General Fund Revenue Report - December 2023

By Brittany Van Strien , Budget Analyst | 2 years ago

General Budget Update: In December 2023, the General Assembly passed Act 34 of 2023, which is the Fiscal Code legislation consisting of 2023/24 budget implementation language. Act 34 also included various provisions impacting 2023/24 General Fund revenues. As such, the updated official 2023/24 General Fund revenue estimate is $44.611 billion.

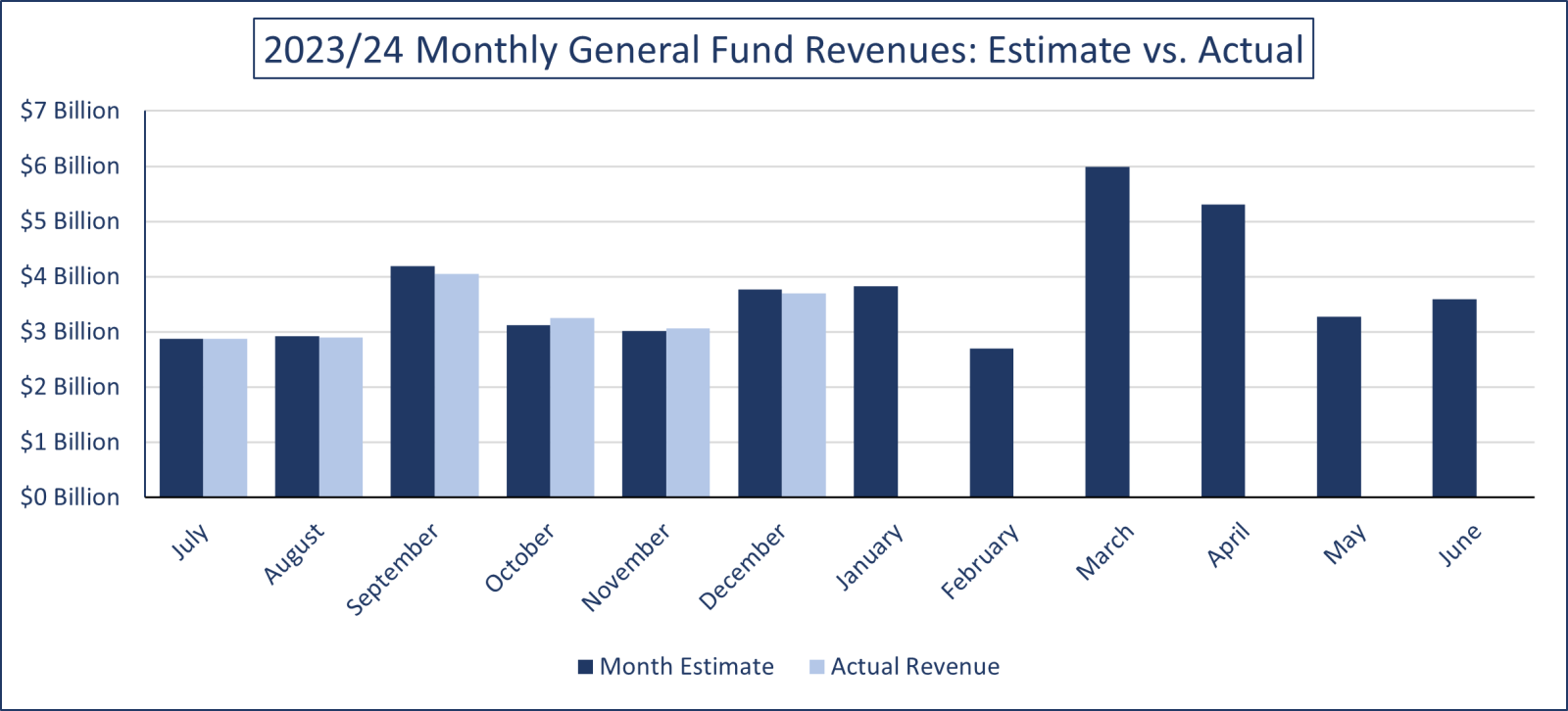

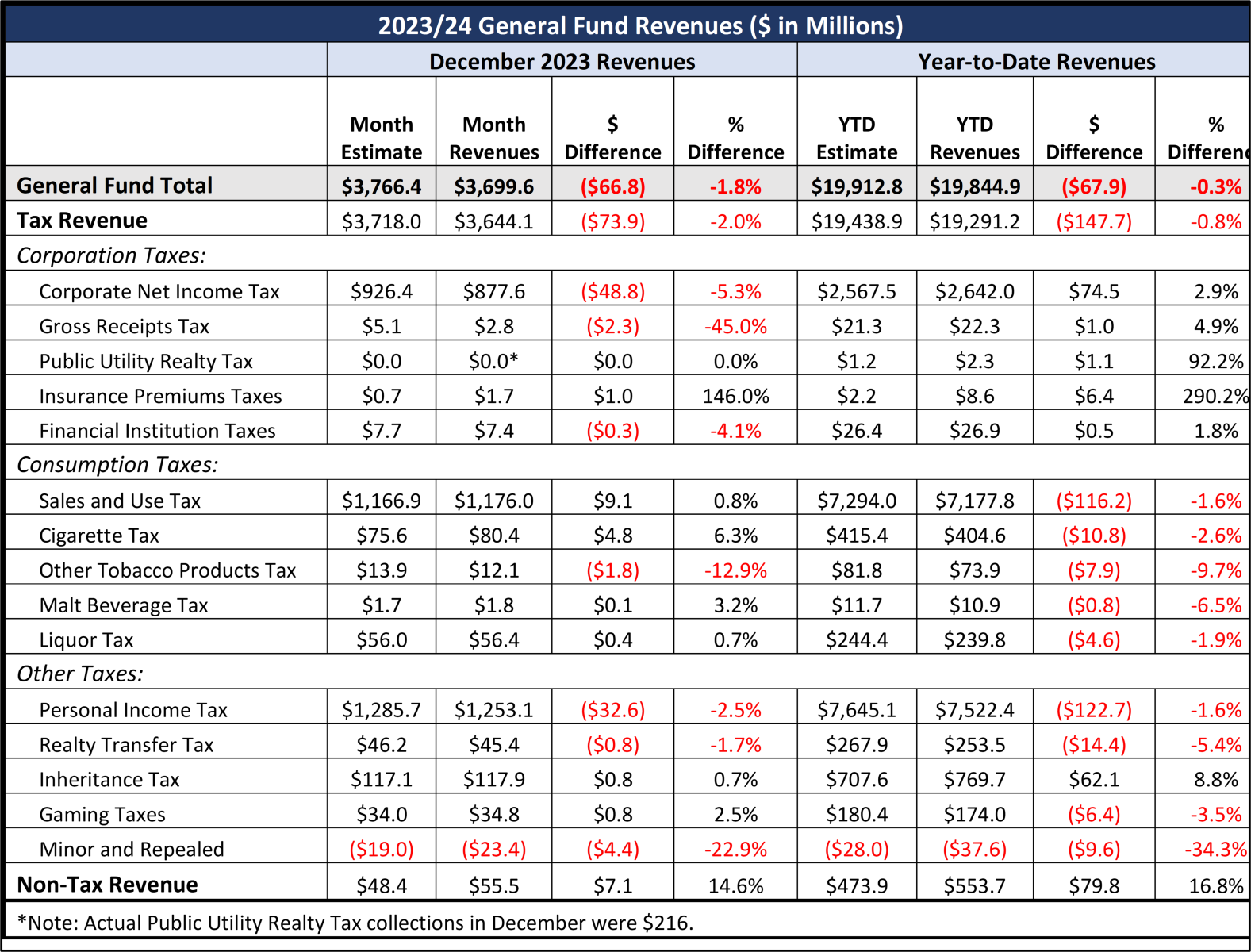

General Fund revenues in December were $66.8 million or 1.8% less than expected.

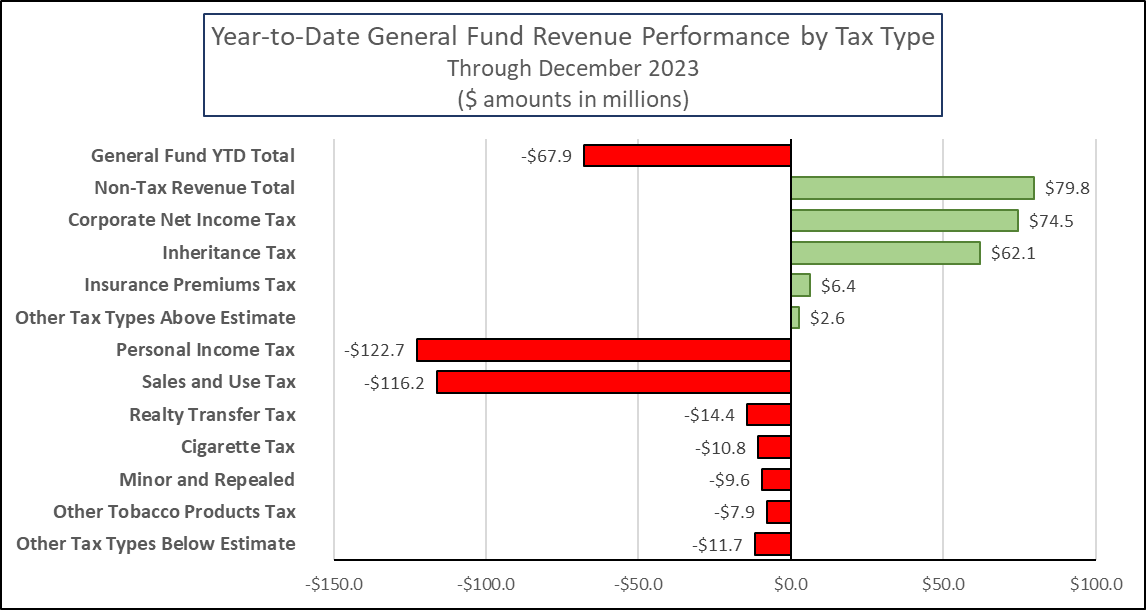

Adjusting for the updated 2023/24 revenue estimate, year-to-date General Fund revenues are $67.9 million or 0.3% below estimate.

Sales and use tax (SUT) revenue was $9.1 million or 0.8% higher than projected for the month. Nonmotor vehicle sales collections outperformed the December estimate by $9.0 million or 0.8%, while motor vehicle sales collections were $0.1 million or 0.1% above estimate. For the year-to-date, SUT collections are still under estimate by $116.2 million or 1.6%.

Personal income tax (PIT) revenue was $32.6 million or 2.5% less than estimated in December. Although PIT withholding collections were $0.3 million or 0.03% higher than expected, PIT non-withholding collections, which includes estimated quarterly and annual payments, were $33.0 million or 18.9% less than projected. For the fiscal year, PIT revenue is $122.7 million or 1.6% below estimate.

Corporate net income tax (CNIT) revenue underperformed in December by $48.8 million or 5.3%. For the year-to-date, however, CNIT collections remain higher than expected by $74.5 million or 2.9%.