2021/22 Executive Budget Briefing

By House Appropriations Committee Staff , | 5 years ago

On February 3, 2021, Governor Wolf presented his 2021/22 executive budget proposal to the General Assembly. This briefing provides an overview of that proposal and will be updated as the committee continues to review the request.

Gov. Wolf’s 2021/22 budget proposes to dramatically improve equity in several key areas important to Pennsylvanians. The proposed budget and policy changes would take a leap forward in implementing a fair education funding policy, make strides on criminal justice reform, increase the minimum wage, provide additional workforce supports, and invest in healthy communities.

Building a more equitable budget will require significant resources, but equity is a priority on the revenue side of the budget as well. The governor proposes a major expansion of the special tax forgiveness provisions that will eliminate or reduce tax burdens for many taxpayers, even as the personal income tax rate increases. At the same time, he advocates closing corporate tax loopholes for big businesses.

The last year laid bare many of the structural problems facing Pennsylvania citizens, families, students, businesses, communities, and the commonwealth’s budget. It also revealed the urgency of addressing these problems. The governor’s budget provides his perspective on what it will take to solve some of these challenges.

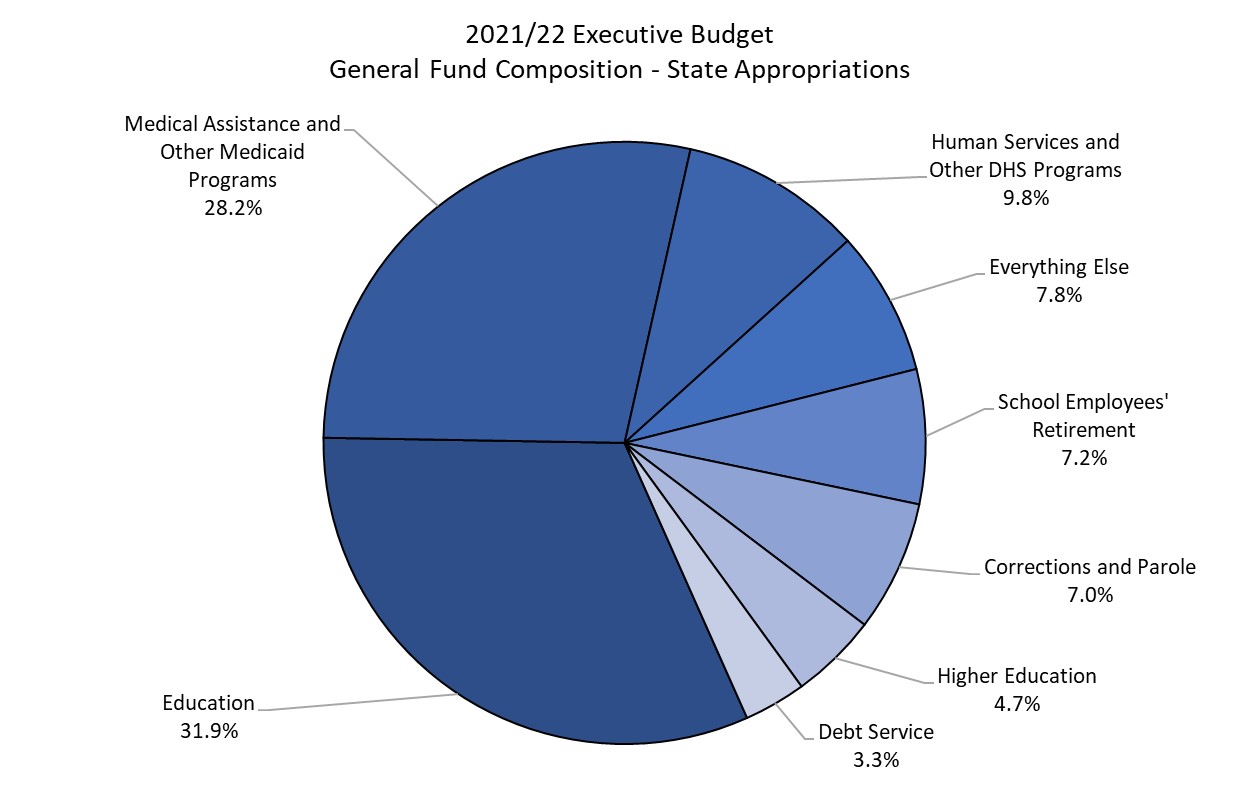

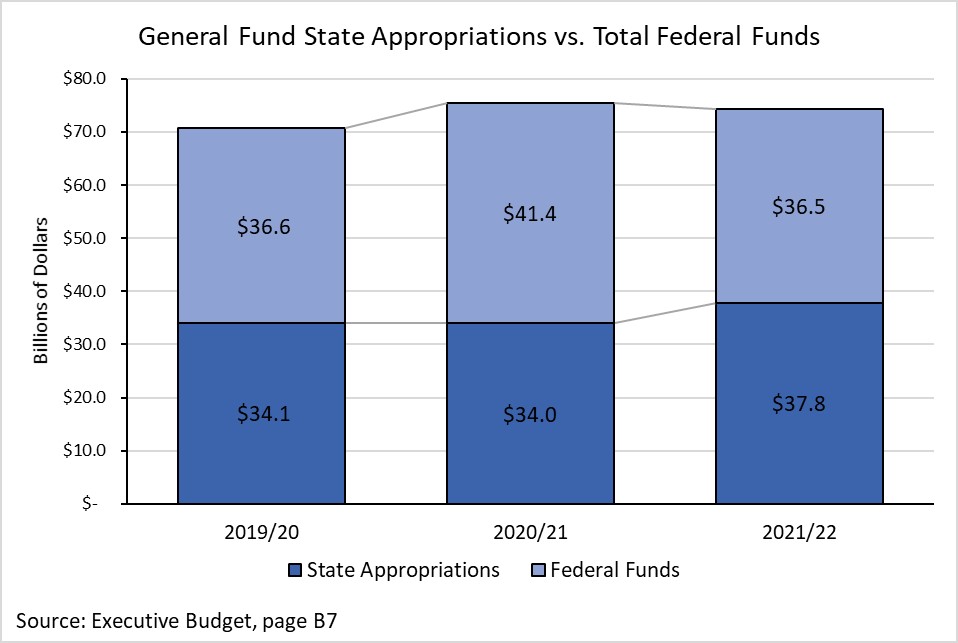

While the General Fund is the focus of legislative budget balancing, it is important to understand the scope of the total operating budget for the commonwealth. The total 2021/22 proposed operating budget including federal and other special funds is $96.6 billion, a decrease of $1.6 billion, or 1.6 percent, from 2020/21. The total operating budget consists of:

- $37.8 billion in state General Fund expenditures, an increase of $3.8 billion, or 11.1 percent,

- $2.9 billion in Motor License Fund expenditures, an increase of $114.5 million, or 4.1 percent,

- $1.9 billion in Lottery Fund expenditures, an increase of $250.1 million, or 15.1 percent,

- $36.5 billion in federal fund expenditures, a decrease of $4.9 billion, or 11.9 percent, and

- $17.5 billion in other special fund expenditures, augmentations and restricted accounts, a decrease of $795.7 million or 4.3 percent.

Although proposed General Fund expenditures show a large increase – specifically a large investment in education- federal expenditures decrease by an even greater amount. This is due to the one-time federal COVID Relief funding received in 2020/21.

