General Fund Revenue Report - February 2023

By Eric Dice , Assistant Executive Director | 2 years ago

General Fund revenues were $351.8 million or 14.2% higher than expected in February.

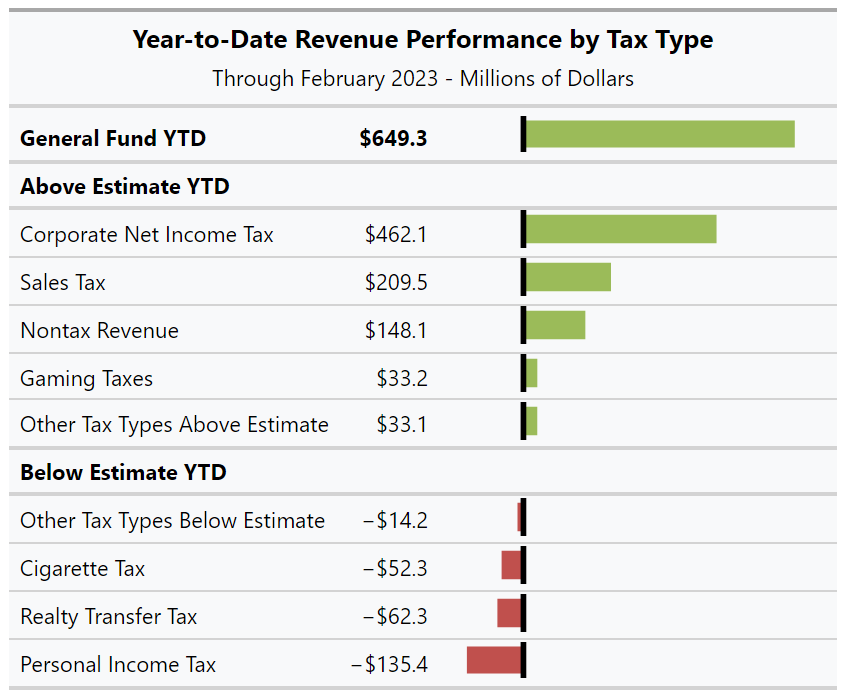

For the year to date, total General Fund revenues are $649.3 million above estimate or 2.6%.

Last month, January revenues were negatively affected by a timing delay, as the Department of Revenue continues to fine-tune its new tax processing system. The delayed revenues, about $94 million in total were recognized in February, bolstering collections this month.

Both the corporate net income tax and the sales tax outperformed the official estimate in February. The corporate net income tax was $124.3 million above estimate in February, while sales tax collections were $63.1 million more than expected. CNIT and SUT revenues benefited slightly from the timing shift into the month. Personal income tax collections saw a more significant timing impact. Monthly PIT revenues were $81.2 million higher than projected, but about $71.0 million was affected by the shift, leaving a smaller but still positive effect for the month.

Looking ahead, the governor’s executive budget will contain an updated revenue forecast for the General Fund when it is released next week. On the tax front, March is typically the largest revenue month. First quarterly payments from corporate net income taxpayers are due, as well as several special business taxes paid almost entirely in March, including the gross receipts tax, the insurance premiums tax, and taxes on financial institutions.

General Fund in February: $351.8 million / 14.2%

General Fund Year-to-Date: +$649.3 million/ 2.6%

| General Fund Revenues - Year-to-Date Performance vs Official Estimate |

| Amounts in Millions |

| |

February 2023 |

Year-to-Date |

| Month Estimate |

Month Revenues |

Difference |

% |

YTD Estimate |

YTD Revenues |

Difference |

% |

| |

| $2,476.0 |

$2,827.8 |

$351.8 |

14.2% |

$25,443.5 |

$26,092.8 |

$649.3 |

2.6% |

| Corporation Taxes |

| $0.0 |

$0.0 |

$0.0 |

- |

$0.0 |

−$3.4 |

−$3.4 |

- |

| Corporate Net Income Tax |

$83.2 |

$207.5 |

$124.3 |

149.4% |

$2,572.9 |

$3,035.0 |

$462.1 |

18.0% |

| Gross Receipts Tax |

$23.2 |

$39.5 |

$16.3 |

70.4% |

$50.5 |

$78.0 |

$27.5 |

54.4% |

| Utility Property Tax |

$0.0 |

$0.0 |

$0.0 |

- |

$1.2 |

$3.3 |

$2.1 |

174.0% |

| Insurance Premiums Taxes |

$20.8 |

$42.4 |

$21.6 |

103.7% |

$94.8 |

$116.5 |

$21.7 |

22.9% |

| Financial Institutions Taxes |

$9.9 |

$14.4 |

$4.5 |

45.9% |

$37.5 |

$36.8 |

−$0.7 |

−2.0% |

| Consumption Taxes |

| $938.8 |

$1,001.9 |

$63.1 |

6.7% |

$9,179.3 |

$9,388.8 |

$209.5 |

2.3% |

| Cigarette Tax |

$73.3 |

$74.2 |

$0.9 |

1.2% |

$624.4 |

$572.1 |

−$52.3 |

−8.4% |

| Other Tobacco Products |

$13.1 |

$12.8 |

−$0.3 |

−2.6% |

$108.7 |

$102.4 |

−$6.3 |

−5.8% |

| Malt Beverage Tax |

$1.6 |

$1.5 |

−$0.1 |

−8.1% |

$14.3 |

$14.7 |

$0.4 |

3.0% |

| Liquor Tax |

$31.9 |

$32.5 |

$0.6 |

2.0% |

$296.3 |

$301.2 |

$4.9 |

1.7% |

| Other Taxes |

| $1,079.3 |

$1,160.5 |

$81.2 |

7.5% |

$10,499.6 |

$10,364.2 |

−$135.4 |

−1.3% |

| Realty Transfer Tax |

$47.6 |

$29.1 |

−$18.5 |

−39.0% |

$498.8 |

$436.5 |

−$62.3 |

−12.5% |

| Inheritance Tax |

$117.0 |

$133.3 |

$16.3 |

13.9% |

$980.9 |

$984.8 |

$3.9 |

0.4% |

| Gaming |

$19.9 |

$29.2 |

$9.3 |

46.7% |

$209.0 |

$242.2 |

$33.2 |

15.9% |

| Minor and Repealed |

$1.1 |

−$0.7 |

−$1.8 |

−161.9% |

−$10.9 |

−$14.6 |

−$3.7 |

33.9% |

| |

| $15.3 |

$49.8 |

$34.5 |

225.3% |

$286.2 |

$434.3 |

$148.1 |

51.8% |