Fiscal Code maintains the same TSF distribution levels of various health-related programs and purposes from 2024/25 in the 2025/26 budget. The distribution is as follows:

- 4.5% (estimated $14 million) for tobacco use prevention and cessation programs

- 12.6% (estimated $39.2 million) for health and related research, of which:

- 70% (estimated $27.4 million) for health research

- 30% (estimated $11.8 million) as follows:

- $1.0 million for spinal cord injury research programs

- The remaining 75% (estimated $8.1 million) for pediatric cancer research

- The remaining 25% (estimated $2.7 million) for grants for biomedical research institutions

- Money appropriated for Amyotrophic Lateral Sclerosis Support Services will be distributed in the same proportion as in fiscal 2024/25

- 1% (estimated $3.1 million) for cancer research

- 8.18% (estimated $25.4 million) for the uncompensated care payment program

- 30% (estimated $93.3 million) for the Medical Assistance for Workers with Disabilities Program

- 43.72% (estimated $135.9 million) to be separately appropriated for health-related programs

The General Appropriations Act includes the appropriations for other health related purposes of $3 million for Life Sciences Greenhouse in the Department of Community and Economic Development and $132.9 million for Community HealthChoices in the Department of Human Services.

The 2025/26 budget includes $1.429 billion for senior programs which is a $71 million, or 5.2%, increase over 2024/25. The Lottery Funding for Senior Programs table provides a summary of the allocations for programs across a number of agencies.

Notable changes include the $20 million decrease in the transfer to the Pharmaceutical Assistance Fund, which supports the Pharmaceutical Assistance Contract for Elderly (PACE) and PACE Needs Enhancement Tier (PACENET) programs. The PACE and PACENET programs provide prescription drug assistance for eligible senior citizens. Additionally, there is an $81 million increase to Medical Assistance-Community HealthChoices and $10.7 million increase to PENNCARE. Funding in the PENNCARE appropriation provides funding to the local Area Agencies on Aging.

| Lottery Funding for Senior Programs |

| ($ amounts in thousands) |

| Agency/Program |

2024/25 |

2025/26 |

$ Chng |

% Chng |

| Actual |

Enacted |

| Department of Aging |

| PENNCARE |

$ 287,848 |

$ 298,555 |

$ 10,707 |

3.7% |

| Pharmaceutical Assistance Fund |

$ 170,000 |

$ 150,000 |

$ (20,000) |

-11.8% |

| Pre-Admission Assessment |

$ 8,750 |

$ 8,750 |

$ - |

|

| Caregiver Support |

$ 12,103 |

$ 12,103 |

$ - |

|

| Grants to Senior Centers |

$ 3,000 |

$ 3,000 |

$ - |

|

| Alzheimer's Outreach |

$ 250 |

$ 250 |

$ - |

|

| Aging Our Way |

$ 2,950 |

$ 2,950 |

$ - |

0.0% |

| Department of Human Services |

| Medical Assistance - Community HealthChoices |

$ 373,966 |

$ 454,966 |

$ 81,000 |

21.7% |

| Medical Assistance - Transportation Services |

$ 4,000 |

$ 4,000 |

$ - |

|

| Department of Revenue |

| Property Tax and Rent Assistance* |

$ 324,400 |

$ 323,700 |

$ (700) |

-0.2% |

| Department of Transportation |

| Older Pennsylvanians Share Rides* |

$ 75,000 |

$ 75,000 |

$ - |

|

| Transfer to Public Transportation Trust Fund* |

$ 95,907 |

$ 95,907 |

$ - |

|

| Total |

$ 1,358,174 |

$ 1,429,181 |

$ 71,007 |

5.2% |

| * Executive Authorizations (EAs) are not included in the General Appropriations Act |

|

|

|

|

Act 45 of 2025 (Fiscal Code) authorized the following fund transfers into the Lottery Fund which increases the Fund’s available balance:

- A one-time transfer of $100 million from the Medical Marijuana Program Fund.