The executive budget proposal projects that General Fund revenues will finish the 2020/21 fiscal year $535.5 million higher than the revised official estimate certified in November. These two adjustments represent a $2.5 billion increase to the estimate certified by the administration in May 2020.

The Department of Revenue is projecting higher than expected corporate net income tax payments, and to a lesser extent, higher revenues from the personal income tax, the sales tax and the realty transfer tax. The revised estimate also assumes the reversal of certain transfers from special funds to the General Fund reducing nontax revenue, as discussed further below.

Despite revenues performing better than expected through the first six months of the 2020/21 fiscal year, which led to upward revisions to both the official revenue estimate in November and the projection in the executive budget, a significant amount of General Fund revenue will not recur for the next fiscal year:

- Approximately $1.8 billion of 2020/21 revenues will not recur because they were shifted into the 2020/21 fiscal year when the General Assembly and the federal government changed tax due dates last spring in response to the pandemic.

- An additional $531 million in transfers from special funds are also one-time revenues.

- On the plus side for the General Fund, $200 million in personal income tax revenue will not be required to support the Property Tax Relief Fund in 2021/22, which was the case in the current fiscal year due to the pandemic’s impact on casino slots revenue.

After removing the effects of the governor’s proposed tax and revenue changes, gross revenues without the governor’s proposed tax initiatives are estimated to decline by over $1 billion because revenue growth does not offset the loss of nonrecurring revenue.

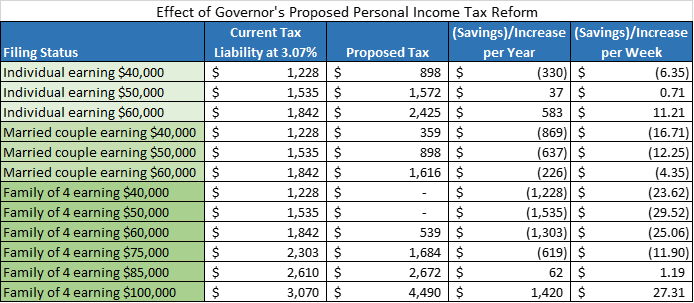

The governor’s proposal is aimed at increasing tax fairness with a more progressive structure to assist low-income families while improving the business tax climate. The major proposed changes are a higher personal income tax (PIT) rate in conjunction with expanded tax forgiveness and mandatory combined reporting in conjunction with a phased-down corporate net income tax (CNIT) rate. Total proposed General Fund revenue modifications, including transfers, are $3.04 billion. The following summarizes the governor’s proposal:

- Tax Forgiveness Expansion – Increases to the income limits for the personal income tax forgiveness program to $15,000 for single filers and $30,000 for married, with an additional $10,000 for each dependent. Therefore, a married family of four making $50,000 would pay no income tax. The percentage of tax forgiveness will decrease by one percentage point for each $500 above the limit for 100 percent forgiveness. Therefore, incomes below these levels in the following scenarios will pay no additional personal income tax compared to what they do now:

- A family of four - $84,000 per year

- Single with no dependents - $49,000 per year

- Single with two dependents - $69,000 per year

- Rate increase – From 3.07 percent to 4.49 percent effective July 1, 2021. Estimated revenue is $2.964 billion in 2021/22 (net of refunds, which are impacted by the tax forgiveness proposal).

- The current tax forgiveness program income limits are $6,500 for single filers and $13,000 for married, with an additional $9,500 for each dependent.

- Combined Reporting – Also known as closing the Delaware loophole, this would broaden the CNIT base by requiring corporations to file a return combining the income for all related entities (i.e., subsidiaries and parent companies), effective January 1, 2022.

- CNIT Rate Reduction – Effective for tax years beginning on or after January 1, 2022, the rate is proposed to decrease from 9.99 percent to 8.99 percent, and then further reduce to 8.29 percent in 2023; 7.49 percent in 2024; 6.99 percent in 2025; and 5.99 percent in 2026 and thereafter.

- Estimated CNIT net revenue increase is $208.5 million in 2021/22, which accounts for the rate decrease and combined reporting. As this is similar to past proposals, the combined effect of the base broadening with the rate reduction is expected to increase revenues for several years, but then turn to revenue decreases, resulting in a net loss to the state once fully phased in. The revenue loss from the rate decrease costs more than the expected revenue from combined reporting in the out-years, which helps Pennsylvania corporations currently paying the full CNIT.

- To the Tobacco Settlement Fund from cigarette tax revenues of $115.3 million to replace monies deducted from the Master Settlement Agreement for deposit in the Tobacco Revenue Bond Debt Service Account.

- To the Environmental Stewardship Fund from personal income tax revenues of $13.8 million for Growing Greener debt service payments.

The 2020/21 budget relied upon $531 million in special fund transfers. The governor now proposes to reverse $49.5 million of those transfers, including:

- PENNVEST Fund, $10 million;

- PENNVEST Drinking Water Revolving Fund, $26.5 million;

- PENNVEST Water Pollution Control Revolving Fund, $9 million; and

- Historical Preservation Fund, $4 million.

He also proposes to transfer $4 million from the Unconventional Gas Well Fund to the General Fund. The net effect of these proposed transfer modifications reduces non-tax General Fund revenues by $45.5 million.

Minimum Wage – The governor proposes a minimum wage increase from $7.25 per hour to $12.00 per hour, including tipped workers, effective July 1, 2021. The plan would then increase the minimum wage by $0.50 per hour each year thereafter until reaching $15.00 per hour in 2027. This proposal is estimated to generate $116.4 million in combined personal income and sales and use tax revenue.

Tax Forgiveness Secondary Effects – The administration estimates proposed changes to expand PIT forgiveness, along with the rate changes, to generate $39 million in sales and use tax revenue since low-income families will have more disposable income to spend on taxable items.

Legalization of Adult-use Cannabis – Governor Wolf indicates an intention to pursue the legalization of adult-use cannabis; however, the budget does not rely on revenue from this in order to balance. The proposal suggests revenue from this could be used to support historically disadvantaged small businesses to rebuild after the current economic crisis, as well as a portion of revenue that could support restorative justice programs to help those harmed by the criminalization of marijuana. There are no revenue estimates provided in this budget. In other states, it has taken several years after legalization to generate revenue.

Severance Tax on Natural Gas – This is not mentioned in the governor’s executive budget proposal and is not listed as a source of revenue to balance the 2021/22 General Fund budget. In the governor’s budget themes, he references Pennsylvania’s “opportunity to provide $3 billion to help workers and businesses to stabilize the economy and recover from the pandemic,” however, he does not provide the intended source of revenue.

The commonwealth will make no deposit into the Rainy Day Fund for 2020/21 as the fiscal year is projected to end with a negative ending balance.

At the end of 2019/20, the Rainy Day Fund held $343 million, which was the highest level following the Great Recession. To help balance the 2020/21 budget, Act 114 of 2020 transferred $100 million from the Rainy Day Fund to the General Fund. The governor’s proposal maintains a balance of about $244 million, with only minor increases of about $1 million in interest each year. This budget projects an ending balance of $391.2 million at the end of 2021/22, which would allow for a transfer of $97.8 million to the Rainy Day Fund at the beginning of 2022/23.

According to Pew Trusts' Fiscal 50: State Trends and Analysis of rainy day funds, the 50-state median was 29 days of reserves, or 7.9 percent of spending in 2020. This budget shows Pennsylvania with 2.4 days of reserves, or 0.6 percent of spending for 2021/22, which would continue Pennsylvania’s trend of ranking near the very bottom of all states.

