General Fund Revenue Update – October 2020

By Eric Dice , Assistant Executive Director | 5 years ago

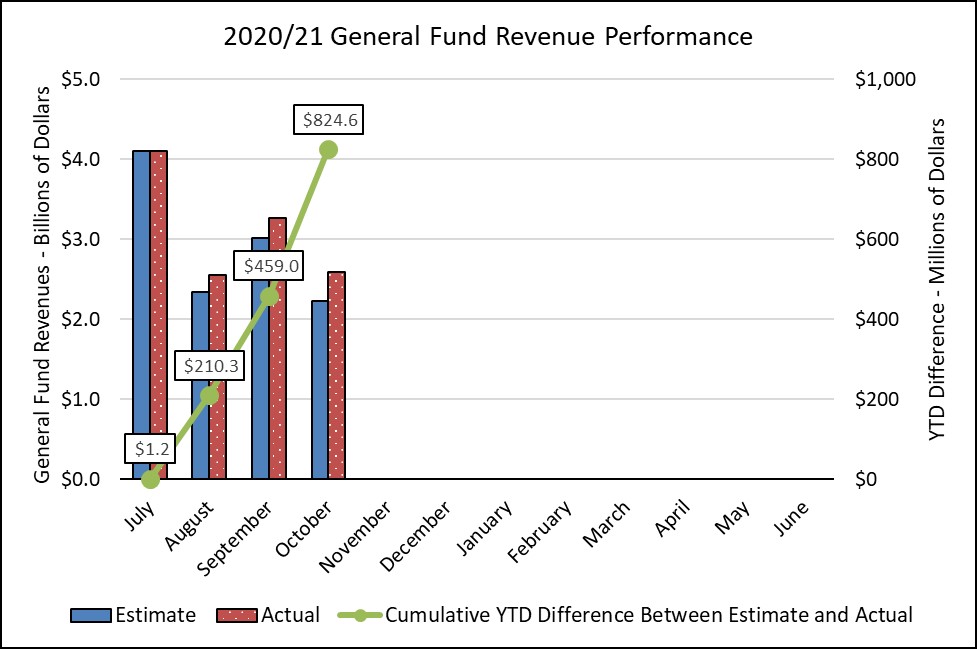

General Fund revenues in October continued to substantially outpace the official revenue estimate, exceeding projections by $365.6 million. Year-to-date, revenues are now $824.5 million higher than expected, compared to the official estimate set back in May amidst great uncertainty. When the General Assembly considers the remainder of the 2020/21 budget, policymakers will need to determine how upward revisions to the revenue estimates will be incorporated into the budget, given the strong performance through the first four months of year, while still considering the potential impacts of the pandemic moving forward.

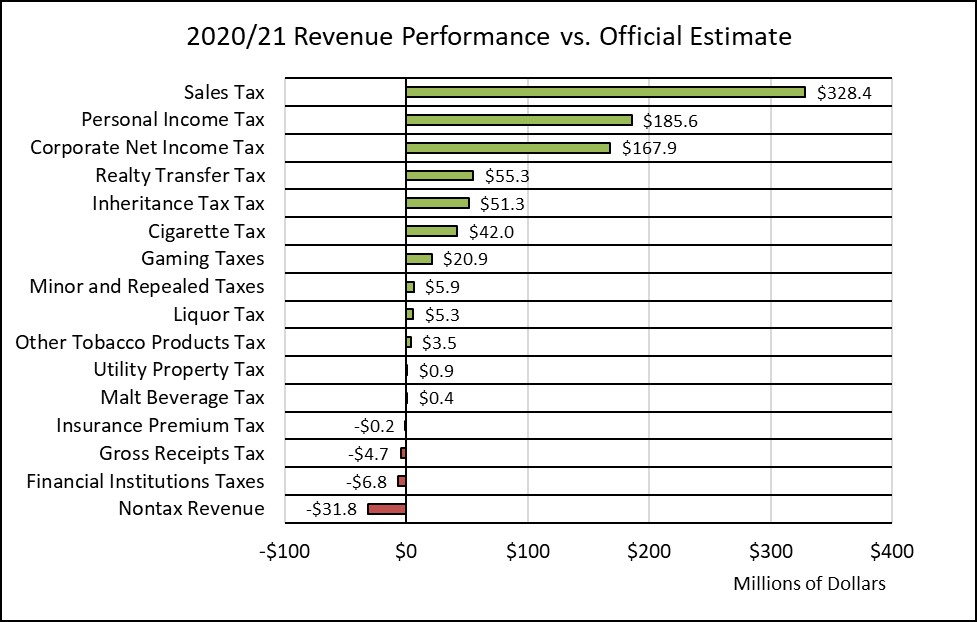

Sales tax again led the way in October. Non-motor collections were $95.4 million above estimate and motor vehicle sales tax collections added another $49.7 million. In total, sales tax collections in October were $145.1 million or 15.4 percent above estimate.