- For 2025/26, and each year thereafter $91 million from iGaming revenues.

- For 2025/26 and each year thereafter a transfer of funds from the Property Tax Relief Fund to the Lottery Fund to cover the sum of the amount of approved claims to be paid in the next fiscal year.

The enacted budget provides the actuarially required contribution rate for the commonwealth’s obligations related to its two major pension funds, the Public School Employees’ Retirement System (PSERS) and the State Employees' Retirement System (SERS).

PSERS’ employer contributions are divided, with approximately half coming from the local school district and the other half coming from the commonwealth. The appropriation for the commonwealth share is housed within the Department of Education. For fiscal year 2025/26, the enacted budget includes an increase of $163 million, or 5.3%, for a total of $3.25 billion. The PSERS employer contribution rate for 2025/26 is 34%, and the funded ratio is 68.3%.

Employer contributions to SERS are housed within the personnel costs of the various offices and agencies which participate in the system. Therefore, there is no single appropriation for the commonwealth’s total employer contributions for SERS. The SERS employer contribution rate is 31.47% for the 2025 valuation year, and the funded ratio is 70.9%.

Appropriations that provide for the administrative costs for staff and operations of PSERS and SERS are funded within two “housekeeping” appropriations acts, which are traditionally passed as part of the combined budget package each year. For fiscal year 2025/26, Act 5A appropriated funding to PSERS while Act 6A appropriated funds to SERS.

Amounts Appropriated by Fund to the Public School Employees' Retirement Board for Administrative Expenses

(in thousands) |

2024/25 |

2025/26 |

Change |

| Public School Employees' Retirement Fund |

$61,403 |

$64,523 |

$3,120 |

5.1% |

| PSERS Defined Contribution Fund |

$1,282 |

$1,405 |

$123 |

9.6% |

Amounts Appropriated by Fund to the State Employees' Retirement Board for Administrative Expenses

(in thousands) |

2024/25 |

2025/26 |

Change |

| State Employees' Retirement Fund |

$39,795 |

$43,249 |

$3,454 |

8.7% |

| SERS Defined Contribution Fund |

$5,979 |

$4,836 |

-$1,143 |

-19.1% |

The enacted budget provides the department with a 5% increase to its general government operations and a $896,000 or 20.1% increase for the occupational and industrial safety appropriation, which supports the Bureau of Occupational and Industrial Safety’s work administering and enforcing laws regulating buildings, elevators, boilers, combustible liquids, and the safety of stuffed toys and bedding.

The commonwealth’s assistive technology appropriations are level funded. Specifically, assistive technology financing receives $1 million, which supports the Pennsylvania Assistive Technology Foundation and assistive technology demonstration and training receives $850,000, which supports TechOWL at Temple University.

The Fiscal Code directs a $104.4 million transfer from the Unemployment Compensation Contribution Fund to the Service and Infrastructure Improvement Fund (SIIF) restricted account. This is an increase of $36.4 million over the amount transferred in 2024/25. These funds support investments meant to facilitate the improvement of operations and administration of Pennsylvania’s Unemployment Compensation program.

The Pennsylvania Historical and Museum Commission’s 2025/26 general government operations appropriation, which supports the functions of the Commission throughout the fiscal year, is increased by $1.1 million, or 4.7%. The cultural and historical support appropriation, which funds grants and subsidies across the commonwealth, is flat funded at $4 million, following a $2 million increase in 2024/25.

The 2025/26 budget for the Department of State (DOS) includes a total of $43.163 million. This is a $1.958 million, or 4.3%, decrease over fiscal year 2024/25. This decrease is largely driven by decreasing the Publishing Constitutional Amendments appropriation from $1.3 million to $0 and decreasing the County Election Expenses appropriation from $1.4 million to $1 million due to less need for funding during a Municipal election year compared to a Presidential election year.

The Voter Registration appropriation was increased by $25,000, or 4.6%, to account for increased service fees associated with mailing voting-related material to Pennsylvanians and the Lobbying Disclosure appropriation was increased by $350,000, or 62.3%, to account for continued IT system updates and transitions.