The governor’s proposal would increase the total authorized complement by a net 54 full-time equivalents, from 77,876 to 77,930. The most significant increases in proposed personnel are 52 positions in the Department of Military and Veterans Affairs for full implementation of the National Guard Youth Challenge Program. The current filled complement has decreased by 599, from 73,457 to 72,858, since January 2020. Total filled positions have decreased by 20 since 2018.

Pennsylvania offers health insurance to some retired employees based on years of service and service class. One of these plans is known as Retired Employees Health Plan (REHP), and benefits are administered by the Pennsylvania Employees Benefit Trust Fund (PEBTF). Like pension liabilities, REHP liabilities are a long-term type of other post-employment benefit cost that the commonwealth is required to disclose in its comprehensive annual financial report and other financial reporting documents. The commonwealth has largely paid these costs on a pay-as-you-go basis, but in recognition of the long-term liability, has built up assets to help address the costs over time.

The 2020/21 enacted budget used the accumulated balance to provide budgetary relief in the General Fund, reducing the reserve balance by $200 million through June 2021 through reduced agency payments to PEBTF. The proposed budget maintains the reduced contribution rates by agencies, which will reduce reserves held by the fund by another $200 million in June 2022.

Total property tax relief available to homeowners has remained the same each year for more than a decade since it was first available, and this budget assumes homeowners will again receive the same amount of relief in 2021/22. The casino closures in 2020 reduced money available for relief in 2020/21; however, that deficit was filled by a $200 million transfer from personal income tax revenues. Gaming revenues are expected to fully fund property tax relief in 2021/22.

A net of $903.4 million is requested in 2020/21 supplemental General Funds to cover costs beyond what the General Assembly appropriated in November. At that time, we were aware of at least $705 million in underfunding across several appropriations in the Department of Human Services.

The two major components of this amount include a recommended reduction of $39 million in the Treasury Department for debt service payments and $941 million in additional funds needed in the Department of Human Services, both of which are outlined in more detail later.

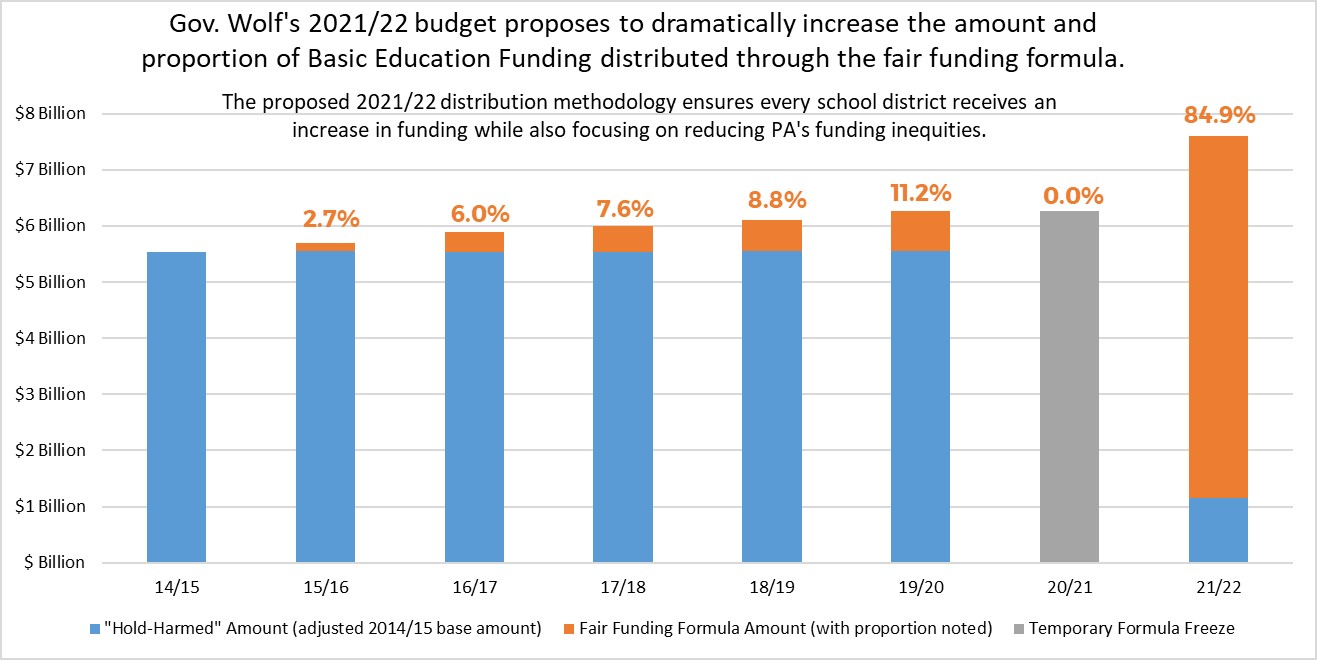

- $1.35 billion (21.6 percent) increase in Basic Education Funding for school districts -- $7.6 billion total for 2021/22

-

- Gov. Wolf is proposing to make the fair funding formula more effective by basing the 2021/22 allocation on three elements:

- Distribute $6.25 billion (the entire existing BEF amount) through the fair funding formula

- Provide $1.15 billion to ensure that no school district loses any funding relative to 2020/21

- Include $200 million more to be shared among all school districts through the fair funding formula

- $200 million (16.9 percent) increase in Special Education Funding

- $25 million (11.5 percent) increase for Pre-K Counts and $5 million (7.8 percent) increase for Head Start Supplemental Assistance

- Since taking office, Gov. Wolf has doubled state funding for early childhood education. The 2021/22 request would add 3,271 more slots to the over 16,000 already added under Gov. Wolf’s leadership.

- $11 million (3.4 percent) increase for Early Intervention to provide an additional 2,000 slots for children age 3 to 5

Gov. Wolf’s 2021/22 education funding proposal makes important and significant strides toward equity and adequacy in Pennsylvania.