Personal income tax also performed better than expected. Employer withholdings were modestly higher, finishing $20.4 million above estimate or 2.6 percent. Non-withheld collections were double what was expected last month, driven by annual payments $85.4 million above estimate.

Other tax types exceeded estimate as well: the corporate net income tax was $30.2 million above estimate, realty transfer tax was $22.2 million higher, inheritance tax finished $17.0 million ahead, and cigarette taxes were $10.1 million above estimate.

For the month of October, total General Fund revenues were $365.6 million higher than expected, or 16.4 percent.

- Corporate net income tax collections were $30.2 million higher than expected (33.3 percent)

- Sales and use tax collections were $145.1 million higher than expected (15.4 percent)

- Non-motor sales tax collections were $95.4 million more than estimate (11.3 percent)

- Motor vehicle sales tax collections were $49.7 million above projections (49.7 percent)

- Personal income tax revenues were $123.2 million more than the official estimate (13.7 percent)

- Employer withholdings on wages and salaries were $20.4 million more than anticipated (2.6 percent)

- Quarterly estimated payments were $17.4 above estimate (24.6 percent)

- Final payments were $85.4 million more than projected (258.0 percent)

- Realty transfer tax collections were $22.2 million more than expected (51.5 percent)

- Inheritance tax collections were $17.0 million higher than anticipated (21.2 percent)

- Non-tax revenues were $8.7 million more than expected (37.0 percent).

Through the first four months of the 2020/21 fiscal year:

- Cumulative General Fund revenues are $824.5 million higher than expected (7.1 percent)

- General Fund tax revenues are $856.3 million higher than projected (7.4 percent)

- Corporate net income tax revenues are $167.9 million more than expected (15.7 percent)

- Sales and use taxes are $328.4 million more than expected (8.1 percent)

- Personal income tax collections are $185.6 million higher than anticipated (3.5 percent)

- Non-tax revenues are $31.8 million below the estimate (-26.8 percent)

|

General Fund Revenues - Year-to-Date Performance vs Official Estimate

|

|

Amounts in Millions

|

YTD Estimate

|

YTD Collections

|

Difference

|

|

General Fund Total

|

11,682.0

|

12,506.5

|

824.5

|

|

Tax Revenue Total

|

11,563.5

|

12,419.8

|

856.3

|

|

Corporation Taxes

|

1,105.8

|

1,263.6

|

157.8

|

|

Corporate Net Income Tax

|

1,071.2

|

1,239.1

|

167.9

|

|

Gross Receipts Tax

|

15.7

|

11.0

|

(4.7)

|

|

Utility Property Tax

|

1.1

|

2.0

|

0.9

|

|

Insurance Premiums Taxes

|

1.5

|

1.3

|

(0.2)

|

|

Financial Institutions Taxes

|

16.3

|

9.5

|

(6.8)

|

|

Consumption Taxes

|

4,556.8

|

4,936.3

|

379.5

|

|

Sales and Use Tax

|

4,043.6

|

4,372.0

|

328.4

|

|

Cigarette Tax

|

338.3

|

380.3

|

42.0

|

|

Other Tobacco Products

|

40.6

|

44.1

|

3.5

|

|

Malt Beverage Tax

|

8.1

|

8.5

|

0.4

|

|

Liquor Tax

|

126.2

|

131.5

|

5.3

|

|

Other Taxes

|

5,900.9

|

6,219.9

|

319.0

|

|

Personal Income Tax

|

5,360.7

|

5,546.3

|

185.6

|

|

Realty Transfer Tax

|

137.9

|

193.2

|

55.3

|

|

Inheritance Tax

|

354.3

|

405.6

|

51.3

|

|

Gaming

|

42.2

|

63.1

|

20.9

|

|

Minor and Repealed

|

5.8

|

11.7

|

5.9

|

|

Non-Tax Revenue

|

118.5

|

86.7

|

(31.8)

|