Community and Economic Development

The 2025/26 budget for the Department of Community and Economic Development (DCED) includes a total of $514.005 million in state funding. This is a $14.68 million, or 2.9%, increase over fiscal year 2024/25.

The Office of Open Records (OOR) received $576,000, or 14.2% increase to hire an additional attorney to handle the large volume of Right-to-Know requests. OOR is also beginning a new lease payment due to moving offices and must replace its appeal filing portal and case management database system.

DCED is streamlining operations when it comes to promoting Pennsylvania as an attractive site for business. A large reorganization created a new line item, BusinessPA, focused on promoting business success, expansion, and attraction in Pennsylvania. BusinessPA received $8.856 million in funding with part of that funding transferred from the Marketing to Attract Business line item and the Office of International Business Development (World Trade PA) line item.

The PA SITES Debt Service line was increased by $4.954 million, or 32.2%. This appropriation provides for debt service for bonds issued by the Pennsylvania Economic Development Financing Agency for the PA SITES program.

Finally, the Fiscal Code contains language that directs no less than $25 million of the $125 million provided for the Commonwealth Financing Authority’s Public School Facility Improvement Grant Program to be used for the Solar for Schools Grant Program in fiscal year 2025/26.

The department of Environmental Protection’s enacted General Fund budget is $246.59 million, an increase of $12.75 million or 5.5% over fiscal year 2024/25. The department’s appropriations which account for the majority of the year-over-year changes:

- General Government Operations - $1.81 million or 6% increase

- Environmental Program Management - $2.97 million or 7% increase

- Environmental Protection Operations - $8.81 million or 7% increase

- Chesapeake Bay Agricultural Source Abatement - $2.19 million or 59.7% increase

Similar to 2024/25, for 2025/26, the Infrastructure Investment and Jobs Act (IIJA) delivers a significant infusion of Federal funds for environmental protection. Additionally, Federal funds allocated through the Inflation Reduction Act (IRA) also contribute to the department’s budget. For 2025/26, IIJA related appropriations deliver $892.9 million in Federal funds, which represents an increase of $90.7 million. In similar fashion, the Inflation Reduction Act related appropriations provide a total of $1.37 billion or an increase of $23.2 million in 2025/26. In total, the combined increase in funding related to IIJA and IRA is $113.95 million over prior year. The Fiscal Code removed language which previously precluded the use of IRA-Solar for All funds, which pending litigation would provide $156.1 million in 2024/25 funds and $166.1 million in 2025/26 funds.

Lastly, as it relates to funding for the Water Commission, which are part of the agency’s appropriations, this budget provides level funding for those commissions as compared to 2024/25.

The department’s enacted General Fund budget is $126.7 million, which represents a reduction of $48.63 million or 27.7% over 2024/25. The reduction in General Fund appropriations is mostly offset by increases in the Oil and Gas Lease Fund (OGLF).

The agency’s three major appropriations receive funding from the General Fund and the Oil and Gas Lease Fund (OGLF). As noted previously, funding within the General Fund is reduced and then increased within the OGLF as provided in the table.