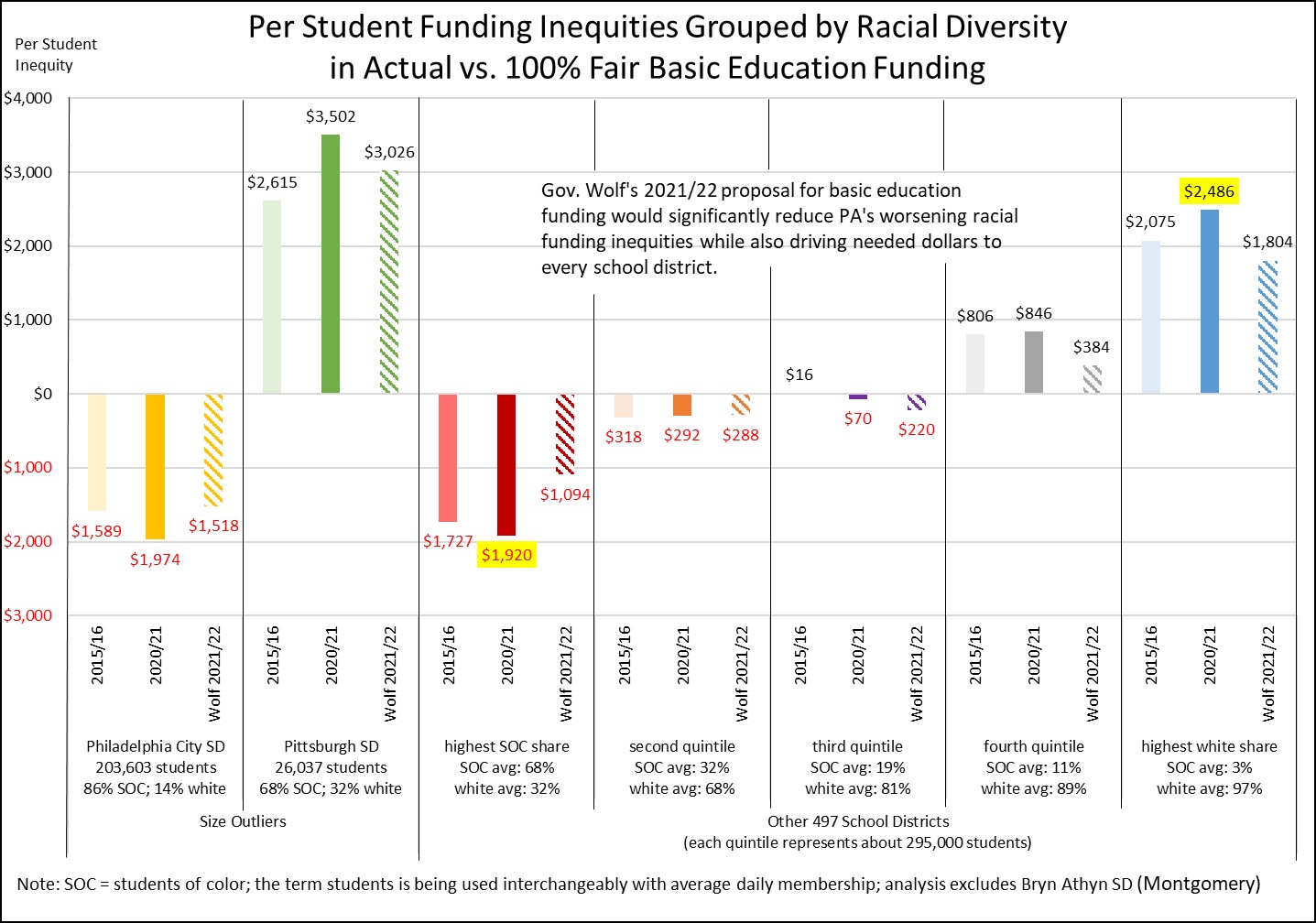

The fair funding formula is only as good as the amount of funds distributed through it. Therefore, Gov. Wolf is proposing to increase the amount of equitably distributed funds from 11.2 percent to 84.9 percent, while also ensuring every school district receives an increase. Up until now, the slow implementation of the fair funding formula has been ineffective at reducing funding inequities, particularly by race, in PA’s school funding system.

Excluding our two largest school districts, which are on opposite sides of the equity spectrum, if you group PA’s other 497 school districts by the racial makeup of their student body, then in 2020/21:

- The students in the districts with the highest shares of students of color are receiving $1,920 per student less than their fair share,

- While students in the districts with the highest shares of white students are receiving $2,486 per student more than their fair share.

In addition to not being distributed equitably, the current education pie is also too small. A recent adequacy analysis found that PA’s school districts are underfunded by $4.6 billion, with 428 out of the 500 school districts not spending enough for their students to meet the state’s academic standards.

School districts can expect to save $229 million if the governor’s proposed charter school funding reforms are adopted. The savings are a product of two common-sense changes.

First, $130 million of the estimated savings comes on the cyber charter side. The savings result from instituting a statewide $9,500 cyber charter tuition rate for a nonspecial education student. Under current law, cyber charters and brick-and-mortar charters get paid the same rate, despite the lower costs of an online instructional delivery model. Early indications are cyber charter enrollments increased 60 percent (enrollment increase of 22,600 students) in 2020/21, and school districts are paying an average nonspecial education rate of $13,000 per student to cyber charter schools. The fair formula for special education, detailed below, is applied to this flat rate for cyber charter schools and contributes to the $130 million in cyber charter savings.

Second, school districts realize $99 million in savings by applying the bipartisan fair funding formula for special education to the way they pay brick-and-mortar charter schools for special education students. The current charter tuition rate for a special education student is based upon a flawed calculation of the average amount a school district spends on its special education students. The calculation is flawed because it assumes special education students account for 16 percent of a school district’s enrollment instead of using the actual student counts, which, for the median district, is closer to 19 percent of enrollment. Additionally, it does not take into account how the average is inflated by a small percentage of high-cost outliers. The bipartisan solution to this problem was to reimburse based upon the average cost of the existing three tiers of needs, rather than just one skewed average cost.

Since 2014/15, the fair funding formula for special education has applied to the way the state reimburses school districts for special education costs, but the legislature never extended it to charter schools despite that being the recommendation of the bipartisan Special Education Funding Commission.

- Expand RACP to include lead and asbestos remediation projects in schools

- Increase the statutory minimum teacher salary from $18,500 to $45,000

- Education Tax Credits (EITC & OSTC) - lower the permitted administrative costs from 20 percent to 5 percent

- The 16 other states that offer scholarship tax credits allow administrative costs ranging from 10 percent to 2 percent.

Renewing his proposal from last year, the governor proposes to create the Nellie Bly Tuition Program, a scholarship for students at the Pennsylvania State System of Higher Education (PASSHE). This proposal redirects $199 million in Pennsylvania Race Horse Development Trust Fund proceeds currently used for horse racing purses to pay for the scholarship program. This last-dollar, need-based program would support full-time PASSHE students to help cover tuition, fees, room and board, books, supplies and other expenses. Recipients must commit to remain in Pennsylvania for the same number of years that they received the grant. If the recipient moves out of state before the terms are met, the grant will convert to a loan, though the residency period can be deferred while the student pursues further education.

The budget largely provides no increase to the operating appropriations for institutions of higher education. One notable exception is the appropriation for community colleges. The governor proposes a $1.4 million increase to support the Erie Community College, the first new community college in Pennsylvania in 25 years. The budget also contains an additional $3.2 million for start-up and capital costs for the Erie Community College through the separate community college capital appropriation.

Operational support for PASSHE, the four state-related universities (Lincoln, Temple, Pitt and Penn State), and the Thaddeus Stevens College of Technology remains level-funded in the budget. No additional money is included in the budget to support PASSHE’s system redesign.

State appropriations for the PHEAA state grant program to students remains constant; however, the executive budget does not propose to replace $30 million in one-time federal CARES Act Coronavirus Relief Funds that the General Assembly appropriated to PHEAA in the spring of 2020 to help provide additional student aid. The federal funds increased grant awards, with the maximum grant rising to $4,525 from its previous amount of $4,123. Grant amounts depend both on the total resources available to PHEAA for the program, as well as the number of students applying. Policymakers will need to evaluate the application trend and the loss of the one-time resources when determining the impact to grant awards and how much to appropriate for the program.

Institutional assistance grants, which support private colleges and universities that enroll PHEAA grant recipients are level-funded in the budget, as are the Targeted Industry Cluster Scholarship program (PA-TIP) and the Act 101 program.

The governor proposes a $550,000 reduction for the Ready to Succeed Scholarship, which provides merit-based aid to students from families with incomes less than $110,000 per year. The budget also contains a $150,000 reduction for the Bond-Hill Scholarship, which supports exceptional graduates of the commonwealth’s two historically Black universities – Cheyney University and Lincoln University -- who go on to pursue certain graduate or professional degrees. The Cheyney Keystone Academy appropriation is reduced by $500,000. This supports the honors program at Cheyney University.

Debt capacity is used in the budget to expand the scope of some of the commonwealth’s regular capital programs.