| 2025/26 DCNR Major Appropriations Summary |

| General Fund and Oil & Gas Lease Fund Comparison |

| ($ amounts in thousands) |

| Funding Source/FY |

Actual |

Enacted |

Enacted less Available |

| 2024/25 |

2025/26 |

$ Chng |

% Chng |

| General Fund (GF) |

| General Gov't Ops |

$ 33,031 |

$ 23,927 |

$ (9,104) |

(27.6%) |

| State Parks Ops |

$ 71,967 |

$ 51,236 |

$ (20,731) |

(28.8%) |

| State Forests Ops |

$ 51,435 |

$ 32,639 |

$ (18,796) |

(36.5%) |

| GF Subtotal |

$ 156,433 |

$ 107,802 |

$ (48,631) |

(31.1%) |

| Oil & Gas Lease Fund (OGLF) |

| General Gov't Ops |

$ 20,790 |

$ 32,943 |

$ 12,153 |

58.5% |

| State Parks Ops |

$ 25,500 |

$ 52,068 |

$ 26,568 |

104.2% |

| State Forests Opts |

$ 21,500 |

$ 45,145 |

$ 23,645 |

110.0% |

| OGLF Subtotal |

$ 67,790 |

$ 130,156 |

$ 62,366 |

92.0% |

| GF/OGLF Total |

$ 224,223 |

$ 237,958 |

$ 13,735 |

6.1% |

The Department of Agriculture’s enacted 2025/26 General Fund budget is $253.38 million, which represents a decrease of $7.88 million over 2024/25.

The Agricultural Preparedness and Response appropriation received $9 million, a reduction of $25 million over 2024/25. The reduction of the General Fund appropriation is a function of the availability of prior year funds.

As part of efforts to combat food deserts and address food insecurity, this budget includes:

- $2 million for the Fresh Food Financing Initiative (FFFI), which was funded at the same level last year

- $30.688 million or $4 million increase for the State Food Purchase Program (SFPP) line item:

- $21.68 million or $3 million increase for the core SFPP program

- $6.5 million or $1 million increase for Pennsylvania Agricultural Surplus System (PASS)

- $1 million for the Emergency Food Assistance Program (TEFAP)

- $500,000 for TEFAP Distribution

- $1 million for Senior Food Box Program

This budget provides level funding of $57.1 million for Penn State’s Agricultural Extension appropriation as well as level funding for the University of Pennsylvania’s appropriations, $31.56 million for Veterinary Services and $1.79 million for the Center for Infectious Disease.

Lastly, the General Fund budget allocates $11.35 million for the Animal Health and Diagnostic Commission as well as $5.35 million for the Pennsylvania Veterinary Lab. Funding for the Pennsylvania Veterinary Lab in FY 2024/25 was allocated within the Race Horse Development Fund at the same level, thus the $5.35 million allocation simply represents a shift in the source of funding.

The 2025/26 budget appropriates $3.24 billion to the Department of Corrections, $82.5 million, or 2.6% more than fiscal year 2024/25. Most of the appropriation ($2.5 billion) is for state correctional institutions. The appropriation for state correctional institutions increased by $74.4 million, or 3.0%. The inmate medical care appropriation decreased by $1.3 million, or 0.3%, to $409 million. Act 45 of 2025 (The Fiscal Code) allows for the transfer of unexpended, uncommitted, or unencumbered funds from the COVID-19 Response Restricted Account to be transferred to the Department of Corrections for payroll or similar expenses.

State Field Supervision receives a $7.1 million increase in the 2025/26 budget. The Parole Board and the Board of Pardons each receive relatively small increases.

The appropriation for the Sexual Offenders Assessment Board is increased by $590,000 or 7.3%. This includes $366,000 to increase the compensation for assessments from $350 to $500 to members of the State Sexual Assault Offenders Assessment Board. This was provided for in Act 45 of 2025 (The Fiscal Code).

The appropriation for the Office of Victim Advocate continues to be restored in this budget and is funded at $4.0 million. The line item was eliminated in the 2020/21 and 2021/22 budgets, although the office continued to receive funding through the Department of Correction’s General Government Operations appropriation. The Fiscal Code also provides $80,000 for information technology enhancements for the Office of Victim Advocate from unexpended funds in the Enterprise and Technology Restricted Account.

| Major Department of Corrections Appropriations |

| ($ amounts in thousands) |

2024/25 |

2025/26 |

$ Change |

% Change |

| GGO |

$ 40,735 |

$ 41,769 |

$ 1,034 |

2.5% |

| Medical Care |

$ 410,408 |

$ 409,089 |

$ (1,319) |

-0.3% |

| Correctional Education and Training |

$ 50,871 |

$ 50,999 |

$ 128 |

0.3% |

| State Correctional Institutions |

$ 2,439,267 |

$ 2,513,629 |

$ 74,362 |

3.0% |

| State Field Supervision |

$ 184,210 |

$ 191,325 |

$ 7,115 |

3.9% |

| Pennsylvania Parole Board |

$ 13,373 |

$ 13,598 |

$ 225 |

1.7% |

| Sexual Offenders Assessment Board |

$ 8,031 |

$ 8,621 |

$ 590 |

7.3% |

| Board of Pardons |

$ 2,880 |

$ 3,010 |

$ 130 |

4.5% |

| Office of Victim Advocate |

$ 3,809 |

$ 4,049 |

$ 240 |

6.3% |

The General Fund appropriation for state police general government operations is $1.14 billion dollars. This amount is $69.3 million, or 6.5%, more than 2024/25. PSP general government operations are funded by the General Fund and the Motor License Fund. The appropriation for general government operations from the Motor License Fund remains at $250 million. Combined General Fund and Motor License Fund appropriations for state police general government operations is increased by $69.3 million, or 5.2%. This includes funding for four new cadet classes.

Total combined General Fund and Motor License Fund appropriations for the state police is increased by $58.4 million, or 4.1%. The Law Enforcement Information Technology and Commercial Vehicle Inspections appropriations each received small increases of $275,000 (1.0%) and $250,000 (1.7%) respectively. The Statewide Public Safety Radio System and Patrol Vehicles appropriations decreased by $1.4 million (5.1%) and $7 million (35%) respectively. In the 2025/26 budget, the Automated Fingerprint Identification System (AFIS) was renamed Multi-Biometric Identification System. The Multi-Biometric Identification System appropriation was flat funded.

State funding for the Gun Checks appropriation, which supports the operations of the Pennsylvania Instant Check System (PICS), decreased by $3 million (39.6%) to $4.6 million. PICS is also supported by an appropriation from the Firearms Records Check fund, which increased by $2.7 million (49.4%) to $8.2 million.

| State Police: Major Fund Summary |

2024/25 |

2025/26 |

1-Year Change |

| $ amounts in thousands |

Available |

Enacted |

$ Change |

% Change |

| General Government Operations |

General Fund |

$ 1,072,441 |

$ 1,141,750 |

$ 69,309 |

6.5% |

| Motor License Fund |

$ 250,000 |

$ 250,000 |

$ - |

0.0% |

| GF + MLF |

$ 1,322,441 |

$ 1,391,750 |

$ 69,309 |

5.2% |

| Total |

General Fund |

$ 1,180,573 |

$ 1,238,963 |

$ 58,390 |

4.9% |

| Motor License Fund |

$ 250,000 |

$ 250,000 |

$ - |

0.0% |

| GF + MLF |

$ 1,430,573 |

$ 1,488,963 |

$ 58,390 |

4.1% |

The 2025/26 budget was a break in the multi-year effort to reduce reliance on the Motor License Fund by the state police, making additional funds available for infrastructure projects and federal match requirements. Total state police expenditures from the Motor License Fund for 2025/26 were $250 million, the same as in 2024/25. In 2024/25 and 2025/26, funding from the Motor License Fund was used solely for State Police General Government Operations.

The 2025/26 budget appropriates $25.3 million to the Pennsylvania Commission on Crime and Delinquency, a $948,000 or 3.9% increase from 2024/25. From this amount, Pennsylvania Court Appointed Special Advocates receive $1.8 million. Act 45 of 2025 (the Fiscal Code) continued the $2 million allocation to a nonprofit organization to monitor conditions in State and county correctional institutions (PA Prison Society) and the $700,000 transfer for a diversion program for first-time nonviolent offenders.

The Fiscal Code further allocated $1.75 million for medication-substance use disorder treatment for eligible offenders and expanded the scope of eligible treatments. Grants will be provided to counties to provide medication-assisted treatment to eligible offenders while incarcerated and upon release. Medication-assisted treatment is defined as the use of United States Food and Drug Administration approved medications, together with nonmedication treatment, as clinically indicated, to treat substance use disorders, including opioid use disorders and alcohol use disorders. This funding was allocated to the Department of Corrections, in the same amount, prior to 2023/24. This expanded definition also applies to unexpended funds from prior fiscal years.