Under the plan, the Redevelopment Assistance Capital Program (RACP) would be modified to include building broadband infrastructure, specifically in unserved or underserved areas of the commonwealth. No specific dollar amount is proposed for this initiative.

As proposed in last year’s executive budget, the governor again proposes a $1 billion expansion of RACP to encompass lead and asbestos remediation projects and make schools eligible grantees under the program.

Debt service for general obligation debt is primarily paid out of the General Fund. The budget requests $1.26 billion for debt service under the Treasury Department, nominally a $116.6 million increase. However, the budget recommends reducing the current 2020/21 general obligation debt service appropriation by $39 million, which makes the year-over-year comparison larger than it would otherwise be.

The governor’s budget would fully fund the actuarially required contributions to the Public School Employees’ Retirement System (PSERS) and the State Employees’ Retirement System. This would mark the fifth consecutive year of full pension funding for the commonwealth after years of systematic underfunding. Pennsylvania remains committed to placing its pension funds on sound financial footing, even in spite of the enormous budgetary challenges presented by the COVID-19 pandemic.

State contributions to PSERS total $2.734 billion, an increase of 1.2 percent over 2020/21. This appropriation can be found within the Department of Education. Contributions to SERS are embedded within various personnel appropriations rather than in a single appropriation. Estimated total contributions to SERS are expected to increase approximately 0.8 percent, or $17.8 million, to $2.245 billion, of which about 40 percent will be paid from the General Fund.

More than 75 percent of these payments go toward the large unfunded liabilities that accumulated over many years due to poor investment returns, unfunded benefit increases, and inadequate employer contributions. Paying down the systems’ unfunded liabilities has put significant pressure on state and school district budgets, but the growth rate of contributions has begun to stabilize due to reforms made by Act 120 of 2010 and Act 5 of 2017. While prior years saw annual contribution rates increasing by several percentage points per year, this year’s increases for both systems are around just 1 percent.

The executive budget proposes over $14.3 billion in state General Funds for the Department of Human Services (DHS). This proposed increase of $1.7 billion over the final enacted 2020/21 budget includes $941 million in supplemental appropriation requests.

The largest drivers of the $941 million in supplemental requests are due to the underfunding of Medical Assistance – Capitation, Medical Assistance – Fee-For-Service, and Medical Assistance – Community HealthChoices appropriations in the enacted budget and aligning federal claiming with actual payments, covered more below. The underfunding was originally estimated to be $705 million in November, when the second part of the 2020/21 budget was enacted before full consideration of Medical Assistance (MA) enrollment increases due to the ongoing pandemic.

Major factors driving the proposed 2021/22 DHS General Fund budget increase of $759 million from revised 2020/21 estimates largely fall in four areas: increasing program enrollments and costs; federal matching; initiatives; and the net impact of one-time payments and adjustments.

The executive budget assumes MA participants grow by 363,000 individuals, or 11.4 percent, on average per month between 2020/21 and 2021/22. This is consistent with the growth in enrollment to date experienced due to the economic impacts of the pandemic. Additionally, under the federal public health emergency, DHS is prevented from terminating MA enrollment except in specific cases, such as death or a move out of state. Nearly half of the estimated increase in enrollment, or 175,000 individuals, is assumed to be adults qualifying for MA under Medicaid Expansion.

The Families First Coronavirus Response Act provides an additional 6.2 percent Federal Medical Assistance Percentage (FMAP) to states on many eligible Medicaid costs. The enhanced FMAP is available through the end of the quarter that contains the end of the federal public health emergency. Currently, the federal public health emergency is set to expire in April 2021 unless extended again. The governor’s proposed budget appears to assume extensions for at least an additional year, which would provide the enhanced 6.2 percent FMAP through at least June 30, 2022. Additionally, because of the assumed extension, payment date changes built into the enacted 2020/21 budget are no longer needed to maximize the ability to claim enhanced FMAP on managed care payments incurred in one fiscal year and paid in the next fiscal year. This is driving a reduced enhanced FMAP estimate in 2020/21 and increased General Fund requirements as compared to the enacted budget, as well as larger enhanced FMAP in 2021/22 reducing General Fund requirements in 2021/22. The proposed budget assumes total enhanced FMAP for the 2021/22 fiscal year of $2.4 billion, which reduces state General Fund need by the same amount. Over three fiscal years, it is anticipated that we will receive over $5.1 billion in enhanced FMAP. Additional FMAP impacts include:

- The Affordable Care Act provided for a temporary increase in the Children’s Health Insurance Program (CHIP) FMAP of 23 percent. That rate began to phase out October 1, 2019 with an 11.5 percent reduction and was reduced again by 11.5 percent on October 1, 2020. While the federal government projects a slight increase in the underlying CHIP rate from 66.54 percent to 66.88 percent on October 1, 2021, the full fiscal year blended rate from both factors will decrease from 69.425 percent in 2020/21 to 66.795 percent in 2021/22. This will require $10.6 million in additional state general funds in 2021/22.

- The federal government projects the standard FMAP for Pennsylvania to increase slightly on October 1, 2021 from 52.20 percent to 52.68 percent. The full fiscal year blended rate will increase from 52.21 percent in 2020/21 to 52.56 percent in 2021/22. This will reduce the need for state general funds by $111.4 million.

Gov. Wolf’s executive budget proposes an increase to Pennsylvania’s minimum wage to $12 per hour, effective July 1, 2021, with annual increases of 50 cents each year until the minimum wage becomes $15 per hour. The higher minimum wage is expected to reduce costs in DHS as children transition from MA to CHIP at a higher FMAP or adults transition to the new state-based healthcare exchange, Pennie, to purchase coverage.

A higher minimum wage will also cost DHS in the County Child Welfare program related to counties’ rates of pay of children and youth caseworkers, as well as provider rates in the field of child care, where providers are currently unable to pay $12 per hour. In total, the initiative will net savings to DHS of $4 million in 2021/22. In previous years, this proposal has netted a cost to DHS. It is possible that as wages have naturally increased over time in some fields, immediate cost impacts are no longer expected. Assumptions of both cost and savings will be further evaluated in the department’s hearing materials.

Gov. Wolf is also seeking $17 million in state general funds for the following initiatives:

- $1 million to expand legal services to low-income individuals and families

- $1 million to develop and provide comprehensive direct care worker training in the Participant Directed Model

- $1 million to discharge 20 individuals from state hospitals through the Community Hospital Integration Project Program (CHIPP)

- $13.8 million to provide home and community-based services to an additional 100 individuals on the emergency waitlist in the Consolidated Waiver and 732 individuals on the emergency waitlist in the Community Living Waiver. The proposed budget continues to assume high school graduates can be served in the Person/Family Directed Services waiver through attrition. The governor also outlines this initiative will include children with complex medical needs transitioning from congregate care settings.

- $1 million to reduce the number of children and youth in out-of-home placements triggered by homelessness, housing instability, or inadequate housing to promote family stability and reunification

Although not highlighted as a budget initiative, the executive budget does contain a child care rate increase, effective March 2021. The annualized impact of the rate increase is estimated to be $87 million in federal funds in 2021/22.