The enacted budget provides $7.5 million for Indigent Defense. Indigent Defense has been flat funded since the appropriation was created in 2023/24. The Office of Safe Schools Advocate, shifted from the Department of Education to PCCD in 2020/21, and funding from the Improvement of Adult Probation Services, shifted from the Department of Corrections in 2021/22, are both flat funded.

$62.2 million in State funds are appropriated for Violence Intervention and Prevention to be used for Community Violence Reduction programs, an increase of $5.7 million or 10% over the prior fiscal year. From this amount, $11.5 million continues to be allocated for use by the School Safety and Security Committee to provide grants for out-of-school programming for at-risk school-age youth (BOOST).

The Fiscal Code amended language in the Medical Marijuana Program Fund to allow the Pennsylvania Commission on Crime and Delinquency to use money from the fund for distribution to police departments and forensic crime laboratories that demonstrate a need relating to the enforcement of the Medical Marijuana Act and to crime victims.

The Fiscal Code also included a one-time transfer of uncommitted money available to the Pennsylvania Commission on Crime and Delinquency from the Medical Marijuana Program Fund through fiscal year 2025/26 to the Crime Victim Services and Compensation Fund (approximately $9 million).

The enacted budget appropriates $453.4 million in state funds to the Judiciary, a $17.8 million or 4.1% increase. Prior to 2023/24, funding for the Judiciary remained relatively flat for several fiscal years. The judiciary received a 6.7% increase in 2024/25.

| Judiciary |

| ($ amounts in thousands) |

2024/25 |

2025/26 |

$ Change |

% Change |

| Supreme Court |

$ 75,009 |

$ 76,432 |

$ 1,423 |

1.9% |

| Superior Court |

$ 38,944 |

$ 40,904 |

$ 1,960 |

5.0% |

| Commonwealth Court |

$ 24,476 |

$ 25,734 |

$ 1,258 |

5.1% |

| Court of Common Pleas |

$ 154,273 |

$ 162,040 |

$ 7,767 |

5.0% |

| Community Courts - MDJs |

$ 101,152 |

$ 106,539 |

$ 5,387 |

5.3% |

| Philadelphia Municipal Court |

$ 10,074 |

$ 10,074 |

$ - |

0.0% |

| Judicial Conduct |

$ 3,432 |

$ 3,432 |

$ - |

0.0% |

| Reimbursement of County Costs |

$ 28,258 |

$ 28,258 |

$ - |

0.0% |

| Total State Funding |

$ 435,618 |

$ 453,413 |

$ 17,795 |

4.1% |

The JCJC receives $3.7 million for 2025/26, an increase of $330,000 or 9.8% over 2024/25. Grants for juvenile probation services are level funded at $18.9 million.

The budget appropriates $15.5 million for the Pennsylvania Emergency Management Agency (PEMA) for general government operations, an increase of $715,000 or 4.8% from fiscal year 2024/25 (including a $1.2 million negative supplemental appropriation for fiscal year 2024/25). The Office of the State Fire Commissioner receives $4.8 million, a 3.3% increase (including a $1.2 million supplemental appropriation for fiscal year 2024/25). The budget maintains funding for the Red Cross Extended Care program at $350,000.

The budget also provides $5 million for State Disaster Assistance. State Disaster Assistance funds will be available for emergencies and non-federally declared disasters. This includes critical needs assistance to repair damage to residential properties that were not covered by insurance or other funding sources. Act 54 of 2025 (The Fiscal Code) includes language earmarking funds for this purpose and further stipulates that no more than 2% of the amount appropriated may be used to pay agency administrative expenses. PEMA is required to publish guidelines to implement this program.

The Hazard Mitigation, Disaster Relief, and Emergency Management Assistance Compact appropriations are all unfunded in the enacted budget. All three funds carried prior year balances.

The Fiscal Code provides $504,000 for audiovisual upgrades for PEMA from unexpended funds in the Enterprise and Technology Restricted Account.

The enacted budget flat-funds Urban Search and Rescue at $6 million. The Fiscal Code establishes that these funds will be used for an urban search and rescue task force established within a regional counterterrorism task force covering Allegheny County. The funding can be used for equipment, equipment storage, and any training necessary for the task force to meet or exceed the minimum requirements of a Type 3 urban search and rescue task force as defined by the Federal Emergency Management Agency.

The Fiscal Code extends the $1.95 Uniform 911 Surcharge through February 1, 2029. Collected fees are deposited into the 911 Fund, which is used to supplement county 911 systems. Approximately $393 million is collected annually through this surcharge.

Within the Department of Military and Veterans Affairs (DMVA), the appropriation for general government operations increased by $2.4 million, or 6.6%, to $38.9 million. The transfer to the Educational Assistance Program Fund, which provides educational assistance for eligible members of the Pennsylvania National Guard and their families, increased by $1 million, or 7.4%.

State spending on Pennsylvania’s six veterans’ homes decreased by $14.7 million, or 9.1%, to a total of $149.9 million. This decrease was offset by an increase in federal funding for Veterans Homes operations and maintenance of $31.8 million for a total of $92 million.

The enacted budget also includes increases in the appropriations for Education of Veterans Children ($30,000 or 15.4%), Educational Assistance Program Fund ($1 million or 7.4%), the National Guard Youth Challenge Program ($360,000 or 16.6%), and Paralyzed Veterans Pensions ($402,000 or 9.6%). The Education of Veterans Children receives a supplemental appropriation increase for 2024/25 of $125,000 for a total of $320,000.

Act 45 of 2025 (the Fiscal Code) provides $504,000 for audiovisual upgrades for the DMVA from unexpended funds in the Enterprise and Technology Restricted Account.

The enacted budget provided a $14 million state appropriation for the Pennsylvania Human Relations Commission (PHRC), which is a $2.7 million or 24.2% increase over 2024/25. This reflects a recognition that state-level civil rights enforcement has become more critical. During the rebudget process, PHRC will make a plan for how to deploy these resources, including how many new positions to fill.

Adding to the work of PHRC, after the budget passed, the governor signed the Crown Act (Act 54 of 2025), which provides additional protections for hair texture and protective hairstyles.

The Fiscal Code requires the Secretary of the Budget to transfer $59.25 million to the Enterprise and Technology Restricted Account from agencies’ unexpended, unencumbered, or uncommitted operating funds appropriated in fiscal year 2024/25 and prior. Act 54 of 2024 established the Enterprise and Technology Restricted Account for the receipt and disbursement of funds for specific projects, and the $59.25 million provided for 2025/26 is appropriated on a continuing basis as follows:

- $20 million for Enterprise Systems Lifecycle Project in the Office of Budget

- $6.9 million for Commonwealth Office of Digital Experience in the Office of Administration

- $10 million for Enhanced Enterprise Cybersecurity Projects in the Office of Administration

- $15.266 million For Space Optimization and Utilization Improvement Project in DGS

- $6.5 million for audio visual upgrades within PEMA and DMVA

- $80,000 for information technology enhancements for the Office of Victim Advocate

- $300,000 for Case Management System Project in the Office of General Counsel

- $200,000 for climate controlled system upgrades at the State Library

The Office of Attorney General receives a $3.9 million, or 7.1% increase for general government operations. Act 45 of 2025 (the Fiscal Code) stipulates that $1.2 million of this amount is for costs related to a special prosecutor for mass transit. The Human Trafficking Enforcement and Prevention appropriation, established in 2024/25, increased by $750,000 or 75.0% rev to $1.75 million. The Organized Retail Theft appropriation, also established in 2024/25, is flat funded at $2.7 million. The School Safety appropriation, which supports the Safe2Say program, increased by $83,000, or 3.2%.