The net impact in the 2021/22 budget for non-recurring cost and revenue shifting is $151.4 million in savings. Specifically:

- Costs of $482.3 million due to the one-time savings by delaying some Community HealthChoices managed care payments from 2020/21 to 2021/22

- Costs of $200 million to replace a one-time transfer from the Pennsylvania Professional Liability Joint Underwriting Association (JUA) assumed in 2020/21 that will not recur in 2021/22

- Costs of $75 million due to maximizing the allowability to roll County Child Welfare fourth quarter bills to the following fiscal year that will occur in 2020/21 and will not recur in 2021/22

- Costs of $30 million to replace the one-time use of Coronavirus Relief Funds in the Youth Development Institutions appropriation in 2020/21

- Savings of $938.7 million due to the roll forward of costs from 2019/20 to 2020/21 that will not recur in 2021/22

The 2020/21 budget included a delay in the Community HealthChoices managed care payments by moving the June 2021 payment to 2021/22. This delay is maintained in the 2021/22 proposed budget by moving the June 2022 payment to 2022/23. Other than maintaining this practice of delaying the June payment to the following fiscal year, no further delays appear to be included in the 2021/22 proposed budget. However, it’s worth noting that the Community HealthChoices program does appear to rely on optimistic projections of future costs. More details on those assumptions will be available when the hearing materials are provided by the department.

The executive budget also eliminates $62.6 million in 2020/21 legislative initiatives for nursing facilities, hospitals, medical schools, autism service providers, and local level organizations.

Gov. Wolf’s 2021/22 budget proposal includes the following additional items of note:

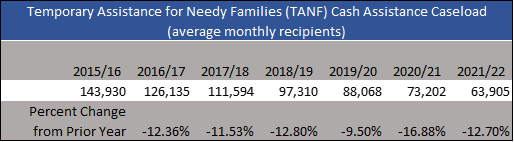

- The federal Temporary Assistance to Needy Families (TANF) block grant is provided to states to provide temporary cash and other benefits to help needy families participating in activities designed to end dependence on government benefits and to provide services for dependent and abused children. One component of the program in the commonwealth is the TANF cash assistance program. Cash benefits are provided for a limited duration to individuals who comply with work and other requirements. The department is projecting a continued and significant decline in the individuals participating in the program.

- The governor again proposes to eliminate the Children's Health Insurance Program Administration appropriation. Personnel costs are proposed to be shifted to the County Administration – Statewide appropriation and other CHIP programmatic administrative costs are proposed to move to the Children's Health Insurance Program appropriation. This aligns with the full integration of the program into DHS, specifically the Office of Medical Assistance Programs.

Gov. Wolf’s executive budget proposal accounts for $748.8 million in federal supplemental 2020/21 funding approved in the federal Consolidated Appropriations Act of 2021. The supplemental federal funds were received for the identification and mitigation of COVID-19, specifically in the areas of testing, contact tracing, and vaccines. In acknowledgement of Act 17A of 2020, which requires appropriation of select COVID-19 related federal funds, these funds are assumed to be available to the department under executive authorization and not require appropriation.

The 2021/22 budget proposal includes modest increases for general fund programmatic and personnel cost, as well as minor adjustments for regular program earnings of federal funds. The governor's budget assumes the replacement of the one-time use of Coronavirus Relief Funds in 2020/21 to reduce general fund need of $4 million in General Government Operations and $10 million in the State Health Care Centers appropriations.

Gov. Wolf proposes an initiative to increase funding to County and Municipal Health Departments (CMHDs) for a total of $8.4 million. This two-part initiative first recognizes the financial pressures placed on the ten existing CMHDs in combatting the coronavirus and proposes to increase funding to the entities by approximately 25 percent, as they are the main providers of public health services to 42 percent of the commonwealth’s population. CMHDs currently exist in the counties of Allegheny, Bucks, Chester, Erie, Montgomery, and Philadelphia, as well as the cities of Allentown, Bethlehem, Wilkes-Barre, and York. Additionally, the proposed initiative will support the creation of an eleventh CMHD in Delaware County, effective January 2022. Finally, the budget maintains another year of $1.3 million to continue the multi-year study on the health impacts of fracking.

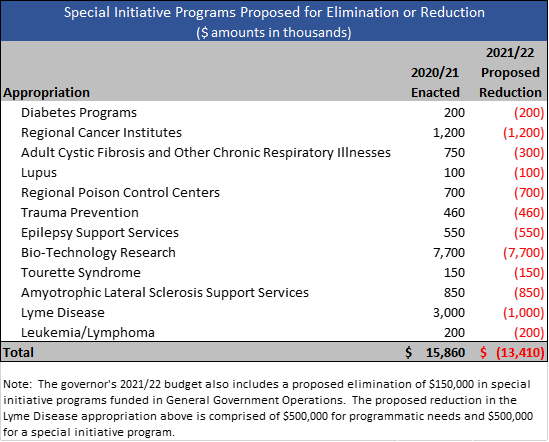

Gov. Wolf again proposes the elimination or reduction of numerous disease and research specific special initiatives, outlined in the following table.

Health Insurance Exchange Authority

Act 42 of 2019 created the Pennsylvania Health Insurance Exchange Authority to develop and operate a state-based exchange (SBE) for the purchase of medical and dental insurance by Pennsylvanians. This new SBE is named Pennie and replaced the use of the federal exchange, HealthCare.gov, for individuals to purchase insurance. The act also established the Pennsylvania Health Insurance Exchange Fund (PHIEF) to support the operations of Pennie through assessments on insurers, or exchange user fees. As of January 1, 2021, the exchange user fee is set at 3 percent of premiums. The proposed budget reflects the executive authorization for General Government Operations of $31.4 million in 2020/21 and $40.9 million in 2021/22.

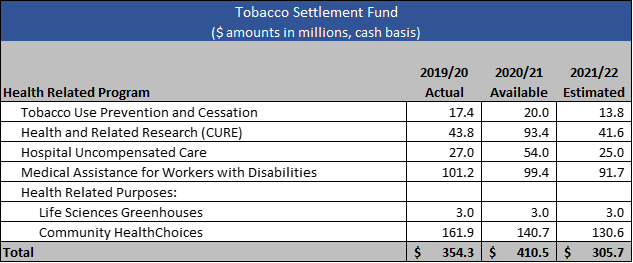

The governor proposes spending $305.7 million from the Tobacco Settlement Fund (TSF) in 2021/22 using the same allocation formula from the current year’s first Fiscal Code (Act 23 of 2020). The allocation formula maintained in Act 23 is as follows:

- 4.5 percent for tobacco use prevention and cessation activities,

- 13.6 percent for health and related research,

- 8.18 percent for hospital uncompensated care,

- 30 percent for Medicaid benefits for workers with disabilities, and

- 43.72 percent for health-related purposes in the General Fund budget.

Act 43 of 2017 authorized the governor to issue $1.5 billion in bonds backed by future revenues from the master settlement agreement. In 2021/22, the debt service payments on those bonds will total $115.3 million. However, Act 23 of 2020 mandated that sufficient revenues are transferred from cigarette tax collections to the TSF in order to completely offset those debt service costs. The governor’s budget fully reflects this transfer.

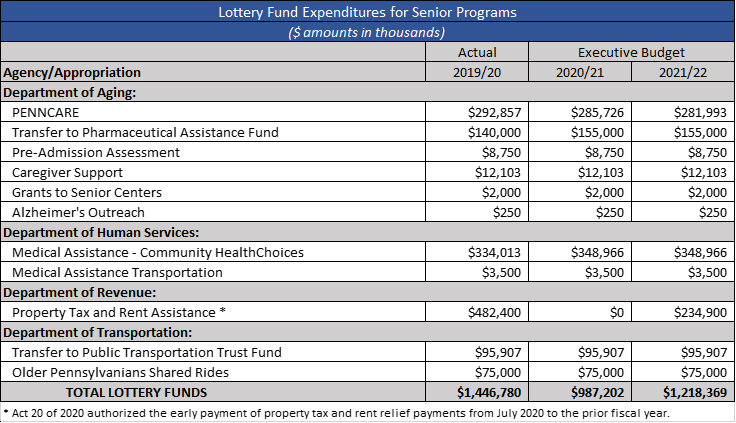

Gov. Wolf is proposing an investment of $1.2 billion from the Lottery Fund in 2021/22 for programs that benefit Pennsylvania’s seniors. This is $231 million more than the 2020/21 funding level. This change is primarily due to Act 20 of 2020, which authorized the early payment of property tax and rent relief payments and shifted $239 million from 2020/21 to the prior fiscal year. The shift of property tax and rent relief payments, along with other expenditures for senior programs, is displayed in the chart below.

Given the increase in ticket sales through the first half of the fiscal year, the Administration has increased its 2020/21 estimate for net lottery collections (revenue deposited into the Lottery Fund after deducting from total ticket sales the commissions retained and prizes paid by local retailers) by $29.5 million. This increase is primarily due to Scratch-Off ticket sales and iLottery plays, which have performed well through the first half of the fiscal year.

The executive budget presumes strong net lottery collections will continue in 2021/22 and grow 2.6 percent over the revised 2020/21 estimate. The proposed budget would leave the Lottery Fund with positive ending balances of $20.5 million in 2020/21 and $40.1 million in 2021/22. The proposed budget would also begin carrying a $75 million reserve from the prior year.

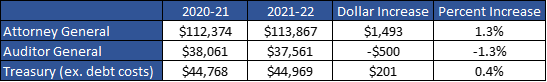

Row Offices

This budget would essentially flat fund the Attorney General, Auditor General, and Treasury with only minimal increases and decreases to most appropriations. The two major exceptions are the General Government Operations of the Attorney General – which would see an increase of 1.6 percent – and the $500,000 appropriation to the Auditor General for special financial audits, which was eliminated.

The governor’s budget proposal would hold overall funding for the Department of Military and Veterans Affairs to near 2020/21 levels and most appropriations are flat funded. However, there is a reallocation of funding between appropriations. The department’s General Government Operations appropriation would be reduced by $6.2 million, while the appropriation for the state’s six veterans homes would increase by $8.3 million. The increased state funding is required to compensate for reduced federal funding.

All grant and subsidy appropriations that provide benefits to veterans would be level funded or see minimal increases.

The governor’s $123.5 million 2021/22 proposal for the Department of Community and Economic Development (DCED) reflects cost-to-carry funding absent appropriations customarily added back during negotiations.

Specifically, the governor’s proposed budget allocates $15 million to the Manufacturing PA appropriation, a $3 million increase compared to 2020/2021. The proposed increase will support competitive grants to Industrial Resource Centers for innovative service delivery, as well as grants to Pennsylvania’s Regional Economic Performance organizations to promote partnerships with institutes of higher education.

Additionally, the governor’s budget proposes a $13.7 million decrease in funding for the “Marketing to Attract Tourism” appropriation. While a 77.2 percent decrease to this appropriation is notable, the department can utilize funds from the Tourism Promotion Restricted Fund, established under Act 109 of 2018 for the Marketing to Attract Tourism and Marketing to Attract Business programs.

Moreover, Gov. Wolf proposes a new $8 million WEDnetPA appropriation, which would be achieved by shifting their current $8 million in funding from the PA First appropriation. This appropriation will provide funding to employers for incumbent workforce training through the department’s WEDnetPA program. Since its the inception, the program has provided assistance to over 21,000 companies, which trained more than 1.2 million Pennsylvania workers.

Lastly, Gov. Wolf’s proposal eliminates the State Facility Closure appropriation, which received $5 million in 2020/21. This appropriation provides grants and loans to local municipalities impacted by the permanent closure of a state-operated or owned facility.

The governor’s proposed budget for the Department of State provides for a $7.63 million increase in state funding, compared to 2020/2021. A majority of this can be attributed to the proposed $4.486 increase for the Statewide Uniform Registry of Electors (SURE) appropriation. This increase in funding will replace the reduction in federal assistance for system maintenance costs and the continuous system upgrades to support election modernization.

In addition, the governor’s proposed budget provides a $1.55 million increase to the department’s General Government Operations appropriation. This increase is needed to maintain the current operations of the department.

The Department of Criminal Justice continues as the third largest expenditure in the state budget after human services and education. This budget proposal includes $2.66 billion in state general funds for the Department of Criminal Justice, an increase of $1.05 billion, or 62.3 percent, from 2020/21. This increase includes $1.06 billion used to replace federal funding received in 2020/21 under the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Nearly $1.1 billion of federal CARES funds were used for State Correctional Institutions and $99 million for Inmate Medical Care in 2020/21. Funding for State Correctional Institutions will, in part, help to establish a memory loss unit at SCI Rockview, a traditional housing unit and a treatment unit for mental health and individuals with intellectual and developmental disabilities at SCI Albion, a state drug treatment program at SCI Laurel Highlands, and to expand the personal care unit at SCI Waymart.

Beginning with Act 1A of 2017, funding for the Department of Corrections and the Pennsylvania Board of Probation and Parole has been appropriated jointly to the Department of Criminal Justice, reflecting ongoing efforts supported by Gov. Wolf to consolidate the two agencies. The budget proposal increases funding for State Field Supervision by $2.8 million.

The budget proposes to move the Office of Victim Advocate back to its own appropriation. The office has been funded out of General Government Operations for 2019/20 and 2020/21. $2.8 million is recommended for the office.

Grants to support county probation are level funded in this proposal, but transferred to the Pennsylvania Commission on Crime and Delinquency, which would make this the tenth year at the current funding level of $16.2 million.

The governor’s budget proposal provides $1.38 billion for Pennsylvania State Police (PSP), a $6.4 million, or 0.5 percent, increase over 2020/21.

PSP draws funding from the General Fund, Motor License Fund (MLF), and other smaller funds. The governor’s budget proposal continues a multi-year effort to shift away from reliance on the Motor License Fund. Appropriations from the MLF to PSP are restricted by a statutory cap – $705.5 million in 2020/21 – that decreases by $32 million annually until it reaches $500 million in 2027/28.

The proposed budget achieves the required reduction in MLF spending, but General Fund appropriations are increased by $86.3 million, or 41.25 percent. A portion of this increase is needed to replace federal funding received in 2020/21 under the Coronavirus Aid, Relief, and Economic Security (CARES) act. The PSP received $226 million in 2020/21 in Federal CARES Coronavirus Relief Funds.

The budget proposal assumes a $168 million fair police service fee on all municipalities for their use of state police services. This fee is similar to the one proposed in 2020/21 and is predicated on station coverage costs, which are driven by incidents and coverage area, and considers various factors, including population and income. It is further weighted for municipalities benefitting from full- or part-time services.

The proposed budget would invest $9.6 million in two additional cadet classes in 2021/22. The two classes would maintain the police complement at full strength, despite expected retirements and turnover.

The governor’s budget proposes a decrease of $5 million in funding for the statewide public radio system due to nonrecurring system implementation costs. A 2020 report by the Auditor General revealed that the P-25 radio system is scheduled to be completed in the summer of 2021, which is on time and within budget.

In 2021/22, Gov. Wolf proposes a $1.3 million appropriation increase to support the PICS gun checks system. PICS is also funded by a restricted account, although the account’s revenue is less than half the annual cost of the program.