The appropriation for the joint local-state firearm task force is flat-funded at $13.9 million with allocations stipulated by the Fiscal Code. Of the total amount, $8.4 million will be distributed between the Attorney General and the Philadelphia district attorney’s office with no more than 20% going to Philadelphia. $3.1 million is for costs associated with the Philadelphia task force and $1.5 million is to fund the establishment and operation of a task force in Pittsburgh. $889,692 is allocated to the Attorney General for operations and property costs related to the Joint Task Force.

Act 45 of 2025 (the Fiscal Code) makes several changes relevant to the office. The code increased the home improvement contractor registration fee from $50 to $100. This provision will increase the fee paid by a home improvement contractor for a certificate of registration with the Bureau of Consumer Protection. Collections are deposited into the Home Improvement Account within the Office of the Attorney General and are used by the office to enforce the Home Improvement Consumer Protection Act. Based on estimated revenues from 2024/25, approximately $1.5 million will be generated by this increase.

The Fiscal Code also increases the $2.50 fee for deposit into the Criminal Justice Enhancement Account to $3.50 and extends the fee to include traffic citations. This account is used to reimburse full-time County District Attorneys.

The Fiscal Code also permits the Attorney General to use funds from a set list of restricted accounts for their general government operations. These accounts include:

- The Criminal Enforcement Restricted Account established under section 1713-A.1.

- The Collection Administration Account established under section 922.1 of the Administrative Code of 1922

- The restricted account established under section 1795.1-E(c)(3)(iii)

- The Straw Purchase Prevention Education Fund established under 18 Pa.C.S. § 6186

- The restricted account established under section 4 of the Telemarketer Registration Act

- The restricted account known as the Public Protection Law Enforcement Restricted Account

- The State court awarded asset forfeiture restricted account as established by the Attorney General under 42 Pa.C.S. § 5803 (relating to asset forfeiture)

| Office of Attorney General State Appropriations |

| ($ amounts in thousands) |

2024/25 |

2025/26 |

$ Change |

% Change |

| General Government Operations |

$ 53,909 |

$ 57,759 |

$ 3,850 |

7.1% |

| Drug Law Enforcement |

$ 59,668 |

$ 62,066 |

$ 2,398 |

4.0% |

| Joint Local-State Firearm Task Force |

$ 13,969 |

$ 13,969 |

$ - |

0.0% |

| Witness Relocation Program |

$ 1,215 |

$ 1,315 |

$ 100 |

8.2% |

| Child Predator Interception Unit |

$ 7,018 |

$ 7,184 |

$ 166 |

2.4% |

| Tobacco Law Enforcement |

$ 1,691 |

$ 1,746 |

$ 55 |

3.3% |

| County Trial Reimbursement |

$ 200 |

$ 200 |

$ - |

0.0% |

| School Safety |

$ 2,557 |

$ 2,640 |

$ 83 |

3.2% |

| Human Trafficking Enforcement and Prevention |

$ 1,000 |

$ 1,750 |

$ 750 |

75.0% |

| Organized Retail Theft |

$ 2,720 |

$ 2,720 |

$ - |

0.0% |

The 2025/26 enacted budget provides for $850,000 increase for the Auditor General for a total of $46.96 million. The increase is a function of $877,000 increase within General Government Operations and $27,000 decrease within the Board of Claims.

Funding for the Treasury Department increased by $211.65 million, or 18.3%, over the prior fiscal year largely due to the $212 million increase in general obligation debt service. It is worth noting that the enacted 2024/25 budget included a negative supplemental appropriation for general obligation debt of $37 million. Other notable changes include the $324,000, or 8.9%, increase for the Board of Finance and $2.34 million, or 94%, decrease for divestiture reimbursement, a line item that provides for the reimbursement of losses associated with divestiture from investments in companies doing business in certain countries within the State Employees’ Retirement System (SERS), the Public School Employees’ Retirement System (PSERS), and the Pennsylvania Municipal Retirement System (PMRS) as provided by the General Assembly. Currently, the list of countries includes Iran, Sudan, Russia, and Belarus.