The budget proposal proposes a $2.8 million appropriation decrease for General Government Operations within the Pennsylvania Emergency Management Agency. Of that, $2 million is for nonrecurring program costs. The Office of the State Fire Commissioner is nearly flat funded, with just a $30,000 decrease.

The governor’s budget proposal includes a $14.4 million increase for Disaster Relief. These funds are for non-recurring costs related to disaster relief and hazard mitigation, which can vary substantially year-to-year.

The budget provides for a $6.15 million initiative to maintain the state’s inventory of essential supplies, including PPE. The initiative also includes six new positions within the Department of General Services’ General Government Operations.

The governor’s budget proposal calls for flat funding for the General Government Operations of the Pennsylvania Commission on Crime and Delinquency (PCCD).

Acts 114 and 115 of 2019, also known as JRI 2, shifted $16.2 million from the Department of Criminal Justice to PCCD for the improvement of Adult Probation Services. Additional funds will be deposited into the Justice Reinvestment Fund beginning in 2021/22 based on a percentage of program savings generated in the year prior to the deposits. Savings will be generated by the implementation of short sentence parole, increased use of the state drug treatment program, and the use of sanctions for technical parole violations. Savings are used to fund grants for the Improvement of Adult Probation Services.

In 2020/21, the Office of Safe Schools Advocate was shifted from the Department of Education to PCCD. The governor’s budget proposal flat funds the office in 2021/22. For 2021/22, the governor is not proposing any funding for the school safety and security beyond the permanent transfer of judicial fees.

Support for grants to local criminal justice agencies and non-profits, including programs to divert low-level offenders from incarceration, support drug courts, and provide for victim services, are all level funded.

The governor’s proposal budget proposes flat funding for the Juvenile Court Judges’ Commission. Grants for juvenile probation services are maintained at $18.9 million.

The budget proposal provides level funding for almost all of the appropriations in the Judiciary. Funding for the Judicial Conduct Board is increased by $0.4 million.

Act 42 of 2018 (the Fiscal Code), established a recurring transfer of $15 million in fee revenue (which otherwise would be directed to the Judicial Computer System Augmentation Account) to the School Safety and Security Fund. 2021/22 will be the third year of the transfer.

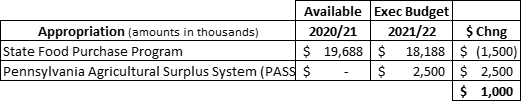

The executive budget provides $458.77 million for the Department of Agriculture, representing a reduction of 3.5 percent, or $16.46 million, from 2020/21. The department’s state General Fund proposal of $166.37 million indicates a decrease of 2.6 percent, or $4.5 million.

The budget allocates additional funding for the administration of Pennsylvania’s Dog Law. The proposal delivers supplemental appropriations of $1.2 million for 2020/21 and $1.5 million for 2021/22. Such allocation is driven by the need for added support as a result of no changes to dog licensing fees since 1982.

Due to increased food insecurity as a result of the COVID-19 pandemic, the governor’s budget proposal provides a net of additional $1 million for the Pennsylvania Agricultural Surplus System (PASS).

In keeping with prior budget proposals, the executive budget eliminates a number of appropriations, which are traditionally added back during budget negotiations.

Additionally, part of the General Fund reduction is the proposed elimination of Livestock & Consumer Health Protection and Animal Health & Diagnostic Commission appropriations.

The executive budget includes reductions in a number of appropriations within the Racing Fund. Reductions are based on the budget’s proposal to eliminate Pennsylvania Race Horse Development Trust Fund restricted racing proceeds to fund the Nellie Bly Scholarship program.

The Department of Conservation and Natural Resources’ total proposed budget is $427.01 million, representing a decrease of one percent or $5.1 million compared to 2020/21. DCNR’s state General Fund proposal of $140.83 million equates to an increase of $6 million. A significant portion of the General Fund increase is a function of the additional support provided to the department’s three major appropriations: General Government Operations, State Parks and State Forests Operations. This general fund increase is necessary to offset reduced revenues including state park user fees.

Operated within the department, the Oil & Gas Lease Fund sees increased utilization to the tune of a $2.46 million, or 3.9 percent, an increase over 2020/21.

The executive budget distributes a total of $807.74 million to the Department of Environmental Protection. The allocation represents a decrease of $2.38 million, or 0.3 percent, compared to 2020/21. The department’s state General Fund proposal of $167.39 million represents a 5.3 percent, or $8.49 million, increase over 2020/21. A considerable share of the proposed increase is related to the DEP’s major appropriations: General Government Operations, Environmental Program Management, and Environmental Protection Operations.

In a change from prior proposals, the Water Commissions are not funded to their fair share. Furthermore, programs funded through the Recycling Fund see a significant decrease with considerable changes to Municipal Recycling Grants, Municipal Recycling Performance Program, and the Public Education/Technical Assistance.

As part of the rulemaking process of joining the Regional Greenhouse Gas Initiative (RGGI) in the beginning of 2022, the executive budget proposes the creation of the Energy Communities Trust Fund. The budget proposes a portion of revenue proceeds generated by RGGI be deposited into the newly created fund. Those proceeds would be allocated toward benefiting workers and communities experiencing challenges as a result of power plant closures or job losses. Additionally, targeted investments would be made to help mitigate the effects of climate change on environmental justice communities. Moreover, the governor’s budget proposal provides capital for a number of programs aimed at reducing air pollution. Those include: greenhouse gas abatement, energy efficiency standards, and clean/renewable energy programs.

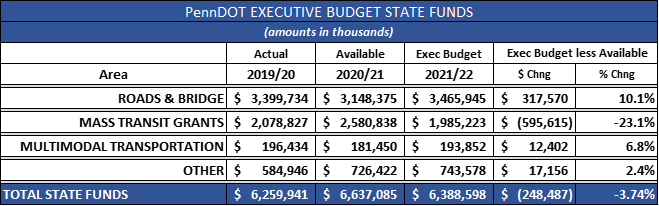

The 2021/22 executive budget proposal includes $6.38 billion in state funding for the Department of Transportation (PennDOT), representing a decrease of $248.48 million, or 3.7 percent, over 2020/21. In order to discuss the contributing factors of the decrease, we have to examine different programs within the agency.

First, there is good news. The State Highway & Bridge Improvement (Hwy & Bridge Construction) includes a $94.35 million increase, or 9.6 percent, over 2020/21. Similarly, the State Highway Maintenance program’s proposed budget is $159.82 million, or 10.3 percent higher, than 2020/21. The Local Highway & Bridge proposal also includes an increase of $63.39 million, or 10.4 percent, over 2020/21. In sum, the Roads & Bridge program receives a combined $317.57 million increase, or 10.09 percent, over 2020/21.

At first glance, it appears that the budget decreases Mass Transit Grants by $595.61 million, or 23.1 percent, over 2020/21. However, the reduction in 2021/22 is driven by rolling unspent dollars from 2019/20 to 2020/21. The result was a significantly higher 2020/21 available budget, thus when compared to 2021/22, it appears like a decrease. A significant portion of the changes over 2020/21, relate to the following programs within the Public Transportation Trust Fund (PTTF):

- Asset Improvement -- $505 million

- Capital Improvements -- $42.46 million

- Programs of Statewide Significance -- $90 million

The governor’s budget proposal provides for a modest increase to Multimodal Transportation and other programs. The budget delivers a $12.4 million increase, or 6.83 percent, over 2020/21 for Multimodal Transportation and a $17.15 million increase in other areas.